$FET price is showing some unusual patterns that could impact its direction in the near future. Recent activity from major holders has caught attention, raising questions about what’s next for the token. While certain indicators point to potential gains, others suggest there might be caution among larger investors.

These conflicting signals are creating uncertainty around the short-term outlook. With the market closely watching, $FET’s next move could be pivotal.

$FET Whales Are Sending Paradoxical Signs

Big holders of $FET have been showing paradoxical signs in recent days. Monitoring the actions of a coin’s whales is crucial because it provides insights into potential market moves, as large-scale holders can influence the price with their buy or sell decisions.

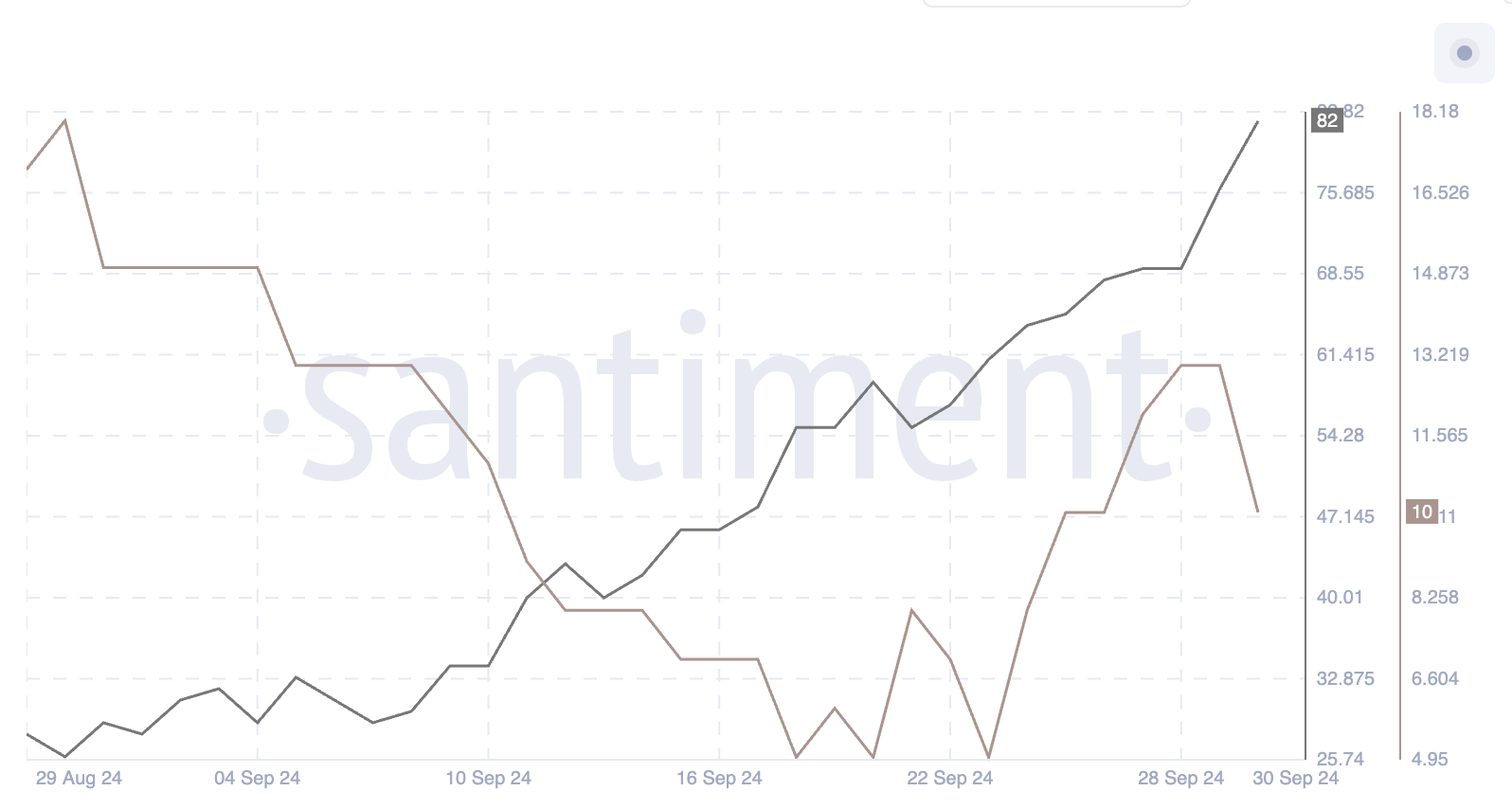

