Though BNB (BNB) has been trading with significant strength throughout 2024, the Binance cryptocurrency exchange’s issues with the U.S. legal system have been a major cause of volatility since late 2023.

The situation may, however, soon change drastically for BNB as Changpeng Zhao, the founder and former CEO of the Binance exchange, is scheduled to be released from prison on September 29, 2024.

Given the historical impact news related to Zhao’s guilty plea and prison sentence have had on the token and the prominence and popularity of ‘CZ’ within the community, the release is likely to serve as a major bullish catalyst in the crypto market.

Still, the cryptocurrency markets are full of surprises, and to understand if betting on a major BNB rally is the right call for investors, Finbold consulted some of OpenAI’s most advanced ChatGPT models on how the token might fare on September 29.

ChatGPT sets BNB price target upon ‘CZ’s’ release

ChatGPT-4o, the formerly most advanced model, quickly acknowledged the harm ‘CZ’ and Binance’s legal issues have had on the overall cryptocurrency market and BNB. However, it also pointed out that the exchange successfully navigated the tempest.

Additionally, the AI explained that significant volatility is expected upon Zhao’s release from prison, though it also stated that BNB’s fortunes are likely to depend more on the general market conditions than on the conclusion of the prison sentence.

Finally, having examined similar events in recent years, ChatGPT concluded that any impact – even if major – is likely to only be short-lived. On the other hand, the AI did add that Zhao’s release could push the cryptocurrency up to $570 or even $600 on September 29 and September 30 – up to 10.70% above BNB price today of $542.44.

Finbold also leveraged the reasoning capabilities of the new ChatGPT o1 in its attempt to gauge the effects of Changpeng Zhao’s release on BNB.

The newer model largely agreed with its counterpart but raised another interesting point: the return of ‘CZ’ might reignite the discussion surrounding the regulatory treatment of the digital assets industry and, therefore, generate some bearish pressure.

Still, the bulk of o1’s assessment remained positive, and it outlined three possible scenarios: an ecstatic reaction that could propel BNB above $600, a positive and limited reaction that could see the token rise to $570, and a situation in which there is no discernable impact at all due to prior events.

Are the AI assessments of BNB too conservative?

While the AI’s assessment of the impact of Zhao’s imminent release might appear conservative, it is worth remembering that prior events themselves had a contained effect on BNB.

For example, though the token plunged 10% once ‘CZ’ stepped down as Binance’s CEO, it quickly regained ground and even soared several months later.

Likewise, Zhao’s prison sentence again triggered a BNB sell-off that initially saw the token drop from between $580 and $590 to $560, but the token was back above $595 in less than ten days.

Such historical precedent – particularly combined with exceptionally choppy trading the token has been experiencing throughout the summer – likely means that the release of Zhao will have only an ephemeral effect and that broader market events will have a far greater bearing on the cryptocurrency.

BNB price analysis

Whatever the impact of September 29 may ultimately be, it is hard to deny that BNB’s trading in 2024 has, in general, been positive. The last full week of trading, for example, featured a steady 5.89% rise to the token’s press time price of $542.44.

Such performance means that the outlook for the token, notwithstanding the news on Binance’s founder, is similarly positive.

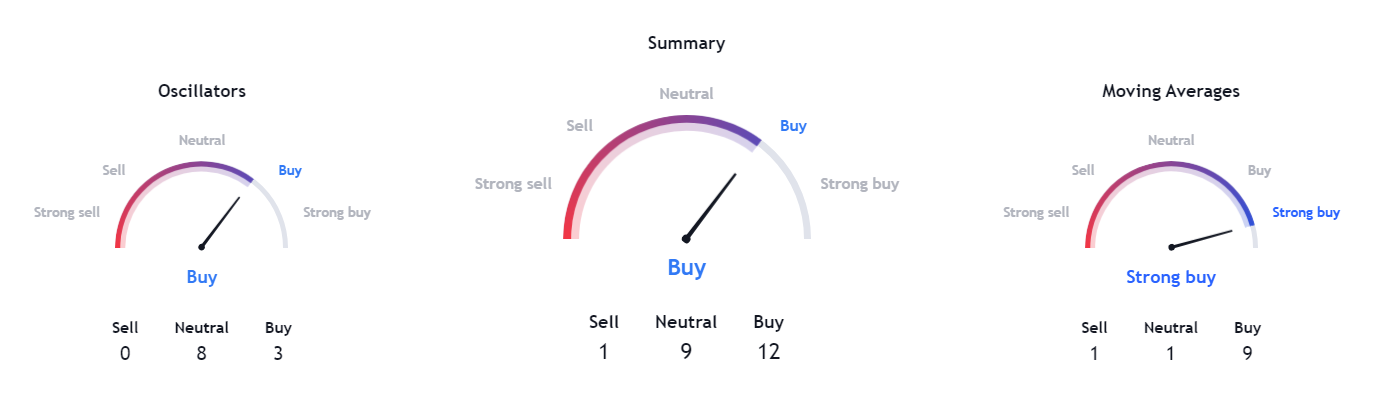

In particular, technicals, including moving averages (MA) and oscillators, available through the asset analysis platform TradingView, rate BNB as an overall ‘buy,’ whether based on the last 24 hours, one week, or 30 days of trading.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com