GMX token remained flat on Tuesday, Sept. 24, as most cryptocurrencies continued consolidating and volume in its ecosystem retreated.

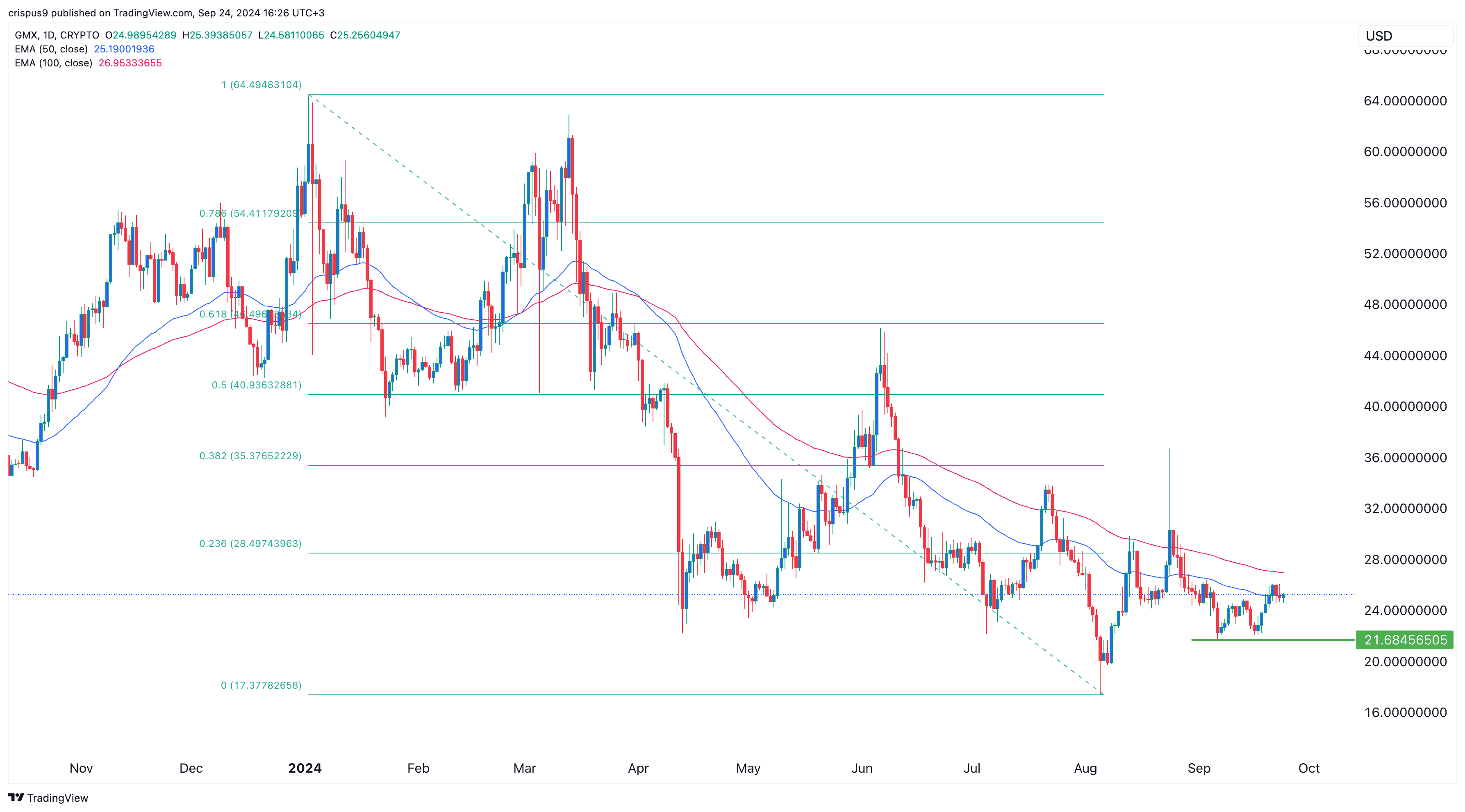

GMX (GMX) was trading at $25.2, slightly above this month’s low of $21.55. It has risen by over 44% from its lowest level this year, bringing its market cap to over $244 million.

GMX, one of the leading players in the on-chain perpetual futures industry, has seen its volume decline in recent weeks.

