Pepe, the third-largest meme coin, staged a strong comeback, soaring to its highest point in over a month as balances in centralized exchanges fell.

Exchange outflows are rising

Pepe (PEPE) jumped to a high of $0.0000091, pushing its market cap to over $3.8 billion. This recovery coincided with the strong rebound of other meme coins like Shiba Inu (SHIB), Dogwifhat (WIF), and Mog Coin, which rose by over 10%.

The market cap of all meme coins tracked by CoinGecko rose by almost 7% in the 24 hours to Sep. 26, reaching $50 billion.

The main reason for this rally was last week’s Federal Reserve’s jumbo interest rate cut, along with hints that more cuts were on the way. Additionally, China, the second-largest economy, unveiled its biggest stimulus since 2020. According to Bloomberg, Beijing is also weighing a $142 billion capital injection to boost the economy.

PEPE breaking out + china about to flood the market with liquidity

— CRG (@MacroCRG) September 26, 2024

Perfect storm for chinese pepe to shine $PEIPEI full send it pic.twitter.com/EKnMKdcknf

There are also signs that more investors are moving back to Pepe. According to Nansen, Pepe had outflows worth $4.2 million on Sept. 26, a 6x increase above average. The total supply on exchanges has dropped by 0.35% in the last seven days.

A significant outflow from centralized exchanges is a sign that more investors are moving the coin from exchanges to their own custody.

Pepe’s jump also coincided with a surge in futures open interest, reaching $129 million, its highest level since Aug. 2, according to CoinGlass.

Pepe price is nearing key resistance

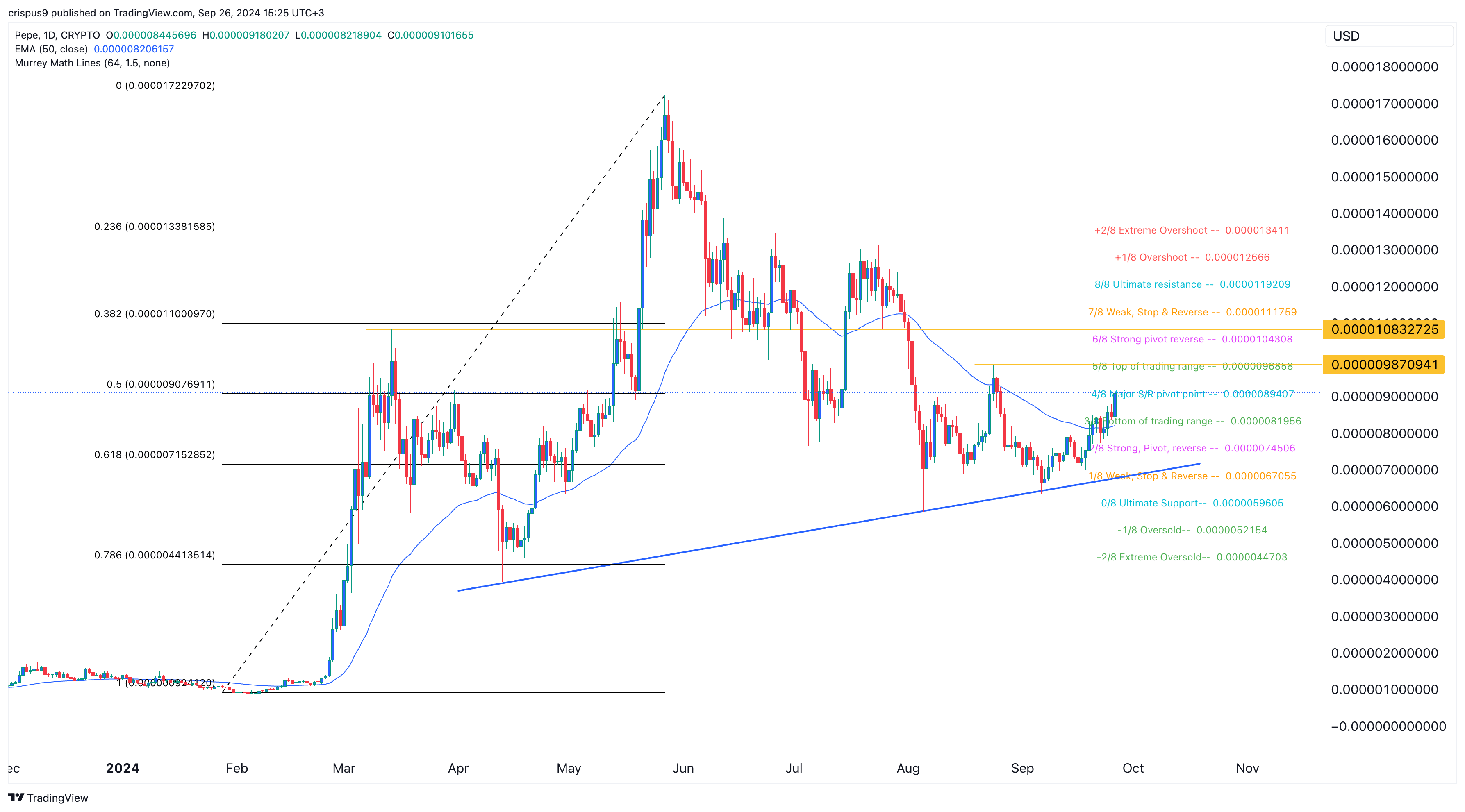

On the daily chart, Pepe bounced back after retesting the ascending support that connects the lowest swing since April. It jumped above the 50-day moving average and retested the 50% Fibonacci Retracement point at $0.0000090.

Pepe also moved to the major support/resistance level of the Murrey Math Lines at $0.0000090 and the Ichimoku cloud indicator.

The next level to watch will be $0.00000987, its highest swing on Aug. 4 and the top of Murrey’s trading range. A break above that level could push it to the next target of $0.0000108, its March high.