After notching a 30% increase, Notcoin’s (NOT) price is gearing up for an extended rally. If achieved, many holders who are currently holding at a loss will either hit breakeven or make gains.

On September 23, Notcoin’s price was $0.0073. However, as of this writing, the altcoin is now $0.0094. This analysis examines the driving forces behind NOT’s latest rally and what investors can expect as the coin attempts to build on the bullish outlook.

Notcoin Sets Sights on New Gains

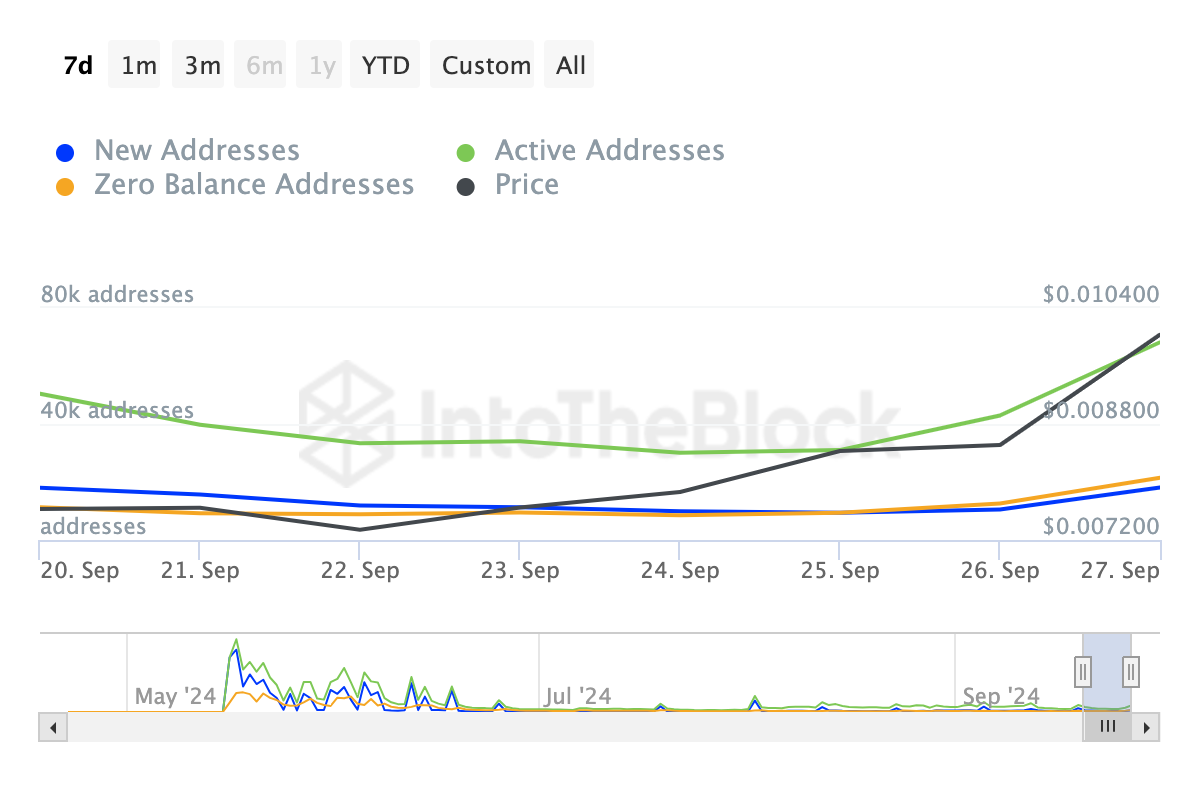

According to BeInCrypto’s findings, Notcoin’s price rally could be attributed to improved network activity. At press time, the number of active addresses has increased by 35% within the last seven days.

Active addresses serve as a good indicator of user engagement on a blockchain. When they rise, it means that users are increasingly interacting with a cryptocurrency. A decrease, on the other hand, indicates less user participation.

Like the active addresses, zero-balance addresses also jumped. This time, it was by 90%, indicating traction and adoption on Notcoin have reached impressive levels. Generally, this is a bullish sign, and as such, was critical to the way NOT’s price sustained its upswing since Monday.

Read more: How To Buy Notcoin (NOT) and Everything You Need To Know

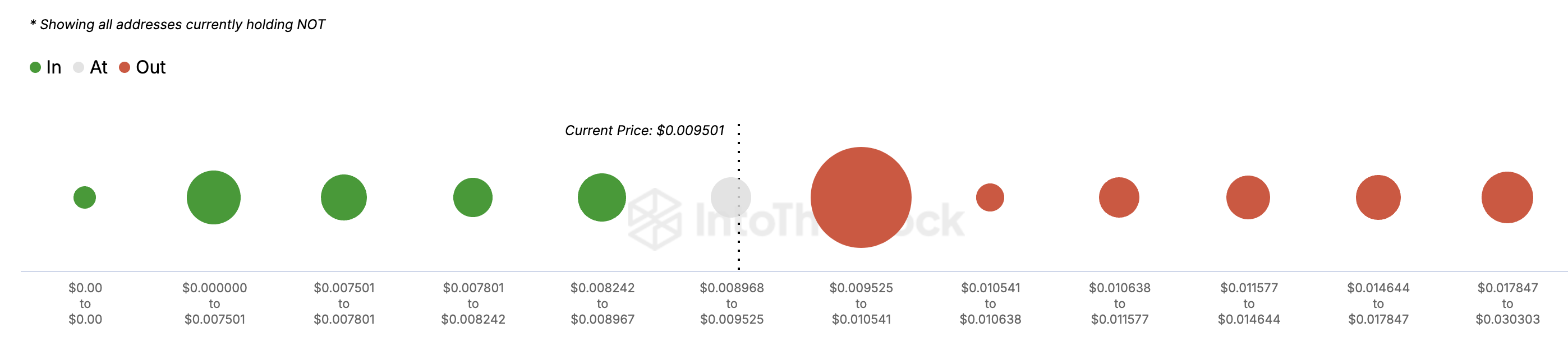

If sustained, Notcoin’s price might also repeat another 30% increase, potentially taking the price to $0.012. Based on the Global In/Out of Money (GIOM), the potential surge could send 23,848 addresses that hold over 62 billion tokens into profits.

By revealing the number of addresses making or losing money at the current price, the GIOM can tell how much holders would make if the price hits a certain level.

For Notcoin, these holders purchased NOT between $0.0095 and $0.012. Therefore, if the price retests $0.012, the 62 billion tokens that are currently out of money will be worth a little over $700 million.

NOT Price Prediction: Major Bounce Likely

Based on the chart below, Notcoin’s price got close to hitting $0.011 earlier but was pulled back to $0.0094. However, the Parabolic Stop And Reverse (SAR) shows that the uptrend might not be over.

The Parabolic is a technical indicator used to determine the price direction of an asset. When the dotted lines are below the price, the trend is bullish. Conversely, if the lines are above the price, the trend is bullish, and a notable correction could be next.

For NOT, it is the latter, suggesting that a rebound is not far away. The Moving Average Convergence Divergence (MACD), which measures momentum, also supports the position as the reading remains positive.

Read more: 5 Top Notcoin Wallets in 2024

Using the Fibonacci levels, Notcoin’s price could increase by another 30% within a few weeks. In that case, the price could be $0.012. Meanwhile, the value could decline to $0.0082 if momentum turns bearish or profit-taking from the recent hike surges.

beincrypto.com

beincrypto.com