After weeks of anticipation, the US Federal Reserve finally cut the key interest rates by 0.5%, triggering a massive rally for bitcoin that sent it to a 3-week peak of over $62,600.

Several altcoins have performed even better, with massive gains from the likes of BCH, NEAR, AVAX, SUI, TAO, and many others.

Bitcoin’s Fed-Induced Surge

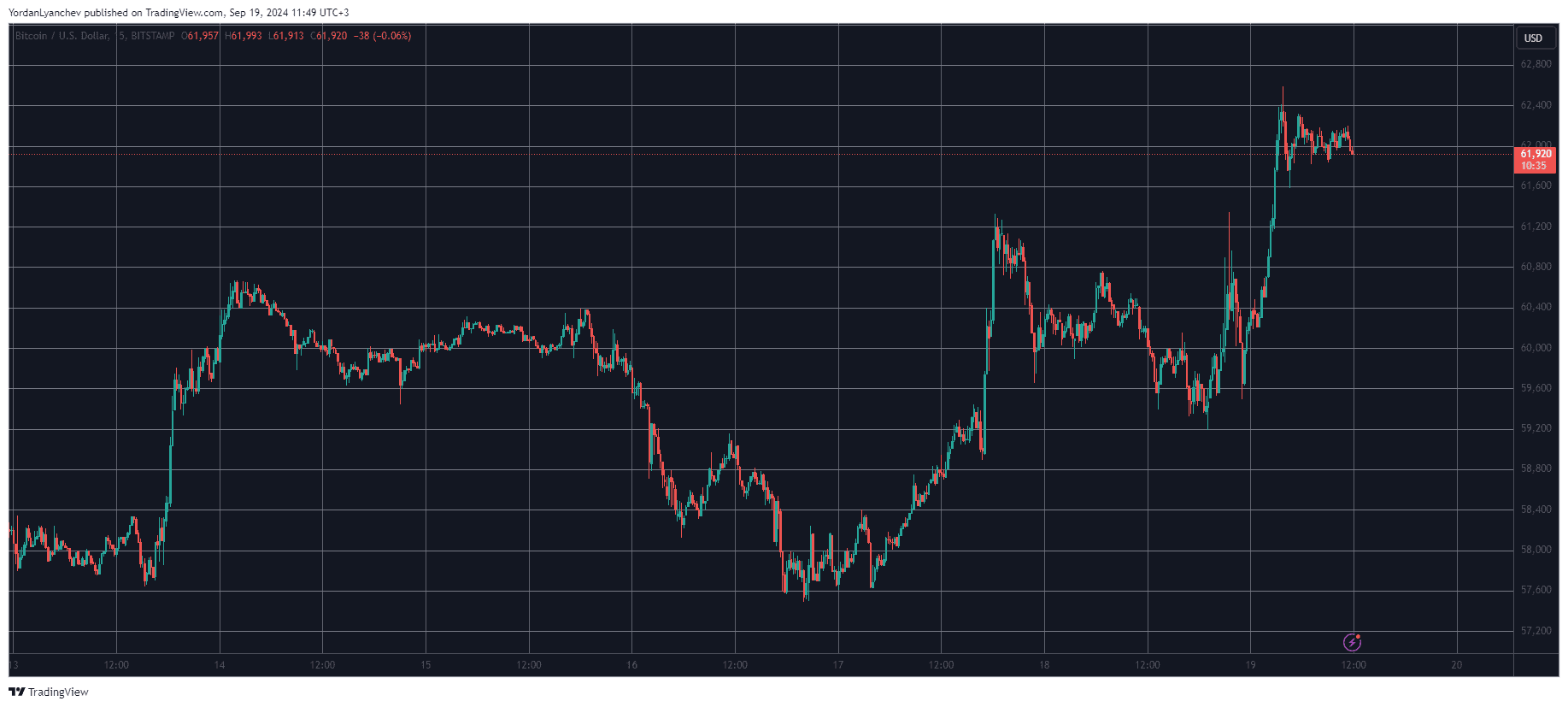

This highly-anticipated week began with a price slip from bitcoin that drove it from over $60,000 to under $58,000 on Monday. This came after the substantial price surge at the end of the previous week when BTC neared $61,000 for the first time in weeks.

However, the cryptocurrency didn’t stay down long on Monday and soared past $61,000 on Tuesday as the hype for the Fed’s actions was building up. Once the US central bank’s meeting was concluded and Jerome Powell announced a 50 basis point rate cut, BTC went on a real rollercoaster.

It went up and down several times from over $61,000 to $59,000 before the bulls took complete control of the market and initiated a massive leg-up that pushed the asset to $62,650 earlier this morning. This became its highest price tag since August 27.

Despite losing some ground since then, BTC still stands close to $62,000 and is up by 3% on the day. Its market cap is above $1.220 trillion, while its dominance over the alts stands tall at 54.7% on CG.

Alts With Bigger Gains

The ever-more volatile altcoin sector has produced some really powerful price increases in the past day. Ethereum has added over 5% of value and now sits well above $2,400, SOL is up by 6% and stands close to $140, while SHIB, LINK, APT DOGE, and TON have gained somewhere between 5-8%.

Furthermore, Bitcoin Cash, NEAR, SUI, TAO, STX, FET, and a few others have charted double-digit gains.

Many lower-cap alts, such as POPCAT, SEI, TIA, and WIF, have also surged by double-digits, which has helped the total crypto market cap add about $100 billion daily. The metric is now at $2.240 trillion on CG.

cryptopotato.com

cryptopotato.com