The proposed $BONK ETP — potentially the first ever meme coin exchange-traded product — could bridge the gap between crypto investors and Wall Street.

Table of Contents

Bonk eyes Wall Street

Bonk ($BONK), a top meme coin built on Solana (SOL), has announced plans to launch an Exchange Traded Product in the United States.

A core developer for Bonk, Nom, revealed the news at Solana’s Breakpoint event, which took place on Sept. 20-21. The meme coin is partnering with Osprey Funds, a New-York based firm known for bringing crypto assets into traditional markets.

As with any crypto ETP, the move aims to lower barriers for traditional and institutional investors to access crypto. An ETP acts as a representation of the underlying asset’s price — in this case the asset would be $BONK — and can be traded on traditional stock exchanges, removing the specific complexities of crypto wallets and exchanges.

According to the announcement, the ETP would be “seed funded by Bonk DAO and strategic partners” and made available to both retail and institutional investors. However, no official launch date has been confirmed yet.

$BONK announces an Exchange Traded Product (ETP)

— Cloudz (@FamousCloudzz) September 21, 2024

The first step towards a $BONK ETF❗️❗️❗️ pic.twitter.com/1OyNyxBvbK

If successful, this would be the first time a meme coin has entered the ETP space — a critical shift for a crypto asset category often seen as especially speculative, as well as short-lived and just plain unserious.

Is a Bonk ETF a done deal?

While the Bonk community has announced plans to launch an ETP in the U.S., it’s important to understand that this doesn’t guarantee that the product will be approved for trading any time soon — or at all.

The announcement is just the first step in what could be a long and uncertain journey, and regulatory approval from the U.S. Securities and Exchange Commission remains a key hurdle.

In the past, the SEC has been cautious about approving ETPs for even the top two cryptocurrencies, citing concerns about market manipulation, volatility, and lack of investor protections.

For Bonk’s ETP to get approved, the SEC would likely need to evaluate several things:

- Market transparency: The SEC would want to ensure that the markets where Bonk tokens are traded are stable, transparent, and resistant to manipulation. Meme coins like Bonk are usually considered especially volatile and speculative, which could raise concerns.

- Investor protection: The SEC’s main job is to protect investors. It would be looking at whether retail and institutional investors have enough information to understand the risks of investing in an ETP with Bonk as the underlying asset. Since meme coins can swing wildly in price, this could be a sticking point.

- Market impact: The SEC would also consider whether introducing a Bonk ETP could disrupt financial markets or create unforeseen risks. It would closely evaluate how an ETP for a meme coin might behave differently from one for more established assets like Bitcoin or traditional stocks.

While Osprey Funds, which is handling the Bonk ETP, has experience with other crypto financial products, including Bitcoin ETFs, that still doesn’t guarantee success.

Even ETP applications for the most well-known cryptocurrencies have faced delays and rejections from the SEC. For example, spot Bitcoin ETFs took years to get approved, and many applications were rejected before the first one was launched in January 2024.

In short, the SEC could approve the ETP, but they could also reject or delay it if they feel the risks are too high or the product doesn’t meet their standards.

