Chainlink’s (LINK) price has risen above $11 following the recent Fed rate cut. This increase has ignited fresh speculation about the coin’s short-term outlook.

In this analysis, BeInCrypto examines the factors contributing to the hike, the potential implications of the rate cut, and what traders can expect from LINK.

Chainlink Key Drivers Want More

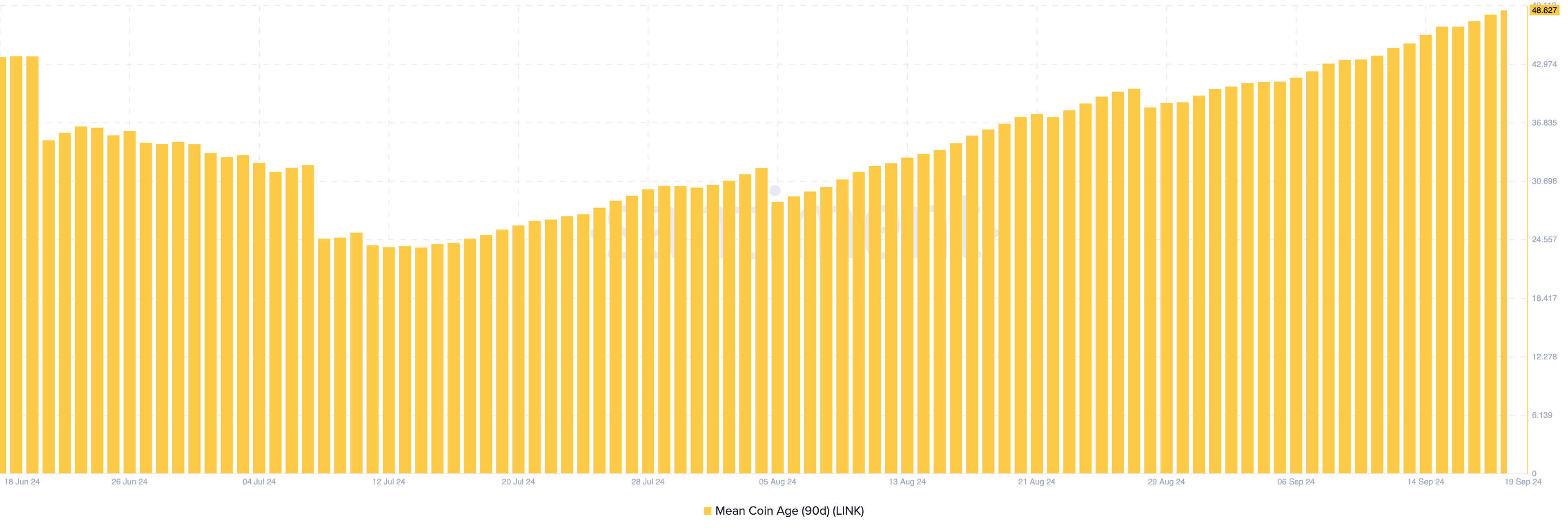

According to Santiment, alongside the recent rate cut, Chainlink’s 90-day Mean Coin Age (MCA) has risen. The MCA reflects the average age of tokens in circulation, with a low MCA suggesting that previously inactive tokens are being moved from cold wallets, potentially leading to a sell-off and putting downward pressure on the price.

Conversely, a rising MCA indicates that investors are holding onto their tokens and engaging less in trading activity, often signaling a long-term hold strategy. In Chainlink’s case, the spike in the MCA suggests that many investors are choosing to keep their LINK tokens dormant or moving them into self-custody, reducing selling pressure.

Read more: How To Buy Chainlink (LINK) and Everything You Need To Know

Beyond the rising coin age, the 4-hour LINK/USD chart reveals a surge in the Cumulative Volume Delta (CVD), a key indicator of market sentiment. Each bar on the CVD shows whether the market is dominated by buying or selling activity. Red bars signal selling pressure, which could drive the price down.

In LINK’s case, the chart shows five consecutive green bars, indicating sustained buying pressure. This suggests that the market’s demand for LINK is growing, potentially supporting the continuation of its uptrend.

LINK Price Prediction: Further Gains

The daily chart shows that Chainlink is holding strong at the $10.02 support level, which played a key role in its recent breakout above the $10.83 resistance. Currently, LINK is trading at $11.30, with no significant resistance in sight to halt the uptrend.

Using Fibonacci retracement levels to assess potential price targets, LINK’s next likely move could take it to $11.86, corresponding to the 38.2% Fibonacci level. If it breaks past this point, the next target could be around $12.98, a level that appears within reach given the current momentum.

Read more: Chainlink (LINK) Price Prediction 2024/2025/2030

However, the cryptocurrency could experience a pullback if it fails to surpass $11.86. If that happens, LINK might drop to $9.25.

beincrypto.com

beincrypto.com