Monday started on a positive note for bitcoin as it jumped to a four-week peak of $64,800 before it was stopped and pushed south.

The altcoins are sluggish on a daily scale, at least the larger-cap ones. Many of the mid- and lower-cap alts have charted notable gains.

BTC Halted at $65K

Bitcoin had an eventful seven-day period, which started with a price retracement from $60,000 to under $58,000 last Monday. The landscape changed mid-week when the US Federal Reserve announced the first rate cut in over four years, with a reduction of 0.5%.

Following the inevitable volatility, the cryptocurrency went on the offensive and added over four grand by Friday morning when it briefly topped $64,000. It failed there at first and spent the weekend trading sideways around $63,000.

This Monday was different than the previous one, as the bulls attempted another leg-up that drove bitcoin to a four-week high of just under $65,000. However, the asset was stopped there and pushed south by nearly two grand.

It’s worth noting that the week ahead is also expected to be quite eventful for the entire market, and you can see why – here.

As of now, bitcoin’s market capitalization has risen above $1.250 trillion, while its dominance over the alts stands at 54% on CG.

Alts With Massive Gains

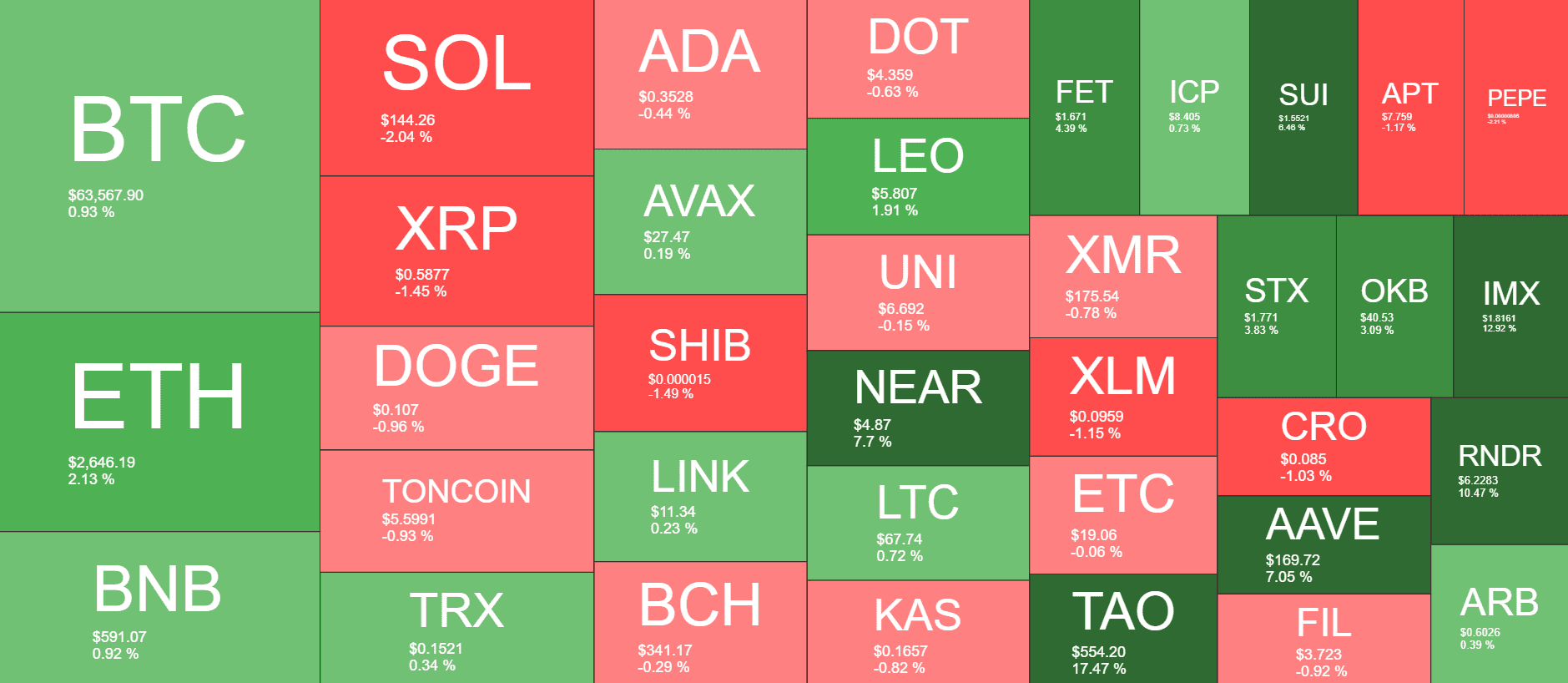

While most larger-cap alts sit quietly today, with minor gains from ETH, BNB, LINK, AVAX, and TRX or insignificant losses from SOL, XRP, and SHIB, the mid and lower caps have produced some impressive increases.

Bittensor’s native token leads the pack with a 15.5% daily surge. Moreover, TAO has skyrocketed by 80% in the past week and trades at around $550 now. IMX, RENDER, AAVE, WLD, and NEAR are the other notable daily gainers.

IMX also finds a spot in the top performers on a weekly scale, with a 45% surge, followed by SUI (40%) and APT (30%).

The total crypto market cap has added around $20 billion since yesterday and is now at $2.320 trillion on CG.

cryptopotato.com

cryptopotato.com