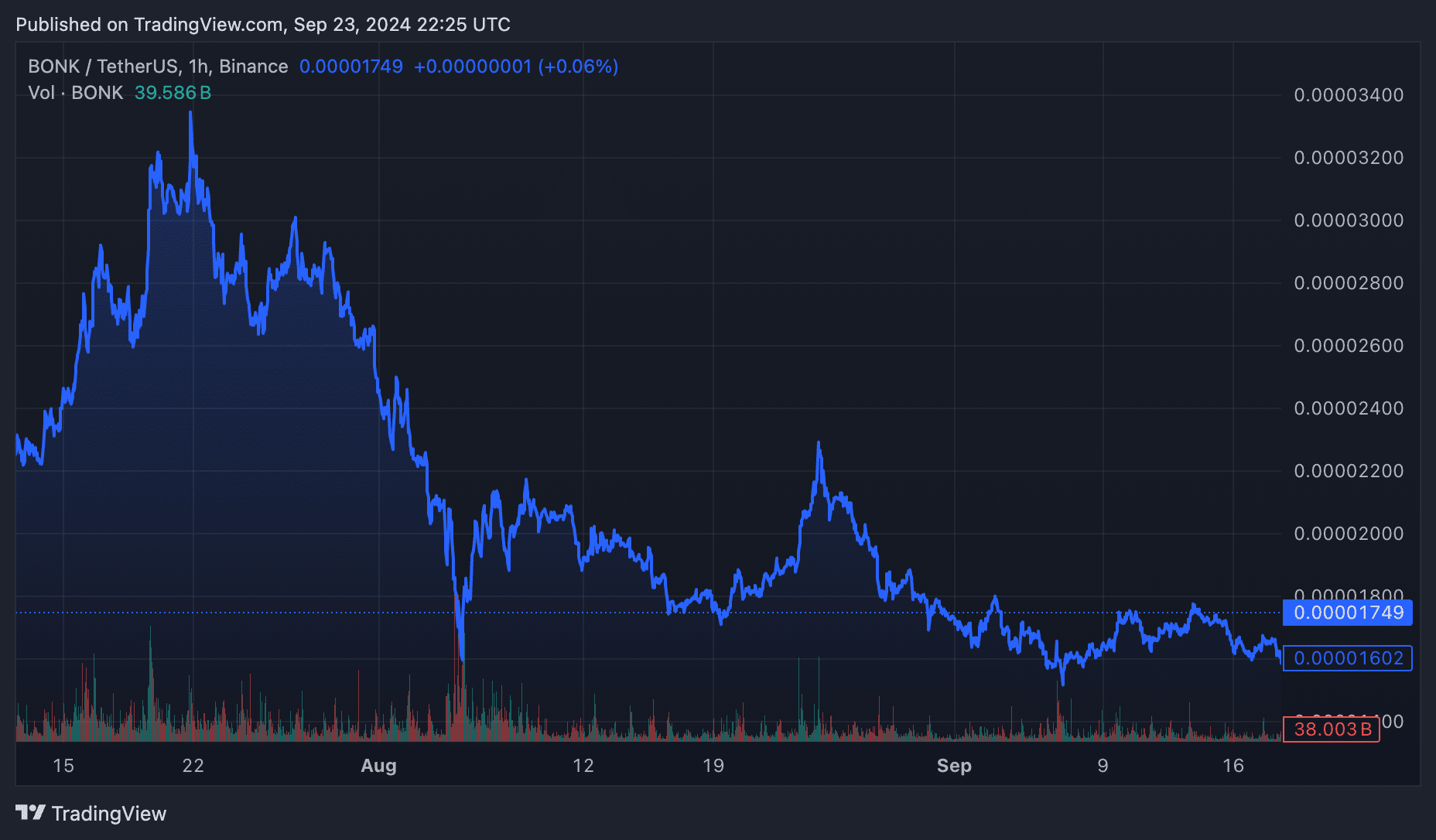

Bonk’s price action remains flat

The major announcement about launching the first-ever meme coin ETP created some buzz over the weekend, though it has not moved $BONK’s spot price dramatically.

As of Sept. 23, $BONK is trading at $0.0000175, a 4.3% increase in the past 24 hours and a more notable 8% rise over the past seven days, which appears to be part of a wider meme coins rally this past week.

Compared to its top meme coin peers, however, $BONK has been trading sideways recently. Shiba Inu ($SHIB), for instance, has seen a more robust price increase, rising over 11% in the last seven days to trade at $0.0000145.

Similarly, Pepe ($PEPE) has outperformed $BONK with gains of more than 13% on the week. Meanwhile, Dogwifhat ($WIF) has been the biggest gainer among top meme coins, with an 18% increase over the past week, now trading at $1.75.

Meme coin investors, known for jumping into highly speculative assets, appear to be more focused on tokens like $SHIB, $PEPE, and $WIF, which have shown stronger price action in recent days.

Additionally, $BONK’s relatively low profile compared to the likes of $SHIB or $PEPE could mean it’s being overshadowed by more established meme coins.

For now, $BONK price action remains subdued. The meme coin’s price is still trading in a relatively tight range, down from recent highs in July and August. It remains to be seen if this trend will continue, or if more traders start taking notice as the regulatory filing process for the ETP develops.

Social media’s mixed reactions

The announcement that Bonk is launching an ETP has sparked varied reactions across social media, split between excitement and skepticism.

For some, this move signals a breakthrough, with one X user calling it “insane” (in a good way) and highlighting how Bonk could become the first meme coin to enter the ETF space.

Ok this is insane. $BONK – the Solana OG meme coin. Loved by all Solana manlets.

— gnarleyquinn (@gnarleysol) September 21, 2024

Is about to launch an ETP. $BONK may be the first ever meme coin to get an ETF. pic.twitter.com/snEPQKIybr

However, not everyone agrees that the industry needs meme coin-based traditional financial products to move forward. Another X user expressed concern that this might actually undermine crypto’s legitimacy. According to their perspective, the push to legitimize meme coins for traditional financial players could be more about inflating the asset’s value for existing holders than providing genuine value to the broader crypto industry.

This sounds like the opposite route of legitimizing crypto. This is just the inevitable route because those who have this as an investment will try anything to legitimize it to gain more buyers, thus increasing their net worth.

— Enryu (@0xEnryu) September 21, 2024

Crypto, broadly, can suffer from this imo.

The worry is that moves like this could shift focus away from what crypto was initially, at least in part, intended to accomplish — offering decentralized alternatives to the traditional, mediated financial system — and lead to speculative bubbles instead.

Others added a layer of cynicism, suggesting that meme coins like Bonk are simply trying to find “alternative exit liquidity,” especially as competition heats up within the meme coin space.

Now that Tron has essentially taken over Solana's main meme #rugfactory use case, its memes need to find alternative exit liquidity.

— Ajki (@ajki76) September 21, 2024

The coming months will reveal whether this ETP brings actual value or simply adds fuel to the speculative fire that often surrounds meme coins.