Chainlink continued its strong comeback, rising for two consecutive days and reaching its highest point in over four weeks.

Chainlink ($LINK )jumped to $12.3, up over 53% from its lowest level this year, as its ecosystem and use cases continue to grow.

Data from DeFi Llama shows that Chainlink maintains the largest market share in the oracle industry with a total value secured of $23.3 billion. It surpasses competitors like WINKlink, Chronicle, and Pyth Network, which have a combined TVS of $20.5 billion.

Chainlink’s rally is happening as investors anticipate a resurgence of the DeFi industry. $AAVE ($AAVE), the largest part of Chainlink’s ecosystem, has surged to its highest level since April 2022.

There are also signs that Chainlink’s ecosystem is expanding. This week, Stader Labs integrated its Cross Chain Interoperability Protocol, supporting token transfers across Arbitrum, Ethereum, and Optimism. Other recent Chainlink integrations include Arcadia Finance, Backed, and Nexera, formerly known as AllianceBlock.

⬡ Chainlink Adoption Update ⬡

— Chainlink (@chainlink) September 22, 2024

This week, there were 19 integrations of 6 #Chainlink services across 8 different chains: @arbitrum, @avax, @base, @BNBCHAIN, @ethereum, @Optimism, @0xPolygon, and @zksync.

New integrations include @ArcadiaFi, @BackedFi, @fufuture_io,… pic.twitter.com/x6x2W32z0L

Chainlink’s price also rose as demand for the coin and its futures continued to increase. Data from CoinGlassshows that futures open interest rose to $187 million, its highest point since July 24.

At the same time, data collected by CryptoQuant through Aug. 20 shows that balances in exchanges have been in a downtrend. Lower coins in exchanges is a sign that many investors are holding their tokens.

However, data compiled by Nansen shows that $LINK had a CEX inflow of almost $5 million in the last 24 hours. CEX inflows mean that some investors have started to exit.

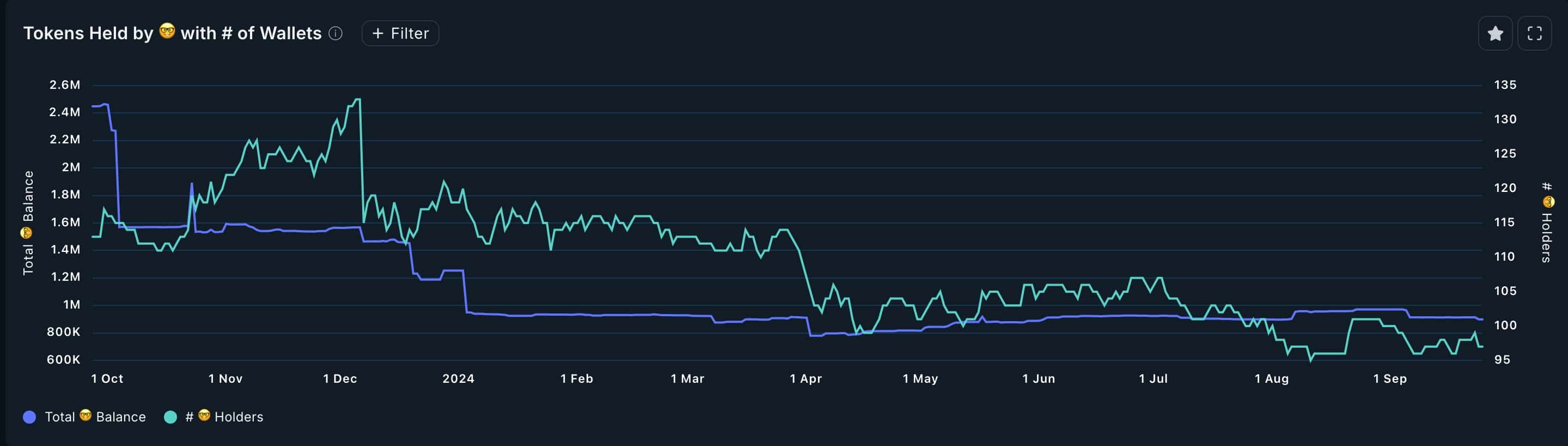

Another notable trend is that the number of smart money investors holding $LINK has dropped from 133 in December to 97. The balances held by these investors have fallen from over 2.4 million in October last year to 900,000.

One potential risk for Chainlink investors is that over 373 million tokens, valued at $4.2 billion, are still locked. Recently, developers unlocked tokens worth $208 million, with most moved to Binance. Future token unlocks could lead to significant dilution for existing investors.

