Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

PUMPkin spice latte

Crypto markets are giving hints of altcoin season. Sadly, we’re not there yet.

As with most things ‘round these parts, there are hardly any formal definitions on which we all agree.

Does a bitcoin bear market start when it corrects over 20% from its local top, as is the case with traditional finance? Obviously not.

Is a protocol “decentralized” because it has a governance token? Life would be easier if that were always true.

The total crypto market cap has jumped almost 20% since earlier this month, swelling by over $360 billion to $2.35 trillion. Altcoins are responsible for about 40% of those gains, with the rest coming from bitcoin.

So, what exactly is an altcoin season?

One sometimes-cited index says an altcoin season starts when three quarters of the top 50 coins have performed better than bitcoin over the past 90 days.

Only 34% of the top-50 have beaten bitcoin across that period. No altcoin season, although there was a very brief period at the start of the year where those conditions were met.

As loyal Empire readers would know, I have a different way of tracking altcoin seasons that includes much more of the market than just the top 50. But even that still says we’re far away.

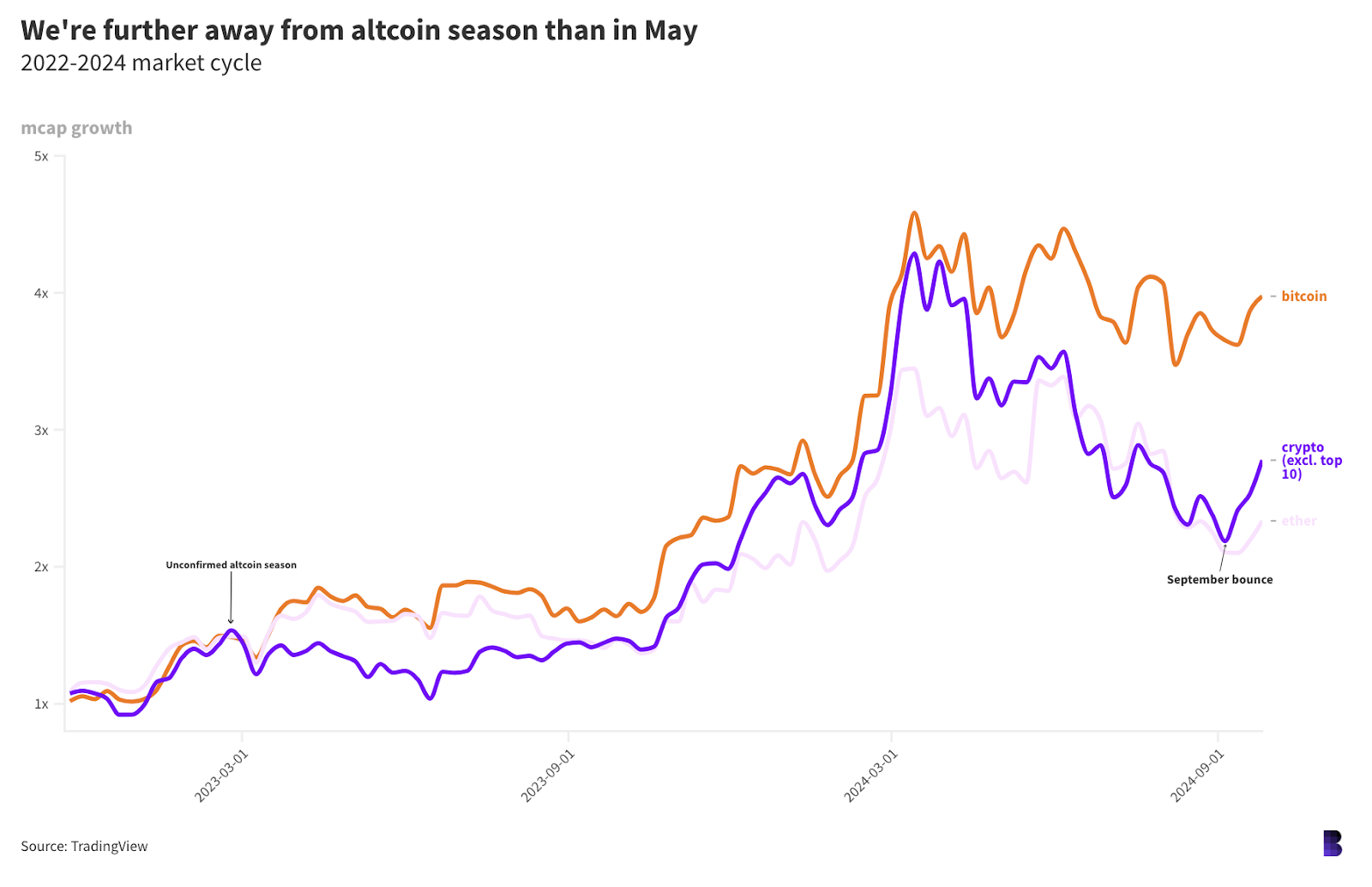

It goes like this: Altcoin season potentially starts when the market cap growth of the entire crypto market — minus the top 10 — eclipses that of bitcoin, starting from the cycle bottom.

An altcoin season is only confirmed if the wider crypto market grows faster than bitcoin for at least 90 days in a row.

It’s not a perfect model, but it does hold up during backtesting. It’s also generous to altcoins: In many cases, market cap growth merely reflects the rate at which tokens are unlocked and added to circulating supplies — not price appreciation.

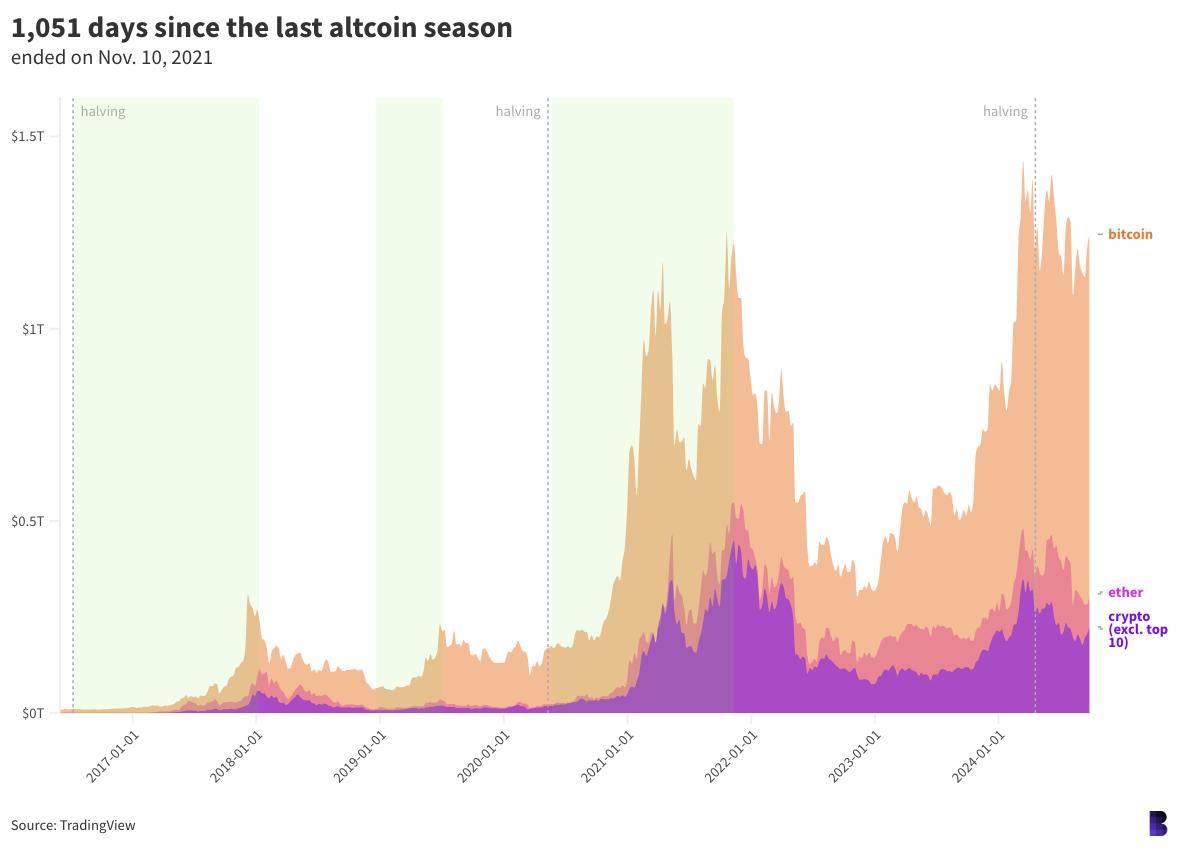

Based on these rules, crypto has seen three distinct altcoin seasons in the past eight years, as shown by the green shaded areas on the chart below.