Data from DeFi Llama shows that the exchange handled over $144 million in the last 24 hours and $924 million in the past seven days. It has been overtaken by Hyperliquid, which processed futures tokens worth over $7.6 billion during this period.

GMX has also been surpassed by other decentralized exchanges like dYdX, Satori Finance, Orderly Network, and Jojo.

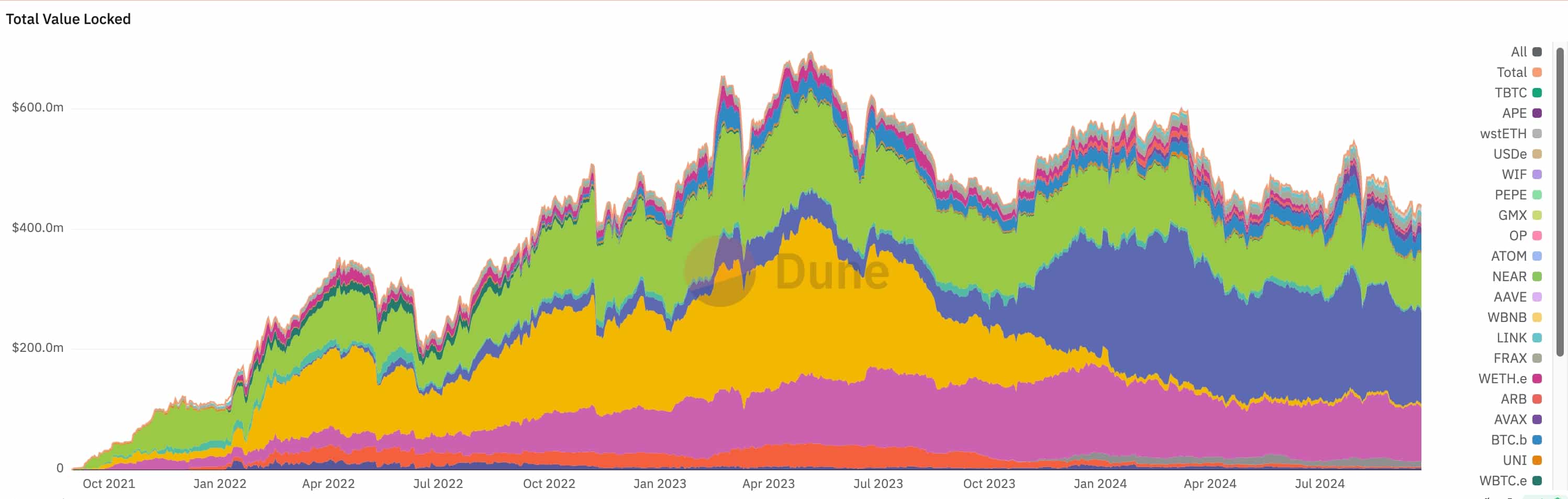

According to Dune Analytics, the total value locked in GMX across all chains has retreated from over $692 million in 2023 to $440 million.

GMX hopes to regain market share by introducing new innovative products. Last week, the developers launched the kink borrowing model across all markets, boosting the available liquidity by between 30% and 40%.

There is also speculation that GMX will soon deploy on Solana (SOL), one of the most popular chains in the industry. The developers are working on enabling GMX staking, which will allow users to generate rewards. In July, members voted to introduce more revenue distribution methods in the network.

$GMX

— Jonezee 🫐 (@Jonas_ALA) September 23, 2024

Buybacks starting. GMX Solana deployment soon. Strong DeFi revival narrative. Deepest onchain liquidity Perp DEX. Market volume up = GMX up, history shows.

GMX, like other futures networks, has seen its transaction volume retreat in recent months. This volume peaked at $321 billion in March when Bitcoin (BTC) reached a record high of $73,800. Its monthly volume in September stands at $291 billion, DeFi Llama.

GMX token is still under pressure

The GMX token remains under pressure, despite rising by over 40% from its lowest point this year. It has failed to flip the 50-day and 100-day Exponential Moving Averages into support levels.

GMX also remains below the 23.6% Fibonacci retracement level, indicating that bears are still in control. Therefore, the GMX token will likely resume its bearish trend and retest this month’s low of $21.68.