Today, enjoy the Forward Guidance newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Forward Guidance newsletter.

Digging into the data ahead of tomorrow’s big jobs report

In recent months, the balance of risks has shifted from fears about getting a handle on inflation to concerns around whether the Fed is late to the game, and how this ongoing growth slowdown may evolve into an outright recession.

Paired with that comes the market’s shift from caring about CPI prints to caring about employment data prints. With tomorrow’s important jobs report being a key macro driver at this stage of the business cycle, let’s dig into some of the data.

Labor market data signals resilience

After falling for multiple months, the job vacancy rate ticked up from 4.6% to 4.8%. This implies there were more jobs available than the previous month. And when considering a classic Beveridge curve type of analysis that compares job vacancy to unemployment rate, there is effectively a lower risk of an accelerating unemployment rate compared to the month before.

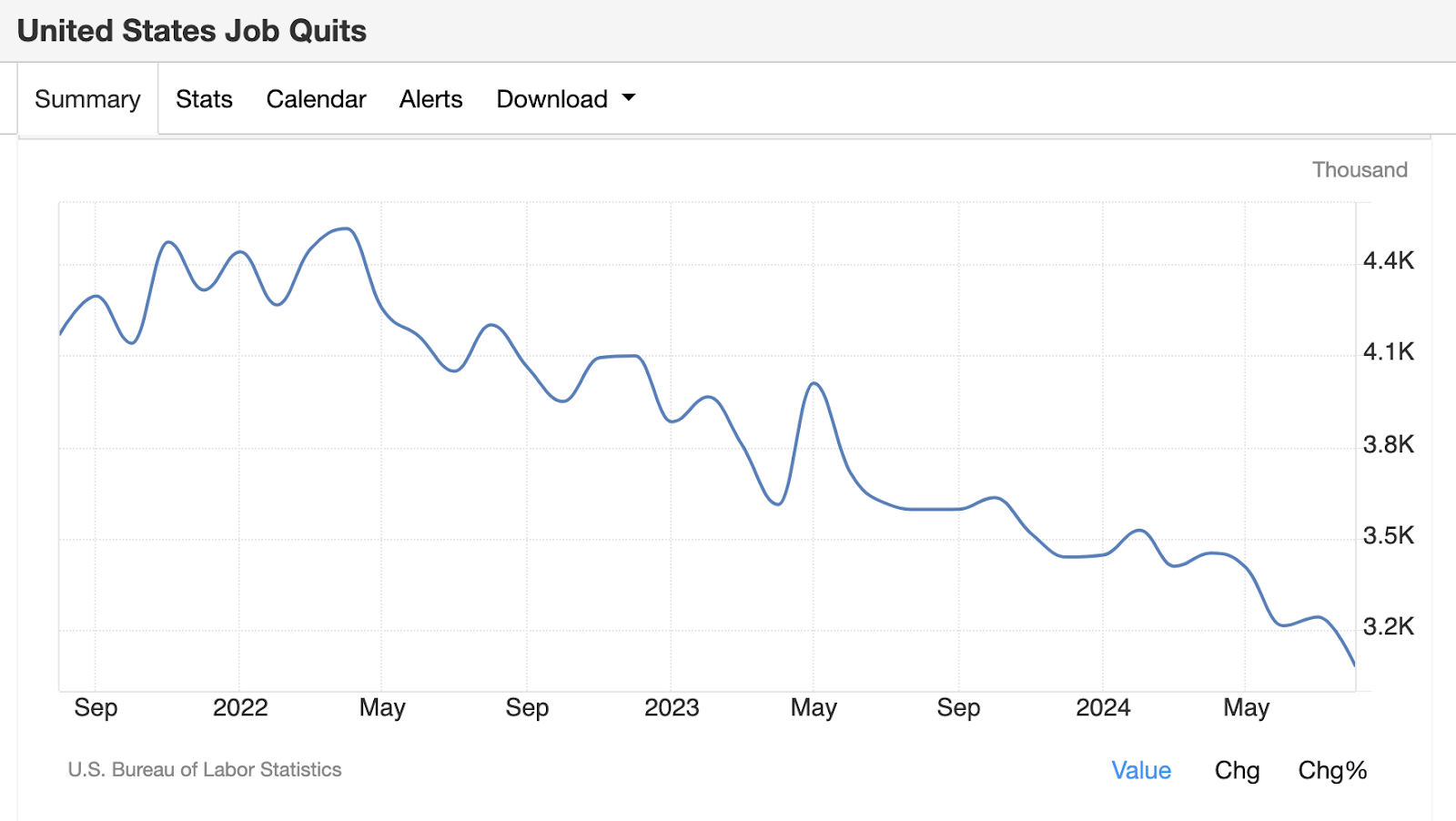

But despite a solid JOLTS report in terms of the job openings, the quit rate headed lower — implying employees are not as confident as they were to leave their current job in the hopes of finding something better-paying. This provides a key cap on the amount of wage growth the labor market is experiencing, as it’s typically through job-switching that the largest wage growth impulses occur.

