Sui, the native token of the Layer-1 (L1) blockchain Sui Network, has experienced a parabolic rally over the past month, reaching $1.73 — a 120% increase in 30 days.

However, market indicators signal that this rally might not last, as SUI holders are starting to sell for profit. This analysis examines potential price targets if SUI’s demand continues to decline.

Sui Sees Negative Shift in Market Sentiment

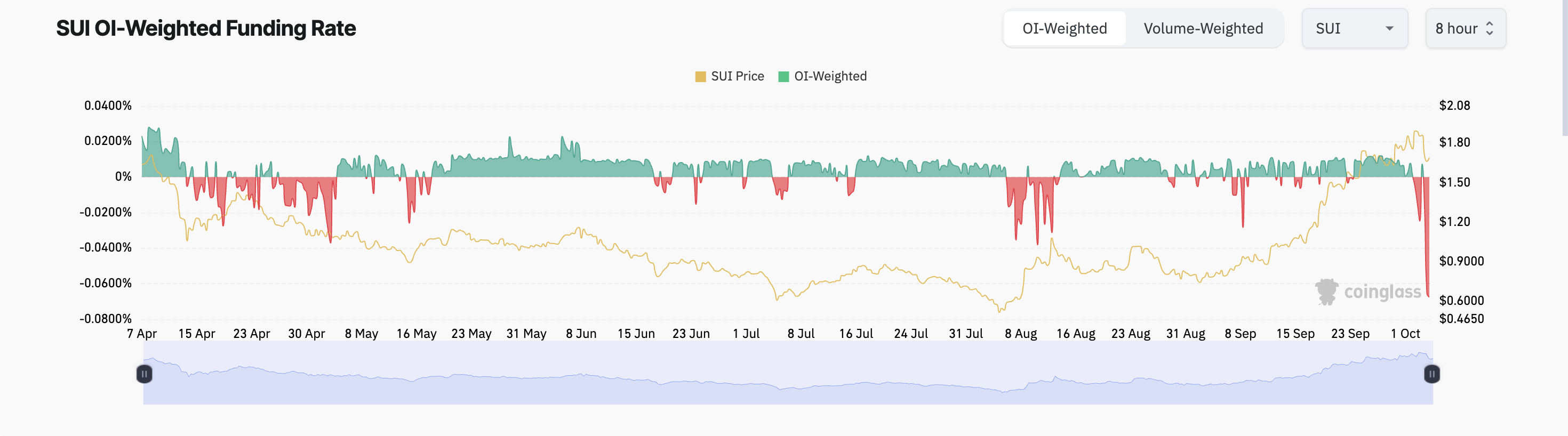

A notable indicator of the negative shift in sentiment toward SUI is its funding rate, which sits at a multi-month low of -0.067%.

The funding rate is the periodic payment between traders who hold long positions (expecting the price to rise) and those holding short positions (expecting the price to fall). When an asset’s funding rate is negative, traders are increasingly opening short positions as they expect its price to drop.

Read more: A Guide to the 10 Best Sui (SUI) Wallets in 2024

SUI’s sudden drop in funding rate to a multi-month low reflects the shift in sentiment from bullish to bearish. Its traders believe the price will likely decline and have begun to position themselves to profit from it.