On September 28, there were 69 holders with between 100,000 and 1,000,000 $FET tokens, and by September 30, this number had risen to 82, marking an 18% increase in just a few days. However, during the same period, holders with between 1,000,000 and 10,000,000 $FET tokens dropped from 13 to 10.

Read more: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

This situation is unusual because while smaller large holders are accumulating, the biggest holders are reducing their positions, which could indicate a mixed sentiment in the market.

For $FET’s price, this divergence might suggest some short-term upward momentum from new buyers, but the retreat of the largest holders could signal caution or potential selling pressure ahead.

Social Dominance Is Down

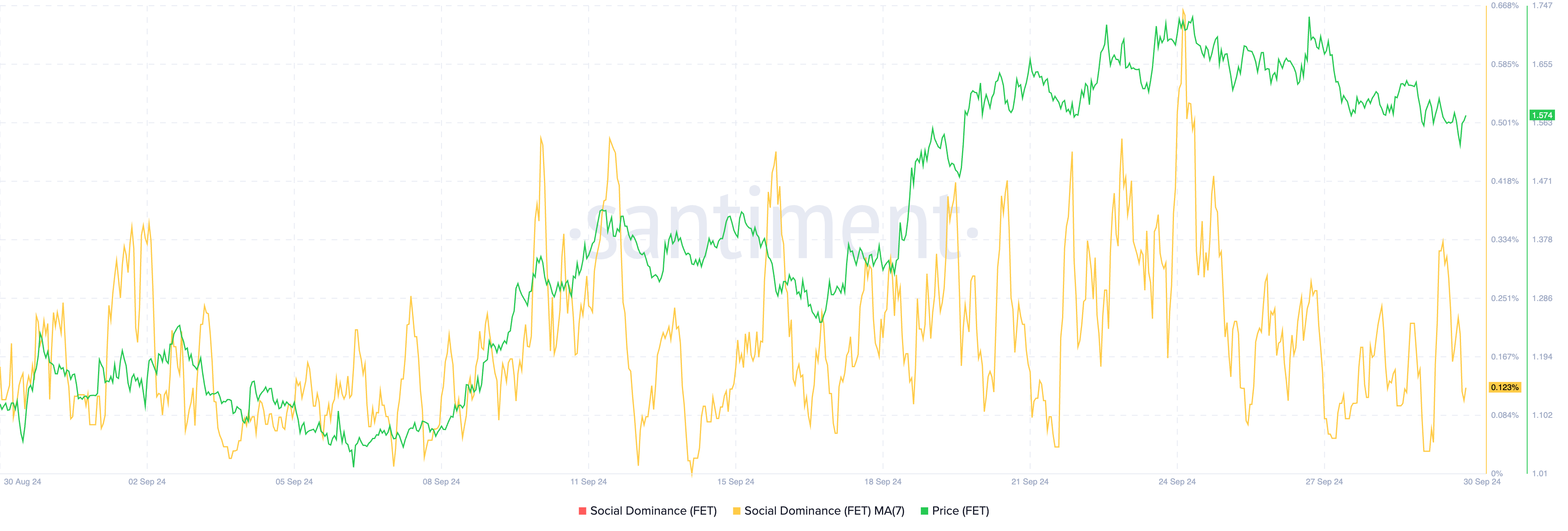

$FET’s Social Dominance 7-day Moving Average has seen a sharp decline, falling to 0.123%, down from 0.336% just a day ago and 0.668% on September 24. This decline matters because social dominance measures the level of attention and discussion a coin is receiving relative to the overall market.