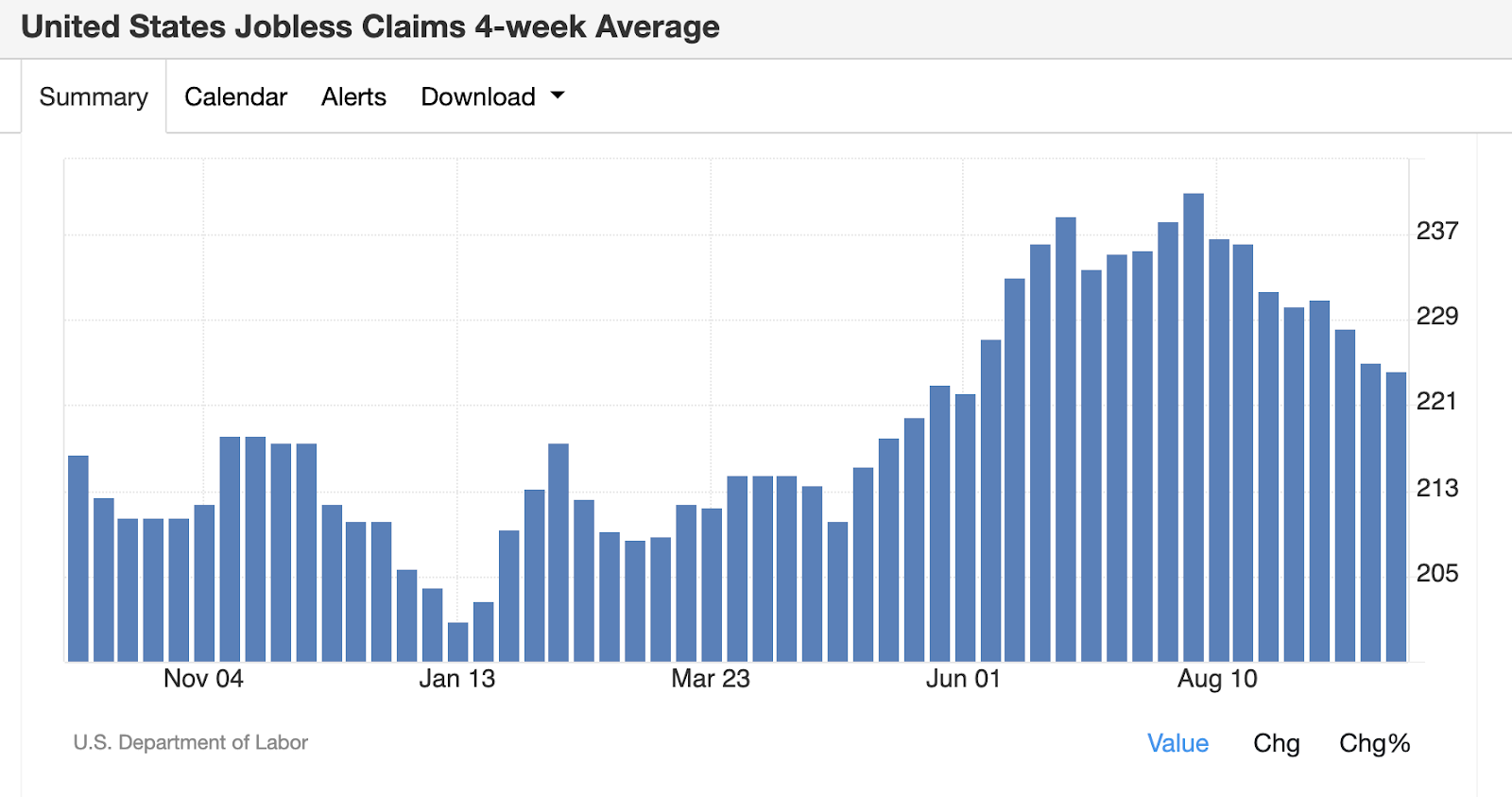

Despite an upside surprise today in initial jobless claims of 225,000 (vs. the forecasted 220,000), the four-week average of jobless claims has been in a steady downtrend and hit its lowest level since June.