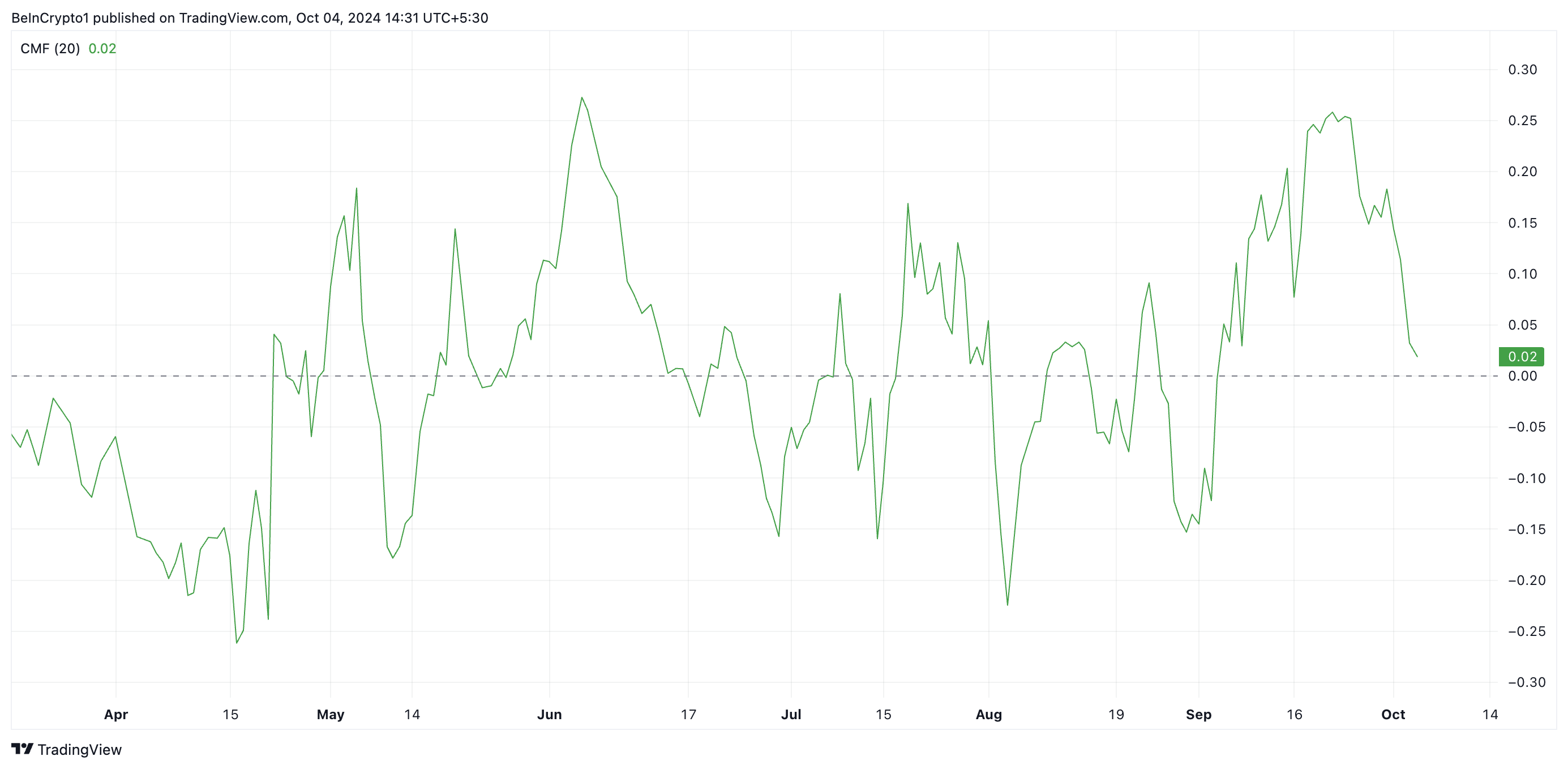

Moreover, SUI’s plummeting Chaikin Money Flow (CMF) confirms the falling buying pressure. As of this writing, this stands at 0.02, trending toward the zero line.

The CMF measures money flow into and out of an asset over a specific period. When it falls, it indicates that the asset sees less buying interest. This suggests that buyers are weakening, and sellers are gaining control.

SUI Price Prediction: A 50% Decline is on the Horizon

Readings from SUI’s moving average convergence/divergence (MACD) indicator highlight the strengthening selling pressure in the market. The coin’s MACD line (blue) is poised to fall below its signal line (orange) at press time, hinting at a bearish reversal.

Traders view this crossover as a sign that prices may start to decline. It indicates that sellers are gaining strength, and it may be a good time for traders to consider closing long positions or initiating short positions.

If the downtrend continues, SUI’s price could drop by 50%, retesting support at $0.86. Failure to hold this level could push the price further down to $0.46.

Read more: Which Are the Best Altcoins To Invest in October 2024?

Conversely, if demand resurges and profit-taking eases, SUI might climb to $2.17, a level last seen in March.

beincrypto.com

beincrypto.com