A drop in this metric suggests fading interest or hype around the asset. Reduced social buzz often aligns with lower buying activity or enthusiasm from retail investors, indicating that excitement around $FET may be waning for the time being.

However, it’s important to note that $FET’s Social Dominance 7D MA hovered around 0.123% last month as well, yet that didn’t stop its price from climbing in the following days.

For example, between September 7 and September 12, $FET rose from $1.07 to $1.42, showing that even with low social dominance, price increases are still possible if other factors drive demand.

$FET Price Prediction: Can It Reach $1.87 Soon?

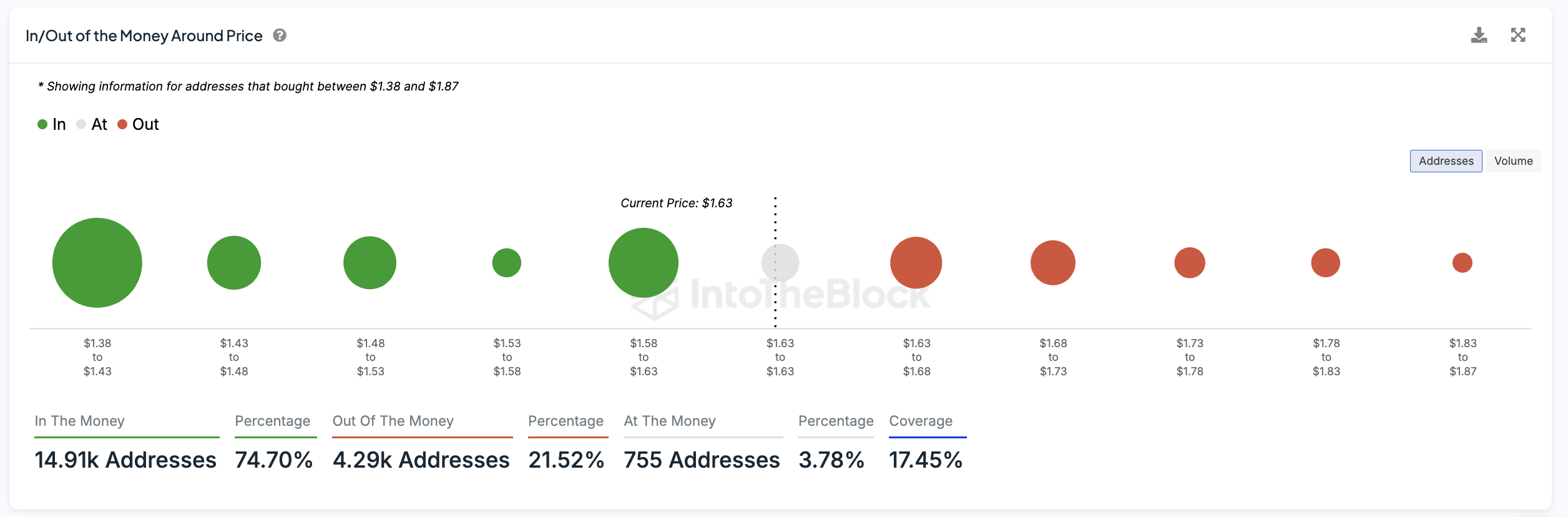

According to the In/Out of the Money Around Price chart, $FET faces strong resistance at $1.68 and weaker resistance at $1.73. If these levels are broken, $FET could quickly rise to $1.87, offering a potential gain of 14.7%. That could be driven by all the hype around artificial intelligence coins, which appear to be on the rise lately.

The In/Out of the Money Around Price metric tracks the distribution of holders who are in profit (in the money) or at a loss (out of the money) based on their entry price, providing insights into where selling pressure or buying support might come from.

It highlights key resistance levels at which holders might sell to secure profits and support levels at which buyers may step in to prevent further decline.

Read more: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

However, if $FET’s current trend reverses, there’s strong support at $1.58, but if that fails to hold, the price could drop as low as $1.38, indicating significant downside risk.

beincrypto.com

beincrypto.com