The previous three weeks were also downside surprises on jobless claims, which paints a high-frequency picture of a somewhat neutral labor market.

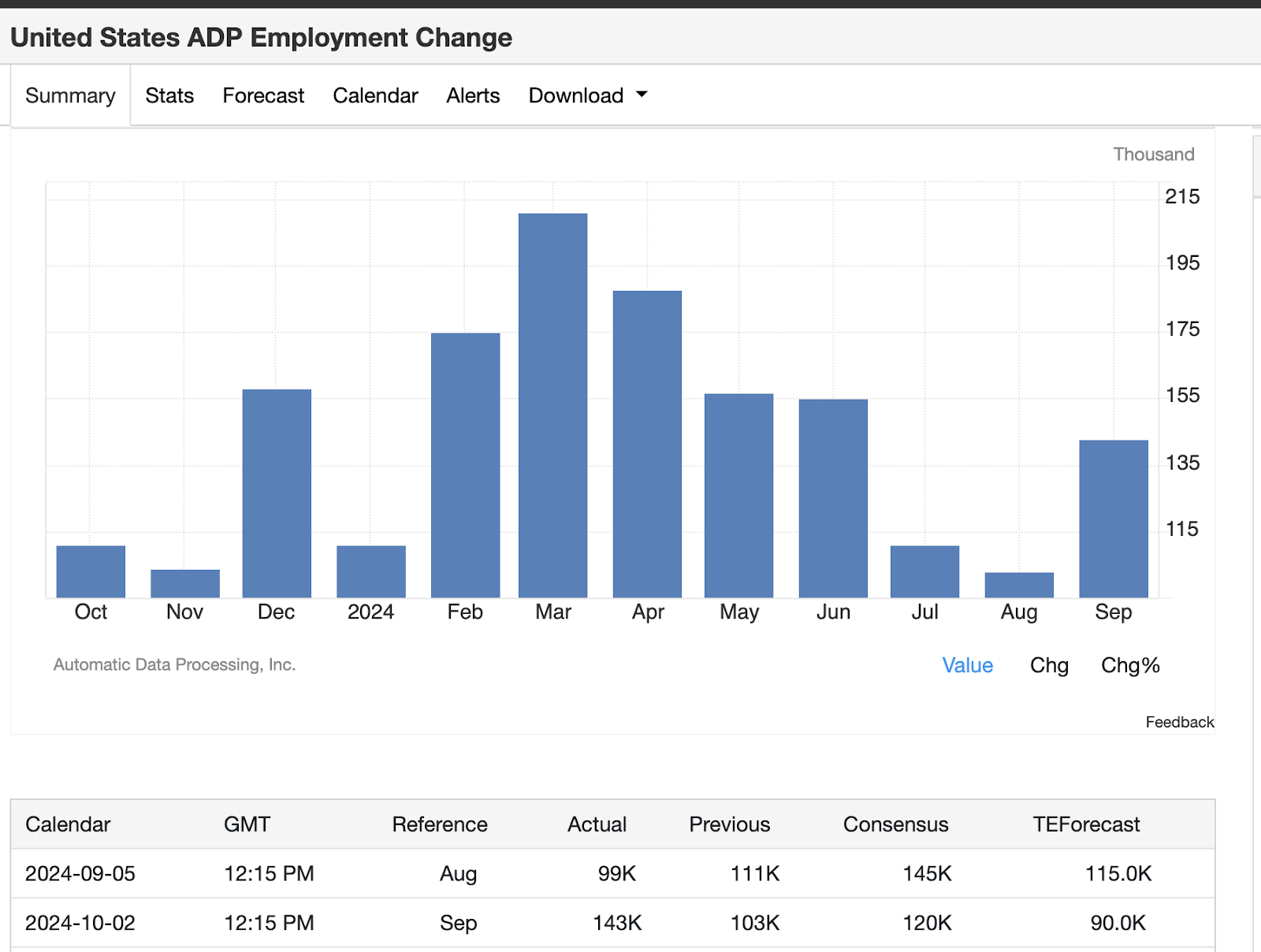

Finally, the ADP employment change blew past expectations of 120,000 and printed at 143,000 — up from the prior month’s 103,000.

