MultiversX ($EGLD) token recently attained momentum and exhibited a rebound from its demand zone of $23. This recent shift in $EGLD price suggested a potential rescue in the coming sessions.

MultiversX price might benefit from investors’ optimism after a couple of positive sessions. However, the altcoin’s funding rate and OI data indicated that investors were skeptical at press time.

Assessing the Recent Performance of the $EGLD Price

Fueled by the market rebound and improved sentiment in the crypto market, traders were peeking for a push above the $30 mark for a clear upswing ahead. The price action indicated that the $EGLD crypto has faced a downward momentum and traded under bearish influence.

Since this month’s opening, $EGLD bulls strived to surpass the 20-day EMA mark but stayed below it. That indicates buyers are looking weak at press time and need to gain further momentum for an upswing.

MultiversX Price Stayed In Green: Is Recovery Imminent?

Trading at $26.13, the $EGLD price bounced from the support line at $25. It noted a surge of over 4% during the last 24 hours. It was an opportunity for bullish investors since the altcoin attained strong support around the $23 mark.

Crypto Arab (@Cryptohelp90) shared a chart of $EGLD in a recent tweet. It pointed out that the $EGLD crypto has been trading inside a falling channel. A breakout might occur soon.

#$EGLD $egld

— Crypto Arab (@Cryptohelp90) September 17, 2024

تحاول egld تنفيذ كسر سيكون بدايه لفرصه جميله باذن الله ✅✅ pic.twitter.com/8jnuUl2P8J

Notably, the $EGLD price faced a prompt barrier of 20-day EMA, which acted as resistance while attempting a push. If bulls transcend the level, it could retest the 50-day EMA mark.

Technical Indicators Overview

The Chaikin Money Flow (CMF) for $EGLD highlighted ascending inflows at press time. That meant more capital was entering the market, representing investors looking more confident.

Technical Indicators Data | Source: Coinalyze

Along with CMF, the MACD indicator represented a positive crossover. It revealed the buyer accumulation activity during the past 24 hours.

However, the RSI line stayed close to the midline zone, at 50, conveying a neutral outlook.

Surge In Popularity

Amid the incremental price rise, the weighted sentiment data witnessed a vertical increase, representing the investors’ optimism for $EGLD. The MultiversX Price crossed the zero line and approached the positive region, conveying a bullish stance.

****

The social dominance curve also displayed a notable upward spike, fetching increased buzz among investors on social media platforms.

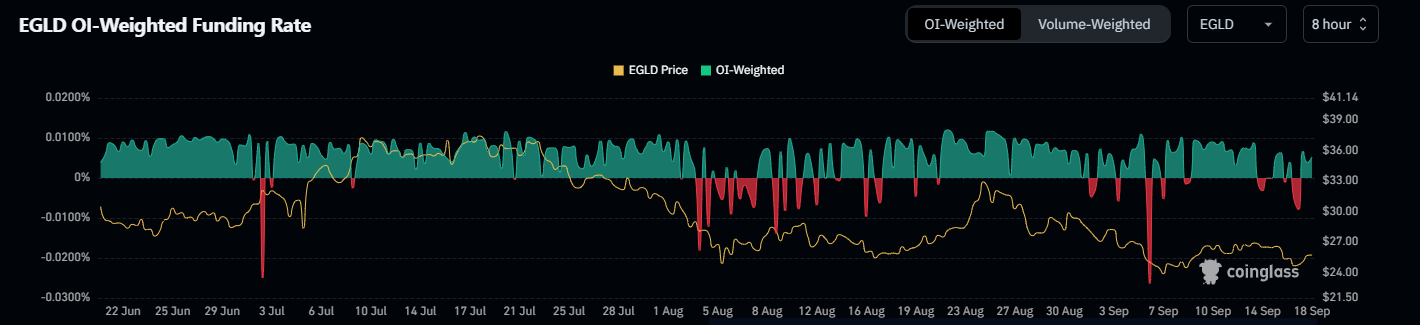

The OI-weighted funding rate data implied a potential change in the market sentiment towards $EGLD.

For the last two sessions, along with follow-up buying action, the funding rate stayed positive. That echoed a bullish outlook and indicated traders were willing to pay a premium for long positions.

$EGLD Funding Rate | Source: Coinglass

Similarly, the Futures Open Interest (OI) rose over 3.90% to $17.90 Million. It reflected fresh long additions in the past 24 hours.

In case of a thriving move above the 20-day EMA level, the $EGLD price could move toward $30 and then $35 in the coming sessions. It could retrace toward the $23 mark ahead if it remains below that EMA level.

thecoinrepublic.com

thecoinrepublic.com