- 18 months between July 2016 and January 2018 — litecoin, monero, ethereum classic, dash and proto-prediction market token augur were in the top 10.

- Six-and-a-half months between December 2018 and July 2019 — bitcoin cash, EOS, stellar and bitcoin sv were close to blue-chip status

- Nearly 18 months between May 2020 and November 2021 — polkadot and chainlink sat at the top end.

The current market cycle started on Nov. 21, 2022, when crypto’s total market cap slipped to $727.58 billion following the FTX debacle, its lowest point since December 2020.

Bitcoin’s market cap has grown by almost four times from that cycle bottom — from $313.4 billion to $1.27 trillion ($15,500 to $64,400).

Altcoins, meanwhile, have grown by less than 2.8x over the same period, which means we’re over a whole order of magnitude away from altcoin season.

That gap had increased dramatically between April and the start of this month, when altcoin season was the furthest away it’s been all cycle. It was at its closest when bitcoin peaked in March.

All that implies that whatever rallies are happening in altcoins right now are really just solid bounces.

Altcoin prices corrected hard after bitcoin’s recent all-time high and have only now broadly returned to where they were at the end of July.

Bears would say that altcoin season won’t arrive before the bull market runs its course.

Bulls, however, might reason that we’re in for what could be the most powerful altcoin season on record — considering how far they still have to run.

— David Canellis

Data Center

- BTC is up 1% in the past day and is eyeing another run at $64,500, after bouncing off it at least three times in the past seven days.

- ETH is flat after meeting its own resistance at $2,640.

- Only two top-100 tokens are down in the past week: KAS has shed 6%, XMR 5%.

- Ether again slipped into deflationary status overnight, but not for long.

- Base TVL has set a new record above $2 billion for the first time ever, adding over $600 million in the past 18 days.

Take a breath

This week has been quiet when it comes to volatility, but it might not stay that way for very long.