The ADP print is a solid gauge of what to expect in the upcoming jobs report. With such a huge upside surprise, it removes a lot of the tail risk behind potential negative outcomes tomorrow.

Growth outlook looks decent

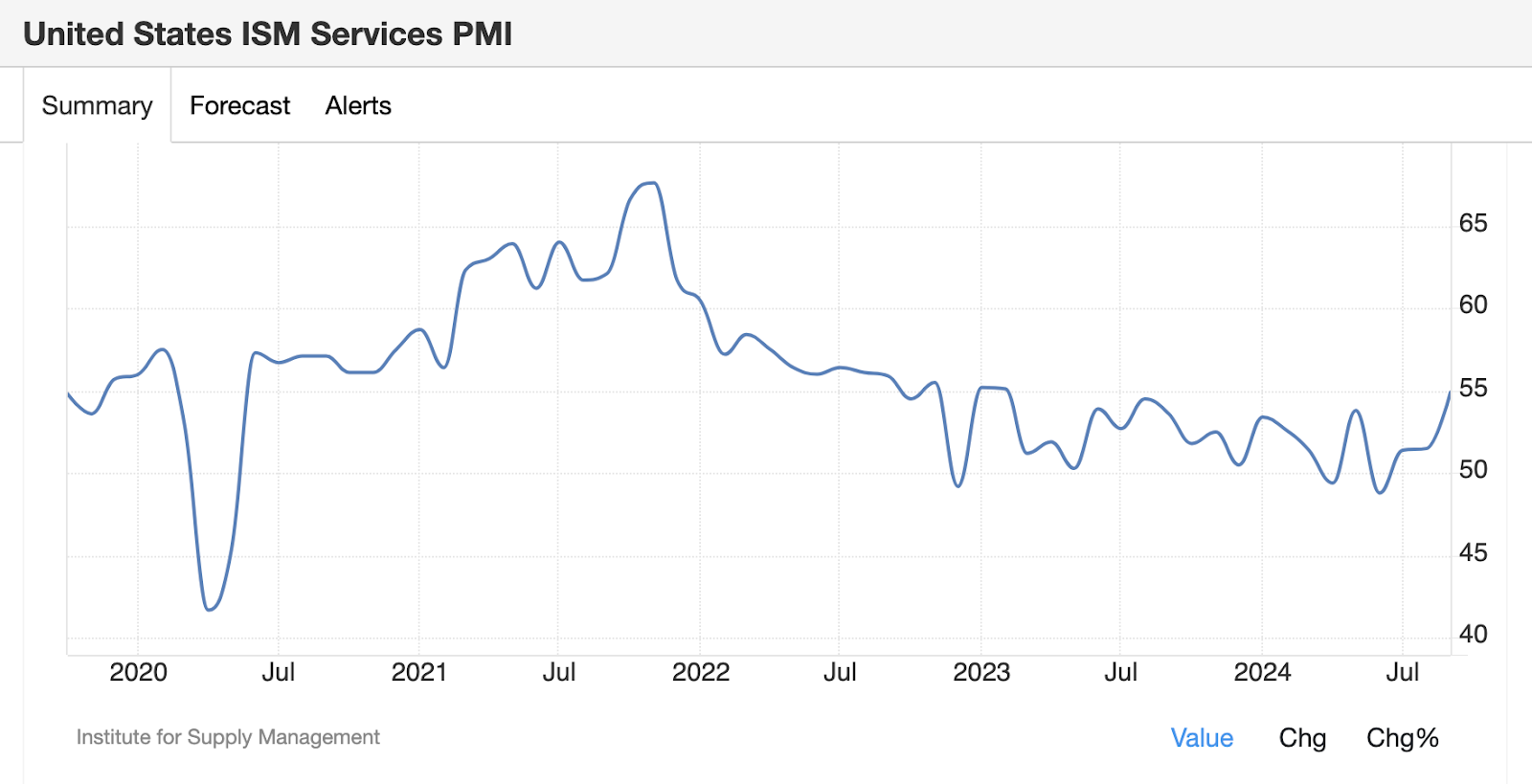

This morning, we received the ISM Services PMI. That came in significantly above expectations of 51.7, printing a 54.9. This is the highest print in over a year and an incredibly prescient indication that growth in the economy remains solid.

