$XRP recently faced a rejection at $0.60, but a Cup and Handle formation on the 4-hour chart suggests potential upside toward $0.70.

Over the weekend, $XRP briefly reclaimed the $0.60 level for the first time in September. Amid this upsurge, it managed to clinch a one-month high of $0.6129 on Saturday.

However, the token quickly entered a correction phase, pulling back from these gains. As of this writing, $XRP hovers around $0.59, trading just under the psychological $0.60 barrier. This resistance zone has proven to be a major obstacle for $XRP.

$XRP Breaches Cup and Handle Pattern

Following the latest development, market analyst Steph noted in a YouTube analysis that $XRP broke above the neckline of a classic cup-and-handle pattern on the 4-hour chart during its weekend rally. Data from the charts shows that $XRP had been struggling to breach this level since Sept. 15.

Interestingly, the current price action reveals a retest of this breakout level. If $XRP can maintain four-hour closes above the $0.59–$0.60 range, it could confirm the bullish trend continuation. However, failing to hold this support may lead to further downside movement.

Steph believes the formation points to a target of $0.69 to $0.70, a potential 17.7% gain from the current price. This value would represent a 6-month peak for $XRP. However, the analyst cautions against complacency, as volatility and liquidity traps could emerge in the short term.

$XRP Resistance Levels and Liquidity Risks

According to Steph, $XRP must first break through the $0.64–$0.65 zone, which coincides with the 0.786 Fibonacci level. This level has previously triggered rejection points, especially earlier this year in April and August.

If $XRP manages to breach this area, the next significant target would be the $0.70 mark, completing the cup-and-handle formation’s implied breakout.

Yet, Steph warns that liquidity risks could impact the market’s trajectory. $XRP’s liquidation heat map shows a considerable accumulation of short positions, with over $52 million worth of liquidity in the $0.66 range. If these shorts are triggered, the price could surge as liquidity is chased.

Attorney Morgan’s Take on $XRP’s Struggle

Meanwhile, legal expert Bill Morgan discussed $XRP’s ongoing battle with the $0.60 resistance level. He noted that $XRP’s failure to sustain its recent breakout indicates a possible drop below the 20-day EMA.

$XRP completely failed to remain above $0.60 and lost all its gains made 48 hours ago on hourly chart. pic.twitter.com/evV98FOS6Q

— bill morgan (@Belisarius2020) September 22, 2024

Citing an analysis from Investing, Morgan explained that the $0.60 level has historically been a point of strong resistance, and failing to break above it consistently could lead to further consolidation.

While long-term $XRP enthusiasts continue to anticipate all-time highs, Morgan advises that investors should remain cautious. According to him, until $XRP can decisively break above $0.60 and hold, any immediate price spikes may be short-lived.

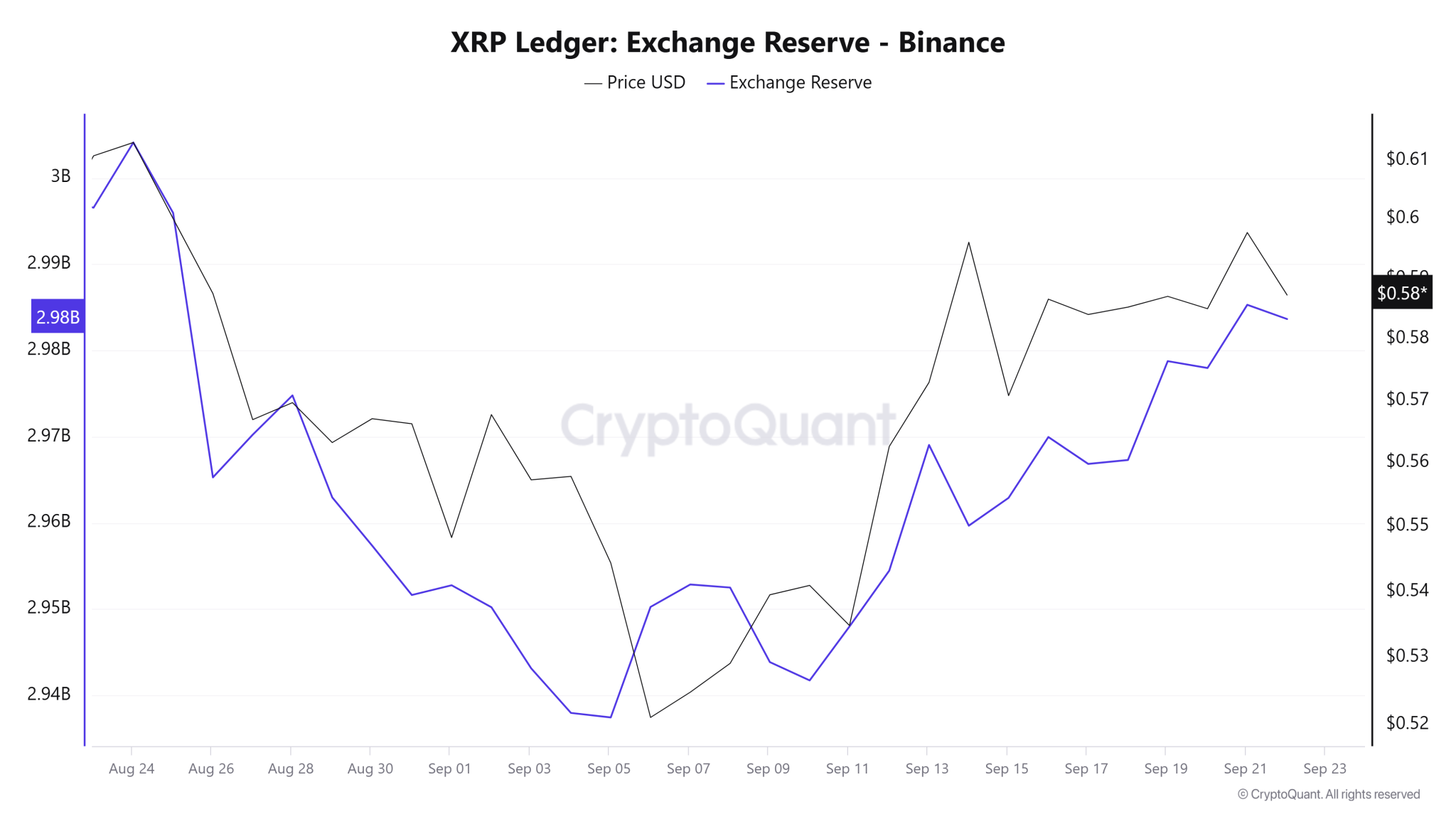

Further, CryptoQuant data suggests that the $XRP reserve on Binance had been on the rise since Sept. 11. Notably, the figure has spiked from 2.941 billion to 2.983 billion tokens over the past 12 days. However, the market observed a slight drop yesterday.

thecryptobasic.com

thecryptobasic.com