Today, enjoy the 0xResearch newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the 0xResearch newsletter.

Averting disaster

There are about 1.38 million ERC-20 tokens in existence. But exchanges, naturally, support only a tiny fraction of those tokens for deposits and trading. Coinbase caters to around 200.

If you sent one of the unsupported tokens into an exchange deposit address, you would be very disappointed to find it vanish into the aether (not to be confused with ether!).

Enter asset recovery. Coinbase’s in-house tool, launched in December 2023, was recently upgraded to support Base.

According to a spokesperson, the tool will allow users to recover some 4,000 distinct ERC-20 tokens erroneously sent to Coinbase addresses over the years.

The US dollar value of all that previously marooned crypto was not disclosed, but if you were the unwitting Coinbase client with assets cast asunder, you may be in luck.

Customers can recover eligible assets and send them to a self-custodial wallet, although for recoveries over $100, “a small administrative fee” applies, along with network fees (deducted from the user’s ether balance).

Sygnum’s Safe Solution

What if, after you recover some castaway crypto from Coinbase and sent it to your Safe, you suffer another sad misfortune and misplace a private key to your multisig?

Today, Sygnum Bank switched on a module for Safe’s Recovery hub that could come to the rescue.

Sygnum is the first bank to offer this service, in development since last year, which provides an institutional-grade recovery option for users who lose access to their Safe wallets. When designated as a recoverer on Safe’s platform, Sygnum can restore wallet access, thus addressing a thorny problem in the crypto space.

Forgotten keys often result in inaccessible funds, and somewhere north of 900,000 ETH — worth billions of dollars — may have been irrevocably stranded due to lost keys, the bank estimates.

The safe module is an alternative to relying on social recovery methods, such as sharing private key fragments with friends and family, or managing personal backups.

And you don’t have to trust the Swiss bank to designate it as a third-party recoverer. Importantly, Safe’s design allows the owner to cancel any recovery attempt through onchain veto rights in the case a bogus recovery is attempted. The tool is designed to be flexible, allowing users to set multiple recoverers, and also features additional security measures like time delays.

The service is designed to be compliant with regulatory requirements, requiring identity verification (KYC) for both the setup and recovery process.

That may rub some the wrong way, but Martin Burgherr, Sygnum’s chief clients officer, assures that the bank takes “appropriate security measures to maintain the required security of personal data and ensure its confidentiality.”

In the future, one might imagine a more Web3 identity alternative that uses zero-knowledge proofs to allow clients to provide selective disclosure. That’s something the bank is watching, Burgherr told Blockworks.

Key management remains a challenge for many, but Sygnum and Safe are working toward a practical solution that retains the concept of self-sovereignty for both institutional and individual users.

— Macauley Peterson

It’s pronounced ‘swee’

I opened up Twitter today and all over the timeline was Sui.

The MoveVM L1 is coming up 6th in daily trading volumes, a Sui bridge connecting to EVM-based chains is going live today on mainnet, and the SUI token has rallied this week into the top 20 tokens by market cap at $5.2 million.

The armchair analyst kind of way to explain this type of sudden burst in growth is to look at how much Sui is giving out in terms of liquidity incentives.

As far as I can tell, that number is not officially reported. But we can make some guess-timates based on Twitter posts:

- Navi Protocol, the top lending market on Sui, is getting 520,000 SUI ($936k) for two weeks.

- Scallop, the second-largest lending market on Sui, is receiving about 170,000 SUI ($314k) on a weekly basis.

- Suilend, the third-largest lending market, is doling out 426,195 SUI over two weeks.

Together, that’s a weekly average of about 643k SUI. If we assume that 15 Sui dapps have the liquidity tap turned on, that bill comes up to something like 77.2 million SUI ($139 million) over the last two months.

That is a lot of money for a very short period of time.

Again, that is just a guess, but with that much money up for grabs, it does explain why Sui’s TVL has seen an up-only direction:

That is not to take anything away from the technological design of Sui, which I’m sure is impressive.