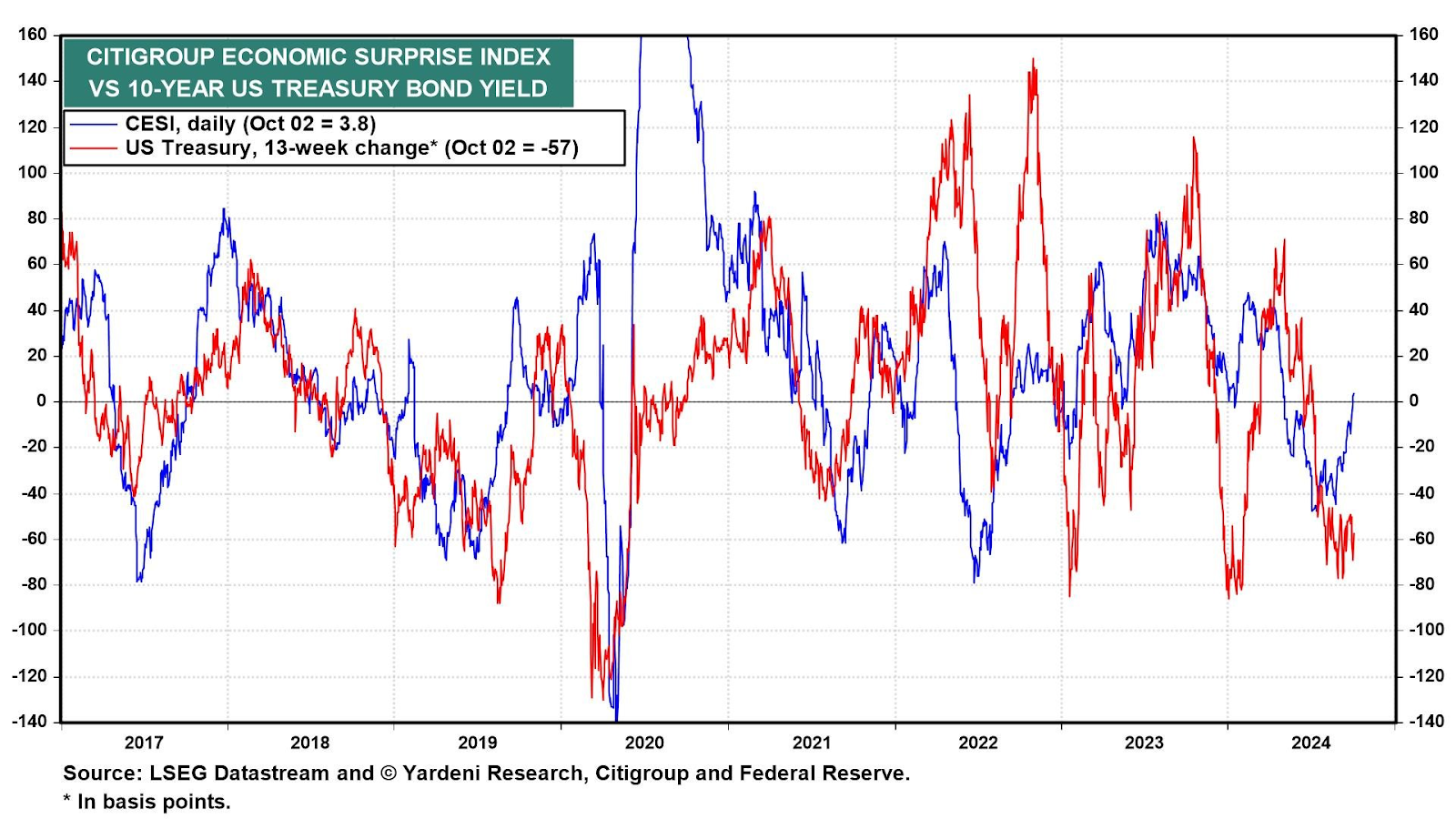

Bringing all these data points together, let’s now look at the economic surprise index:

After a huge move downward — implying worse-than-forecasted economic data prints — we have now reversed back into positive territory. What that leaves us with on the eve of the most important jobs report of our lifetime (until the next one comes out, of course), is that the economy is surprisingly resilient. Based on the higher frequency labor market data that’s come out this week, the jobs report tomorrow will probably be fine.

— Felix Jauvin

1

The number of equal-weight S&P 500 sectors that outperformed their market cap-weighted counterparts during the first three quarters of the year. The sector in question was real estate.

Why does this matter? It shows us it’s not just tech leading the market cap S&P to new heights this year.

