Cardano ($ADA) has been holding steady in the crypto market, catching the attention of investors. Many are now wondering where its price is headed. In this price prediction, we’ll take a closer look at what’s driving $ADA’s performance and whether it could see a rise in the near future. Let's take a look at this Cardano Price Prediction article in more detail.

How has the Cardano ($ADA) Price Moved Recently?

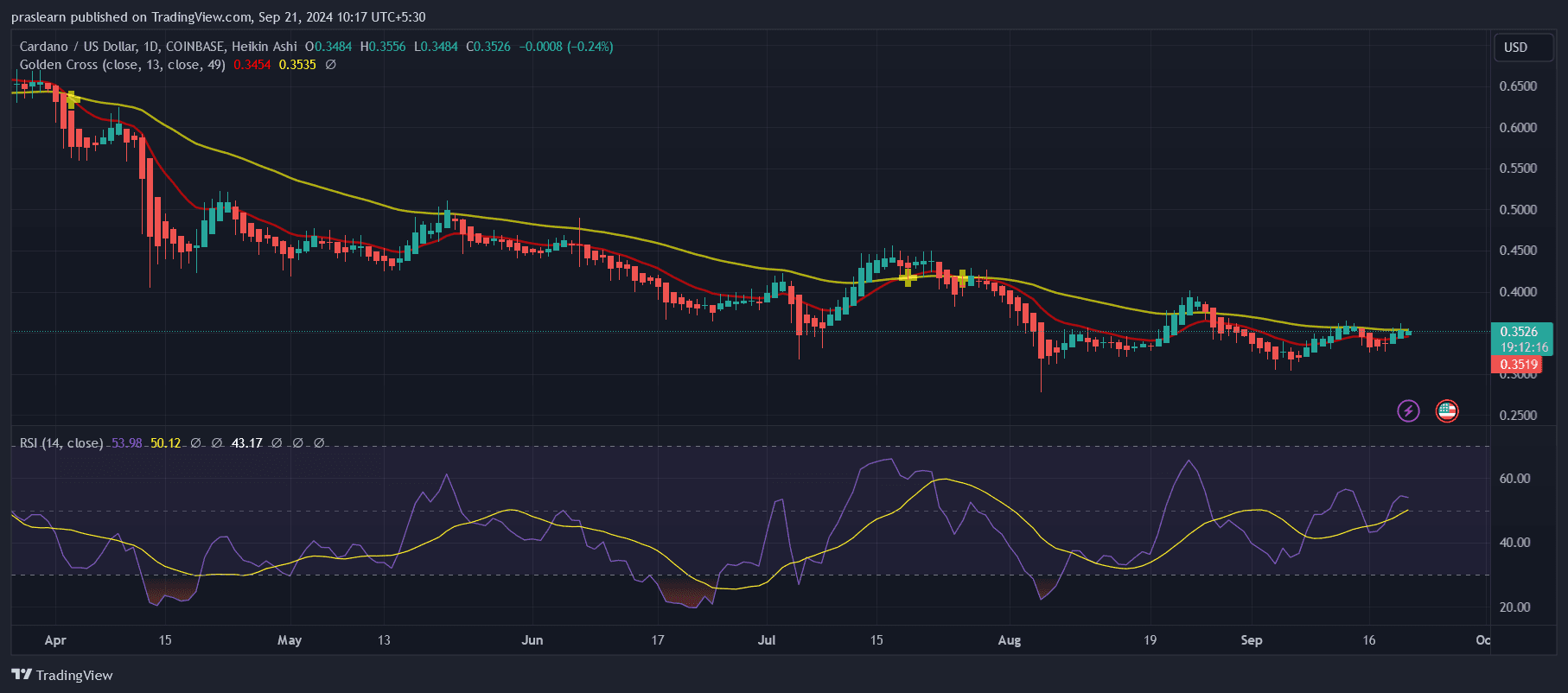

Cardano's current price is $0.353273, with a 24-hour trading volume of $370.18 million, a market cap of $12.70 billion, and a market dominance of 0.58%. Over the past 24 hours, $ADA's price has dipped by 1.75%.

Cardano hit its all-time high of $3.10 on September 2, 2021, while its lowest recorded price was $0.017354 on October 1, 2017. Since reaching its peak, the lowest $ADA has dropped to was $0.234392, while the highest it has climbed in the same period was $0.806108. The current price sentiment is neutral, as reflected by the Fear & Greed Index score of 54 (Neutral).

Cardano’s circulating supply stands at 35.96 billion $ADA, out of a maximum supply of 45.00 billion. Its annual supply inflation rate is 6.33%, meaning 2.14 billion $ADA were minted in the past year.

Why is Cardano ($ADA) Price Steady?

Cardano's ($ADA) price stability can be attributed to its expanding ecosystem and ongoing developments. Key projects like the Iagon bridge, which facilitates asset transfers between Cardano and Ethereum, are enhancing its long-term potential.

This kind of infrastructure development strengthens $ADA’s utility and appeal to developers, helping it maintain a steady market position. As more integrations like these take place, the demand for Cardano’s blockchain could increase, reinforcing the price floor despite short-term volatility.

However, $ADA's price stability is also influenced by competition from emerging projects like Rollblock, currently in its 6th presale. Promising potential returns of up to 200x, Rollblock is drawing attention from $ADA holders looking for higher-risk, high-reward opportunities.

This diversion of investor interest might be dampening $ADA’s momentum, keeping its price from rallying further. As a result, while Cardano continues to benefit from technological advancements, its immediate price movement remains steady as some investors explore alternatives.

Will Cardano ($ADA) Price Rise?

Cardano ($ADA) has shown some resilience over the past year, with its price increasing by 44%, which indicates underlying growth despite the overall crypto market volatility. However, $ADA is currently trading below its 200-day simple moving average, suggesting that it hasn’t yet gained enough upward momentum to break out of its longer-term downtrend. The token remains 89% below its all-time high, pointing to the significant distance it would need to cover before reaching previous highs.

That said, Cardano appears to be in an oversold position, meaning a price rebound could be imminent. Historically, oversold conditions often lead to a price correction, providing a potential catalyst for $ADA's rise.

Additionally, its performance in recent weeks has been promising, with 19 green days in the last 30 days, reflecting a 63% positive momentum. This suggests that $ADA is on a recovery path in the short term, even though it has been outperformed by major assets like Bitcoin and Ethereum over the past year.

From a liquidity standpoint, Cardano maintains medium liquidity, which helps absorb significant trading volumes without excessive price fluctuations, but it also means $ADA might struggle to gain significant upward momentum without fresh capital inflows or a major catalyst.

Additionally, its 6.33% yearly inflation rate is relatively moderate, but continuous token creation could apply pressure on the price if demand doesn’t increase proportionally.

Looking ahead, the price of $ADA is likely to experience gradual growth rather than a sharp rally, especially as the ecosystem expands with projects like the Iagon bridge. While there is potential for a rise in the near term due to its oversold status and recent green streak, the competitive pressures from assets like Bitcoin, Ethereum, and emerging projects like Rollblock could limit Cardano’s upside in the short term. However, the long-term outlook remains positive as ecosystem development progresses.

cryptoticker.io

cryptoticker.io