Like all new L1s on the block, Sui is fast. Its founders have claimed on the 0x Research podcast the chain’s parallelized execution design allows horizontal scalability to be “infinite,” thus rendering Vitalik’s blockchain trilemma “irrelevant.”

Sui does not have to grapple with the multitude of scalability problems that plague older chains like Ethereum. It doesn’t have to deal with the kind of political turmoil stirred when a new up-and-coming researcher like Max Resnick comes in and questions the overarching multiyear-long roadmap and proposes a radical idea of his own (multiple current proposers).

Sui’s fee markets are also segmented and use auctions to ensure stable network fees globally, even when SUI’s price spikes up or down. This multidimensional fee market contains gas spikes to local fee markets. It’s a similar idea to one Solana has been talking about to explore solving its many network outages in earlier years due to transaction spam.

— Donovan Choy

Chart of the Day

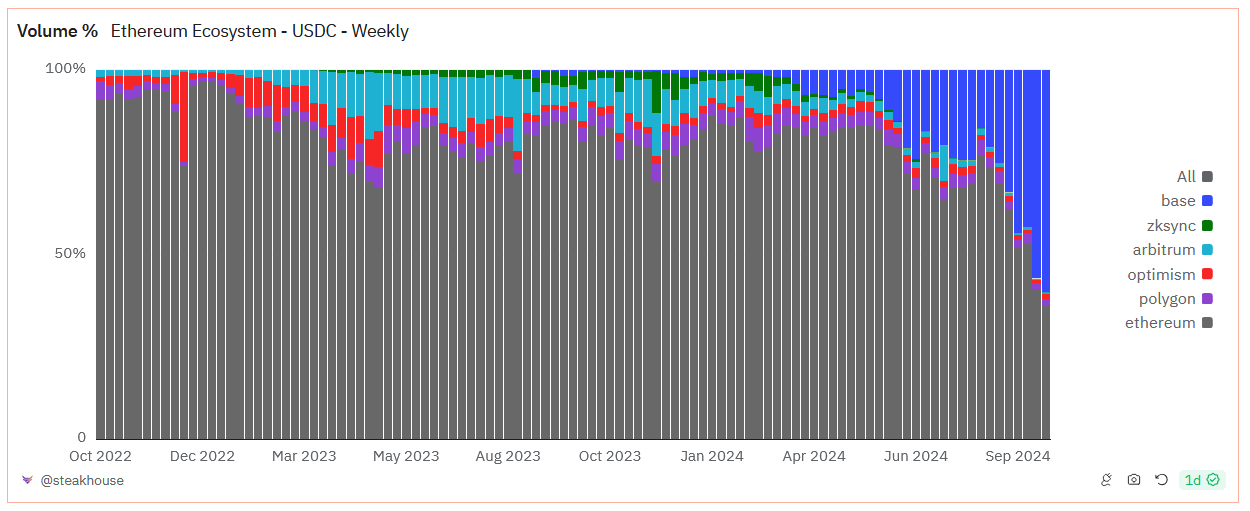

USDC transfers on Base:

Base’s share of total USDC transfer volumes across major EVM networks is hitting a second consecutive weekly peak over Ethereum mainnet — 60.2% share this time. It’s not clear what onchain activity is driving the surge.

My first hunch was memecoins, yet Base’s memecoins do not drive that much trading volume. Its top memecoin, BRETT, generated $44 million in trading volume over the last 24 hours. For context, total USDC transfer volumes in the last week of September was $75.8 billion.

Other relevant variables may include the revamp of Coinbase’s Web3 smart wallet, which lets users send USDC (and EURC, cbBTC) for free, or the conclusion of Base’s three-month long “Onchain Summer” campaign which distributed 300+ ETH to builders and generated $5 million revenue for creators.

— Donovan Choy

blockworks.co

blockworks.co