The equal weight S&P 500 index is up just over 12% in 2024, while the market cap-weighted version has gained close to 20% since the start of the year.

Did Grewal sell out?

The head of the SEC’s enforcement division will be departing the agency next week.

Gurbir Grewal, who has led the US securities regulator’s enforcement operations since July 2021, joined the agency just months after Gary Gensler was sworn in as chair.

Crypto-related enforcement actions, which had been on the rise before Grewal and Gensler took over, were a significant part of Grewal’s tenure.

Under Grewal’s leadership, the agency issued 35 crypto enforcement actions in 2022 and 40 in 2023. Plus, the division of enforcement almost doubled its crypto assets and cyber unit in May 2022, bringing the team’s headcount to 50.

In 2024 (as of Sept. 6), the agency had brought 18 crypto enforcement actions.

Most notably, the agency’s cases against Coinbase, Binance, Kraken and Consensys were all brought under Grewal. Each suit has, in part, addressed token classification — a major theme under the Gensler/Grewal regime. The SEC also launched and closed its so-called “Ethereum 2.0” investigation under Grewal.

The agency, during Grewal’s tenure, has also shown significant increase in NFTs, which the SEC generally considers to be securities.

Gensler has plenty of time left in his term, so I don’t expect we’ll see a huge change in enforcement patterns under the next director. The current deputy director of the division, Sanjay Wadhwa, will step in as acting director starting Oct. 11. The SEC declined to comment on who will take over the role permanently.

If I had to bet, I’d say Grewal’s headed to the private sector, but we will just have to wait and see.

— Casey Wagner

Banks get set to use Swift for new transaction trials

It looks like we could see another big step forward on the crypto transaction front as banks get set for trials on a system powering billions of money transfers.

Financial institutions will be able to soon use Swift’s platform to test out the settlement of “digital assets and currencies,” the organization said Thursday.

These pilot transactions are set to start next year.

A quick reminder for those in need: Swift — the Society for Worldwide Interbank Financial Telecommunication — was formed in 1973 and offers a messaging network through which international payments are initiated.

With more than 11,000 institutions connected to the network, Swift carries more than 5 billion financial messages each year.

Swift Chief Innovation Officer Tom Zschach put it simply in a statement: “For digital assets and currencies to succeed on a global scale, it’s critical that they can seamlessly coexist with traditional forms of money.”

The upcoming pilots were born from ample prior experimentation.

Swift claimed in 2022 it had successfully shown that CBDCs and tokenized assets can move seamlessly on existing financial rails. When establishing a global CBDC system, it added, familiarity (alongside the infrastructure) is an important facet.

Then last year, Swift sought to link private and public blockchains in a trial collaboration with Chainlink and finance giants such as BNP Paribas and BNY Mellon (tests it ultimately deemed successful).

Swift also has its hand in other efforts related to tokenized assets — a space Standard Chartered said could reach $30 trillion by 2034.

It is participating in Project Agora (led by the Bank for International Settlements), which is exploring how tokenization can enhance wholesale cross-border payments. Swift is also looking into how its “interlinking capabilities” could integrate the US Regulated Settlement Network, for example, with TradFi systems.

Visa and Mastercard said in May they would join banks like JPMorgan and Citigroup to test this so-called Regulated Settlement Network. Colin Butler, Polygon’s global head of institutional capital, said these entities getting closer to aligning on a standard represents “the 5-yard line for mass institutional adoption.”

While only time will tell what exactly we learn from these future trials, the prospect of financial institutions having a single point of access to digital asset classes and tokens appears bullish.

— Ben Strack

Bulletin Board

- Payments giant Visa has created a platform to try to help financial institutions issue fiat-backed tokens and test out their use cases. Spain-based BBVA has been working within the Visa Tokenized Asset Platform (VTAP) sandbox this year and looks to launch an initial pilot with select customers in 2025 on the Ethereum blockchain.

- A CFTC subcommittee voted to pass recommendations related to policies to support the use of blockchain for non-cash collateral, Bloomberg reported, citing unnamed sources “familiar with the matter.” The Global Markets Advisory Committee will now consider the recommendations and is expected to vote later this year. Such approval could make it easier for institutions to accept tokenized assets as collateral.

- Grayscale Investments launched an Aave trust Thursday after introducing an XRP trust last month. The crypto-focused asset manager has been on a product-launching kick this year, also debuting trusts holding bittensor (TAO), sui (SUI), maker (MKR) and avalanche (AVAX) in August.

blockworks.co

blockworks.co