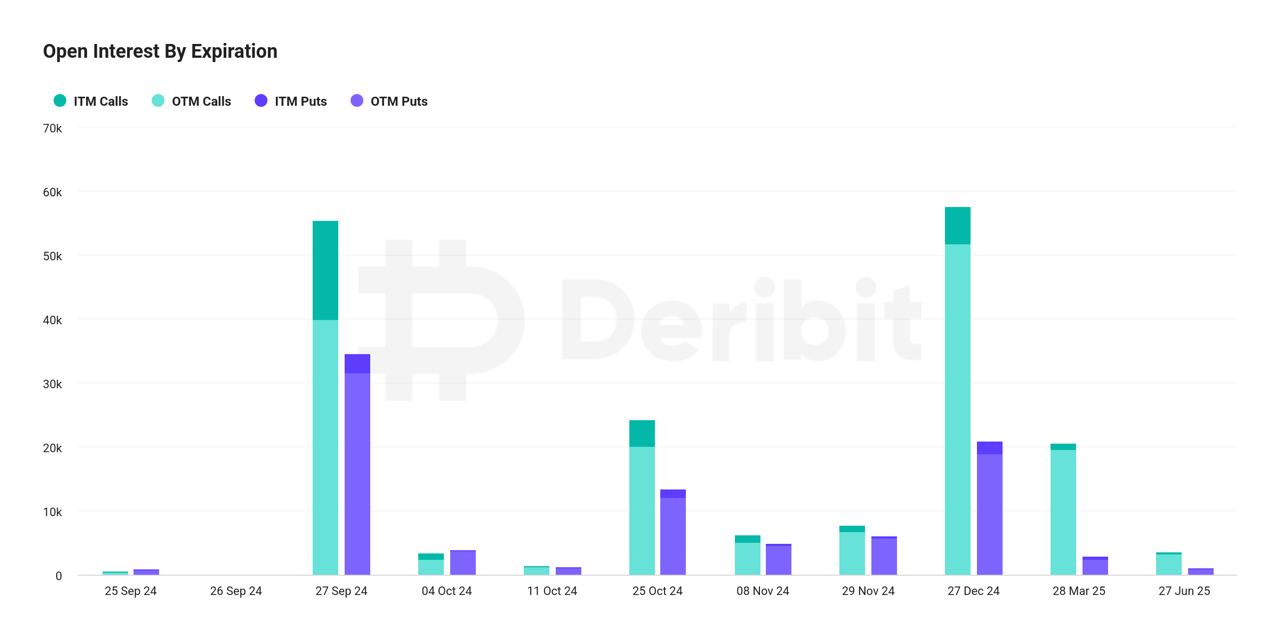

You see, $5.8 billion of options expire tomorrow in one of the largest expirations so far this year.

20% of bitcoin options are in the money, meaning that the larger expiry “is likely to heighten market volatility or activity as traders close or roll over their positions, which could also impact price,” Deribit CEO Luke Strijers said.

“Overall the options market (all parties) has seen a good year with volumes growing month over month. Despite a lot of new competition, we have not seen a very large loss of market share, which is a healthy signal as the market is growing — exchanges do not compete for the same clients, we jointly grow the pie and activate new ones,” Strijers continued.

With this looming, let’s zoom out and look at the broader market since David’s provided us with a nice snapshot into altcoins. A K33 note earlier this week showed that CME traders are “cautiously optimistic.”

“CME premiums pushed toward 9% for BTC and ETH following the FOMC’s rate cut announcement. Open interest on CME peaked at 161,040 BTC last Thursday after the FOMC, amidst an aggressive 6,500 BTC increase in exposure from active market participants. Since then, open interest has retraced to 152,000 BTC,” the analysts wrote.

But perp traders aren’t feeling as optimistic and some bearish sentiment remains, which could “set the stage for a sizable short squeeze.”

“Perp traders have begun to lean more conservative since the initial FOMC-related rally, with a widening perp discount amidst steady price action. This coincides with an increase in open interest which still hovers near yearly highs,” per analysts Vetle Lunde and David Zimmerman.

The fear and greed index, for those of you that follow it, is neutral after showing some fear last week.

The macro influence isn’t going away any time soon, with K33 noting: “We also expect economic indicators to continue influencing bitcoin price action. Next week sees the monthly release of important US labor market statistics, accompanied by a banking holiday season in the Eastern hemisphere, which may heighten emphasis on US-related data.”

We’re getting closer and closer to the November election and the fourth quarter, which still looks to be a potentially positive time for crypto.

For the bulls, it’s almost go time.

– Katherine Ross

The Works

- Ethena is launching a stablecoin backed by BlackRock’s BUIDL.

- Vice president and presidential nominee Kamala Harris said the US should become “dominant” in blockchain.

- PayPal’s US business customers can now buy, own and sell crypto, the firm said.

- Asset manager Guggenheim tokenized $20 million of commercial paper on the Ethereum blockchain, CoinDesk reported.

- Curve Finance is considering removing TrueUSD as collateral for its stablecoin Curve USD.

The Riff

Q: Where is crypto headed in 2025?

I’m still only hearing positive things about next year.

Mind you, that hype train has yet to fully leave the station. But the folks on board seem pretty content with the way things are going. And no, a lot of them don’t seem to care who becomes president.

BTC at $1 million is unlikely, so let’s not get too crazy, but $75,000 to $100,000 is still on the table.

A full-swing bull market is also still in play, though it’s hard to tell how likely that is at this point. We’re still a tad too early to make those calls, but hopium is a wild thing.

– Katherine Ross

Only cowards wait until the end of the year for lofty predictions. Here are my top five:

- A memecoin native to Bitcoin will flip PEPE.

- A synthetic stablecoin will implode.

- DePIN activity will decouple from token prices.

- At least one spot ETF will be hacked.

- Initial coin offerings will make a comeback.

Other weird stuff might start to come true, too. AI trading bots could gamify flash loan attacks. Would they be punished to the same degree as humans?

A public good crypto-lottery might replace Telegram click-to-earn games. After all, what’s the difference between trying to time the top on a memecoin airdrop and leaving it all up to RNG on the blockchain?

Personally, I’m ready for a more chaotic crypto space in 2025. If we wanted calm, we’d be obsessing over pension funds, not magic internet money.

— David Canellis

blockworks.co

blockworks.co