Veteran analyst Peter Brandt warns of a bearish pattern that could target levels below $100.

Solana’s recent price movement has presented traders with a challenging position. SOL failed to break above the $139 level, leading to a decline in value and a brief rise at this press. Currently trading around $138, Solana shows signs of weakness, leaving investors on edge about potential further losses.

The bearish outlook is further highlighted by technical analysis, market indicators, and external factors affecting the crypto’s performance.

Further Downside Risk

Market veteran Peter Brandt has pointed out a bearish pattern forming in Solana’s price chart. Brandt highlights a large rectangular consolidation with defined support around $129 and resistance near $204.

If the current support level fails, the pattern could complete, suggesting a potential drop toward the $80 range. This would reflect downside risk based on the measured move of the rectangle.

Observation about $SOL

In an area of support. If support gives way, then large rectangle will complete and point toward $80 and change pic.twitter.com/66L6We7ewZ— Peter Brandt (@PeterLBrandt) September 18, 2024

Supporting this bearish outlook, the 8-day simple moving average (SMA) currently sits at approximately $133.58, positioned above the current price level. This indicates that Solana is facing resistance from short-term averages, reinforcing the downward momentum.

Additionally, the Relative Strength Index (RSI) stands at 42.17, below the neutral 50 mark, underscoring bearish sentiment without reaching oversold conditions. This reading indicates prevailing selling pressure with room for further declines if selling persists.

Development Activity Sentiment Align Bearishly

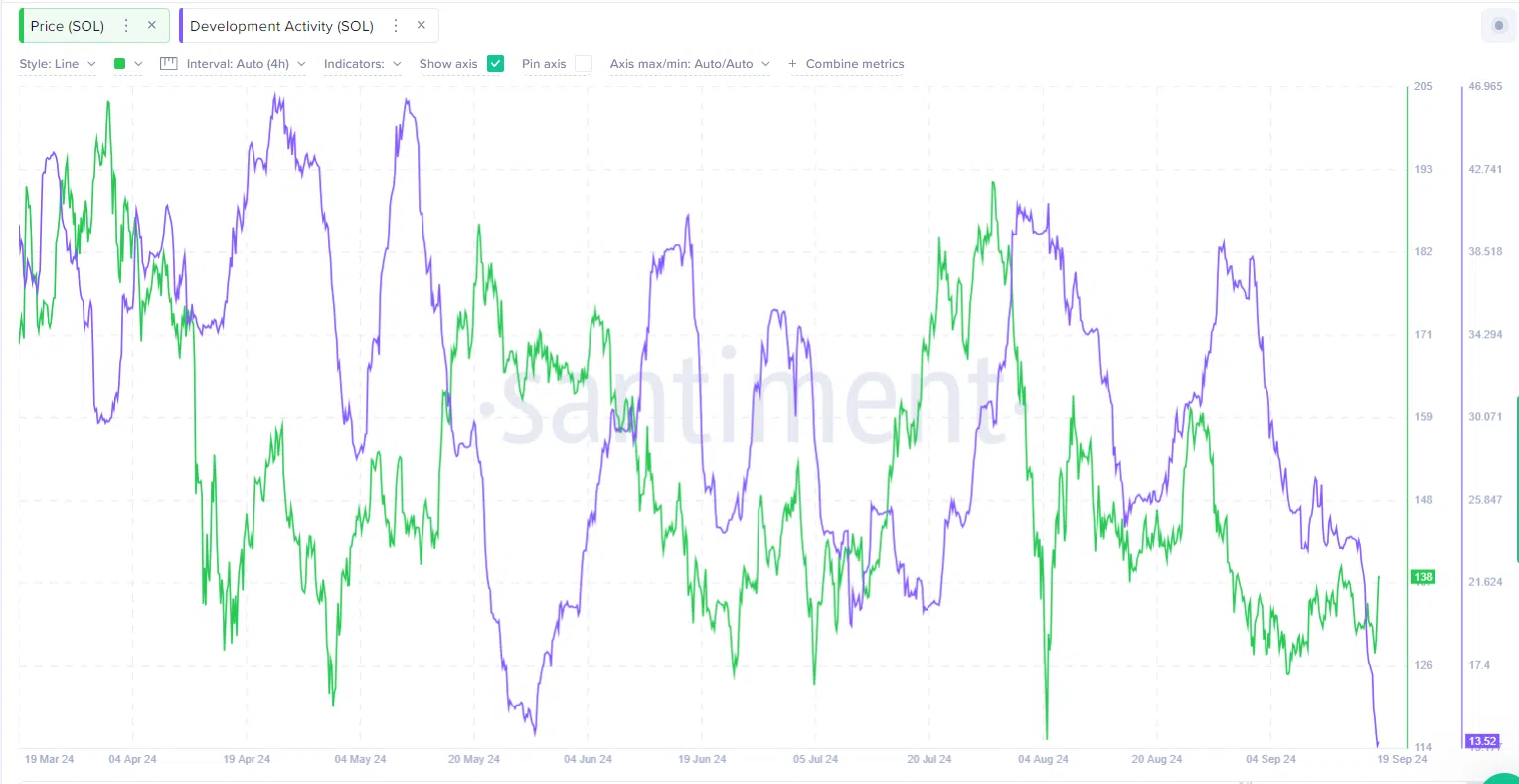

Solana’s bearish momentum is also mirrored in its development activity, with the Santiments Development Activity Index showing a consistent decline since early September. This trend suggests a decrease in project-related activities within Solana’s public GitHub repository, reflecting reduced developer engagement.

The lower development activity signals waning confidence in Solana’s blockchain projects, which may further erode investor sentiment and contribute to the negative market outlook.

The bearish sentiment around Solana is compounded by ongoing sell-offs from the bankrupt FTX and Alameda group. Over the past three months, these entities have unstaked 530,000 SOL, valued at approximately $71 million, redistributing it across multiple addresses.

Notably, the recent transfer activity averaged 176,700 SOL per month, including a redemption of 177,693 SOL valued at $23.75 million. Despite these moves, FTX and Alameda still hold a substantial amount of staked Solana, with 7.06 million SOL valued at $945.7 million, potentially posing additional downward pressure on the market.

thecryptobasic.com

thecryptobasic.com