The so-called ‘Uptober’ has begun on a very sour note for cryptocurrency. Solana’s (SOL) value is struggling to gain traction after failing to break over the critical $161 resistance level in the past two months. Solana has declined by over 14% month-to-date and was trading for as low as $135.25 on Oct. 3. Now, as the crypto confronts persistent downward pressure, traders wonder if more drops are on the way.

Bearish indicators signal ongoing downward pressure on Solana

The future prospects for Solana seem to be turning based on critical technical indicators that have recently shown a bearish trend. The macro momentum for Solana is currently pointing to a gloomy outlook, as evidenced by major technical indicators.

The Relative Strength Index (RSI) has fallen below the neutral line of 50.0, indicating a strengthening bearish trend. The RSI’s position in the bearish zone indicates that selling pressure has increased, with little sign of a reversal in the near term.

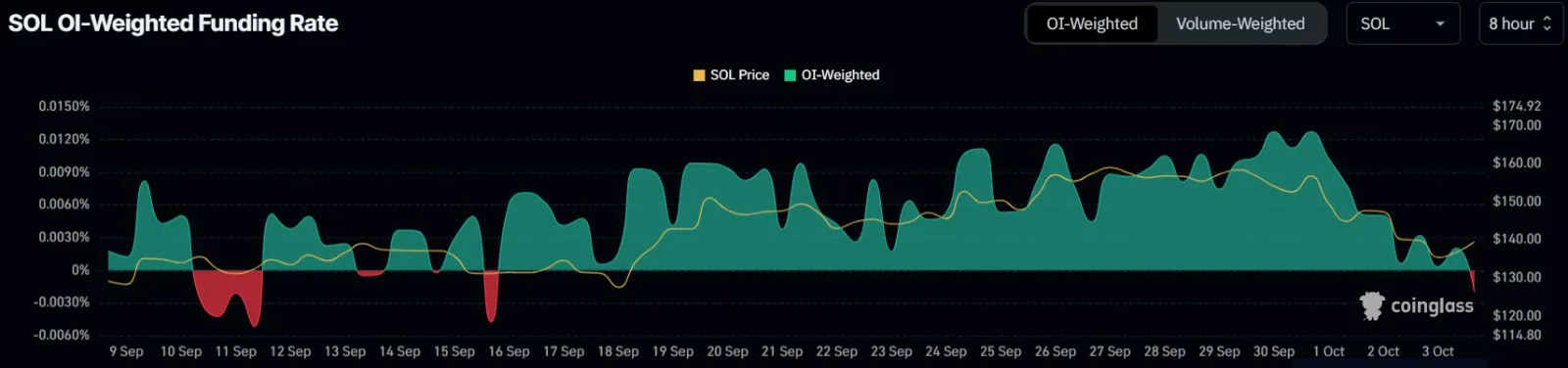

Following Solana’s failed breach of the $161 resistance level, bearish sentiment has strengthened. In addition, Solana’s funding rate has turned negative for the first time in over two weeks. A negative funding rate means traders are paying to hold long positions, a clear signal that the market now expects SOL to continue falling.

Solana falters below support as the crypto market weakens

Currently trading at around $143.99, SOL is under the support threshold of $150. With market sentiment turning bearish and no immediate signs of a reversal, SOL could drop to $124, a level that acted as strong support last month. If it manages to hold at $124, it could bounce back, but if it fails, the next stop might be around $120, which marks the lower limit of its current consolidation range.

Should SOL flip $150 into a support level, however, there’s a chance for a recovery. Breaking through the $155 resistance would invalidate the current bearish outlook, giving Solana a shot at reclaiming its upward momentum.

Solana’s struggles come at a time when the broader cryptocurrency market is also under pressure. October, typically dubbed “Uptober” for its favorable price action, has so far failed to live up to its name. Escalating tensions between Iran and Israel have added to the downward momentum across the digital asset space, erasing gains from the previous month.

The total crypto market is currently valued at $2.12 trillion, down nearly 1% in the past 24 hours. Bitcoin (BTC) and Ether (ETH) have also seen significant declines, with BTC down 6.64% and ETH crashing 10.35% in the past week. At the time of writing, Bitcoin is trading at $62,240.43, and Ether is at $2,411.85.

Solana is not the only altcoin experiencing a decrease in value lately; other popular cryptocurrencies such as Cardano (ADA), Binance Coin (BNB), and XRP have also witnessed drops in their prices over the past week; ADA decreased by 15% BNB, by 9.22% and XRP by 10.51%. At present, traders are closely monitoring SOL price levels as a possible market downturn is looming.

cryptopolitan.com

cryptopolitan.com