Cardano founder Charles Hoskinson took to X to reaffirm his belief in Cardano (ADA) as a top cryptocurrency. He highlighted its decentralized governance and upcoming roadmap developments as key strengths, even with current market volatility.

For those wondering, Cardano is still number 1. It's not even close with Decentralized governance and all the amazing roadmap items coming

— Charles Hoskinson (@IOHK_Charles) October 4, 2024

Price and Market Overview

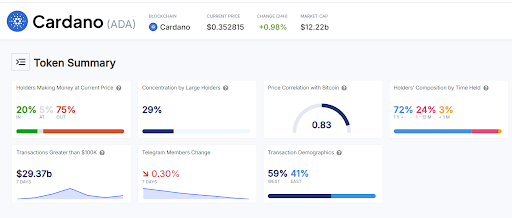

Cardano’s price stands at $0.352889, with a 24-hour trading volume of $205.82 million. It increased 0.50% over the past day, bringing its total market cap to $12.34 billion. ADA has a circulating supply of 34.96 billion coins and a maximum supply of 45 billion.

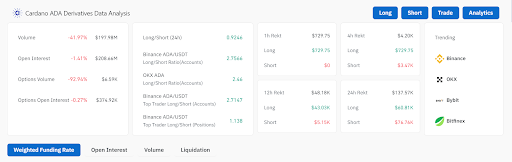

However, the broader ADA market remains volatile. Derivatives data shows Cardano’s trading volume fell 41.97% to $197.98 million. Options volume dropped even more sharply, decreasing by 92.94%, suggesting a shift in trader sentiment.

Bullish Sentiment Dominates Despite Market Fluctuations

Despite the drop in derivatives activity, bullish sentiment prevails on major platforms like Binance and OKX. Binance’s ADA/USDT long/short ratio currently stands at 2.75, indicating a stronger bias towards upward price movement. Long positions are dominant, though $137.57K in positions were liquidated in the past 24 hours, affecting both long and short traders equally.

Open interest also saw a minor decline of 1.41%, totaling $208.66 million. This slight dip indicates cautious trading behavior, though opportunities remain for those looking to capitalize on future price shifts.

Read also: Cardano’s “Ghost Chain” Debate Reignites as ADA Falls

Challenges for ADA Holders Amid Price Movements

Cardano holders face challenging market conditions, with 75% currently at a loss. Only 20% are in profit, highlighting the struggles many investors face amid price fluctuations. However, 72% of Cardano holders have held their positions for over a year, demonstrating long-term confidence in the asset.

Large transactions worth over $29 billion were recorded over the past week, showcasing continued interest from institutional investors. Moreover, whales who control 29% of ADA’s supply are still active, suggesting their influence could drive future price shifts.

Technical Analysis: Volumes, RSI, and MACD Insights

Cardano’s trading volume on the chart sits at 992.53K, reflecting a relatively low level of activity. This indicates cautious sentiment, with neither buyers or sellers showing dominance, contributing to the sideways movement in price.

ADA’s Relative Strength Index (RSI) is currently at 56.05, slightly above the neutral 50 level, suggesting a mildly bullish trend. Previous dips in the RSI have been met with rebounds, highlighting renewed buying interest.

On the Moving Average Convergence Divergence (MACD) front, the histogram remains in bearish territory with a value of -0.004 for the MACD line and 0.001 for the signal line. While the bearish pressure is evident, the close proximity of the lines signals a potential crossover, which could lead to a bullish reversal if buying momentum picks up.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com