Bittensor, a fast-growing artificial intelligence token, was the second best-performing top 100 cryptocurrency in September after Sui.

TAO jumped by 108% in September

Bittensor (TAO) rose by 108%, while Sui (SUI), a popular Solana rival, jumped by 115% during the month. TAO has risen by 276% from its lowest point in August, bringing its market cap to over $4.4 billion.

Bittensor’s rally coincided with the rebound of some of the most popular AI assets like Nvidia, C3.ai, Alibaba, and Palantir.

It also followed major developments in the AI industry. One of the biggest events was Alibaba’s decision to launch over 100 new open-source AI models as it seeks to become a major player in the industry.

Another big event was on OpenAI’s surging valuation, which rose from $100 billion on Aug. 30 to $150 billion by Sept. 14. The company, which runs ChatGPT, has become one of the most valuable in the AI industry. AI coins like Bittensor tend to perform well when the industry is thriving.

Bittensor soared after Grayscale launched the TAO fund, which has attracted over $4.1 million in assets and trades at a 5.6% premium to net assets. Grayscale also launched a SUI fund, which attracted $2.3 million in assets.

Meanwhile, Bittensor’s demand in the futures market surged, reaching a record high of $172 million on Sep. 30, up from September’s low of $46 million. Soaring open interest is a sign of increased demand among traders and investors.

On-chain data also shows that the Bittensor network is growing, with the number of active accounts rising to over 127,000 and the amount staked hitting 5.9 million.

Some analysts believe that Bittensor’s token will have more upside. In an X post, an analyst predicted it would jump to $1,000, citing its strong technicals.

Another user pointed to the upcoming launch of BIT001, which will allow Bittensor’s subnets to create their independent tokens.

Bittensor formed a golden cross

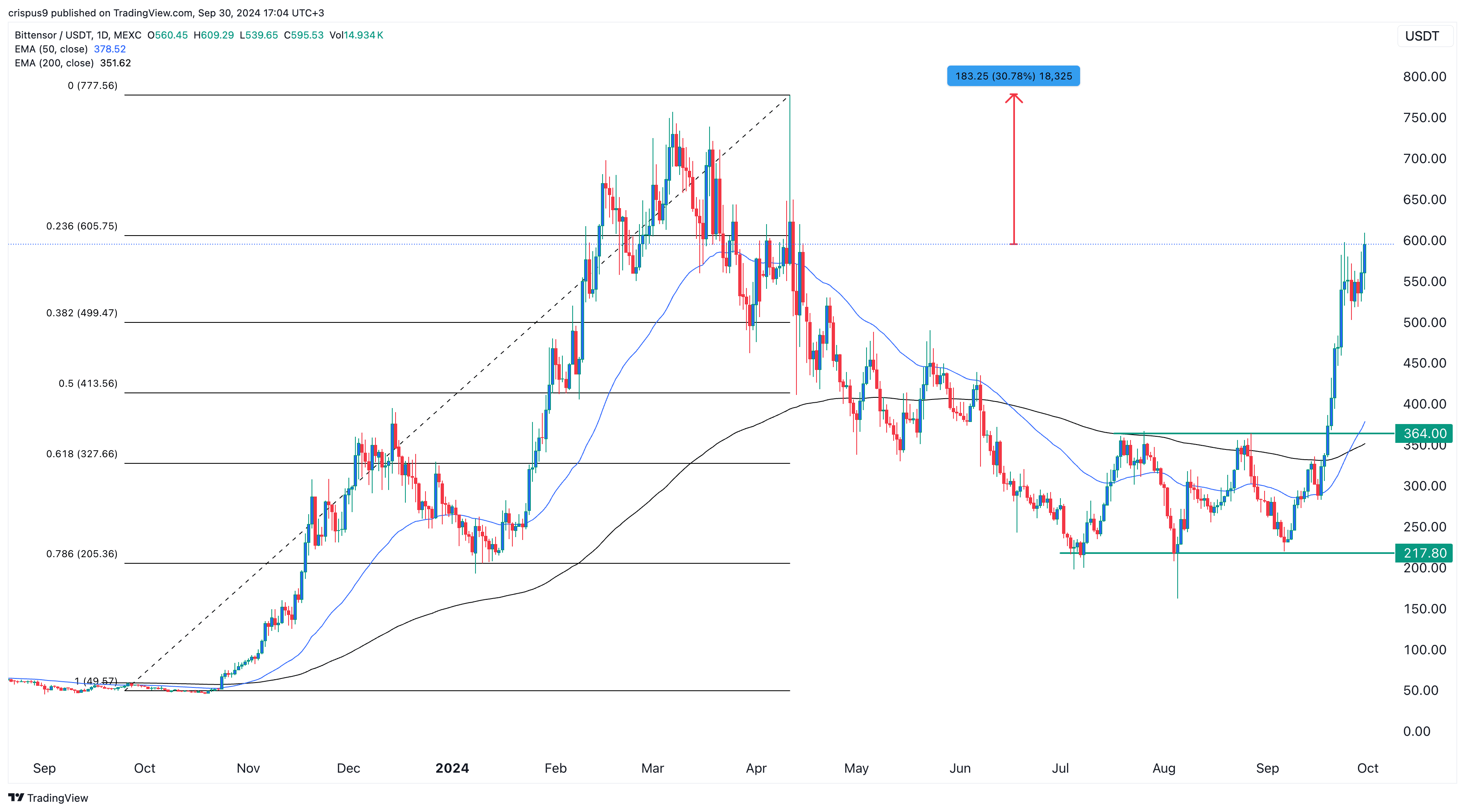

The TAO price jumped after forming a triple-bottom at $217 and moving above its neckline at $365, its highest point on July 26 and Aug. 27.

Bittensor also formed a golden cross pattern as the 200-day and 50-day moving averages crossed each other.

It was approaching the 23.6% retracement point on Sep. 30 and was attempting to cross the psychological level at $600. A break above that level would indicate further gains to $777, its highest point this year, which is 30% above the current level.