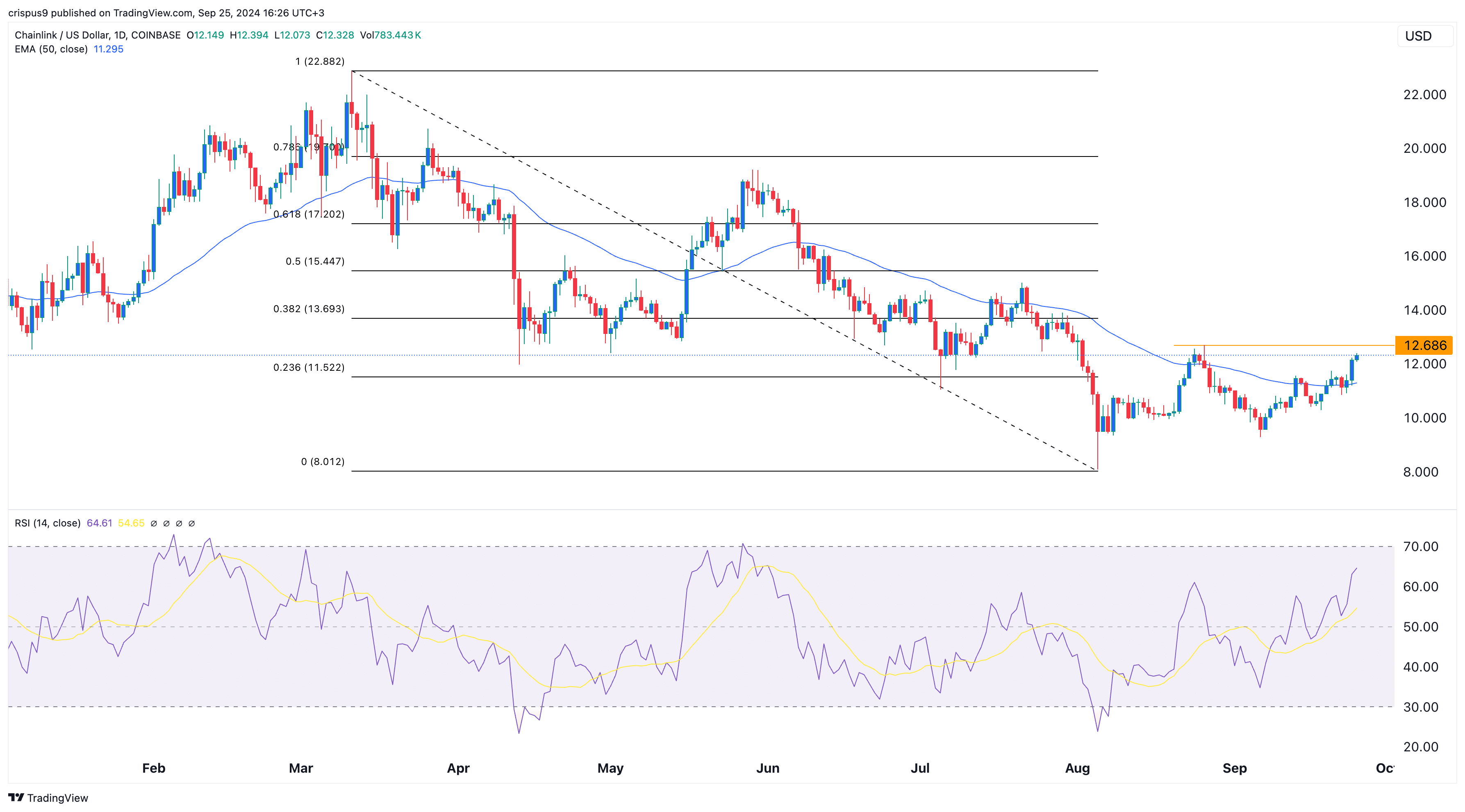

Chainlink price nears key resistance

On the daily chart, Chainlink has rebounded from the year-to-date low of $8.01 to $12.3. It has flipped the 23.6% Fibonacci Retracement point at $11.52 into a support level. Additionally, the coin has moved above the 50-day moving average, while the Relative Strength Index has moved to 64.

The RSI is an oscillator that measures the rate of change of an asset. It increases when an asset gains momentum. More upside could be confirmed if $LINK rises above the key resistance level at $12.68, its highest swing on Aug. 26.