-

Cardano Whales has moved a significant 19.5 billion ADA tokens, worth $6.48 billion in the past day.

-

ADA’s Long/Short ratio stands at 1.02, indicating bullish market sentiment among traders.

-

ADA could soar by 30% to the $0.45 level if it closes a weekly candle above the $0.35 level.

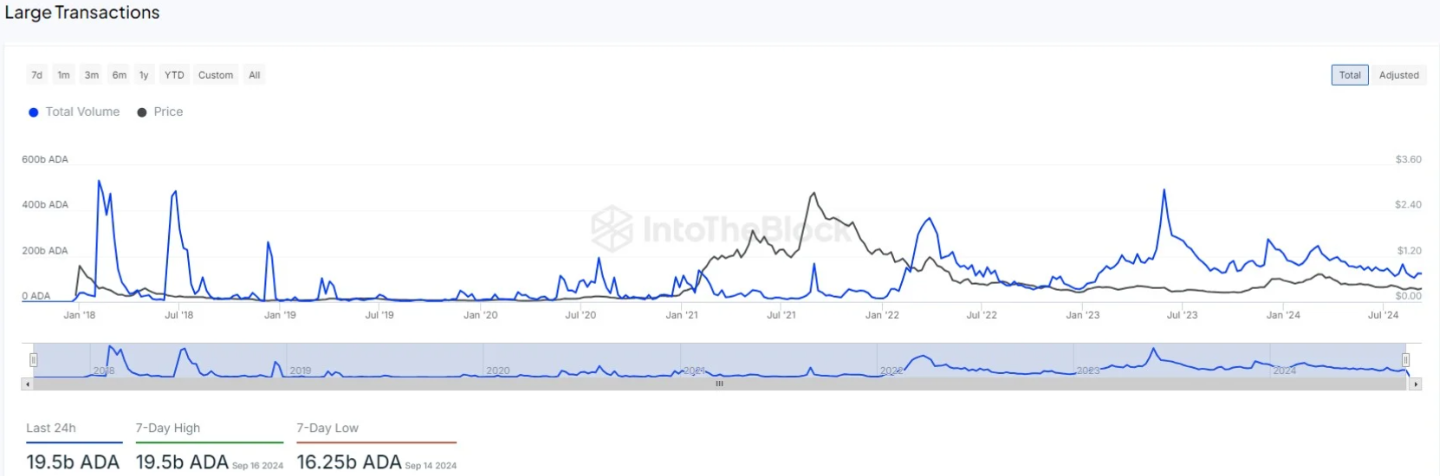

In this confusing market sentiment, Cardano (ADA) whales’ activity over the past 24 hours has raised hope among investors and traders, indicating something significant may be unfolding. According to the on-chain analytic firm IntoTheBlock, Cardano Whales has moved a significant 19.5 billion ADA tokens, worth $6.48 billion in the past day.

Whale Activity on the Rise

Additionally, large transactions (transactions more than $100,000) have increased by 10% in the last 24 hours. According to the data, these whales have made more than 3,100 transactions during the same period, compared to the weekly high of 3,300.

This notable surge in large transactions in a signal day is comparatively higher than Ethereum’s, indicating that whales might be in the mood to pump ADA, as it has been struggling near the support level of $0.33 level, since July 2024.

Current Price Momentum

Following the whales’ activity, ADA has experienced a price jump of 4.35%. However, at press time, it is trading near $0.333 and is currently up by 1.25% in the last 24 hours. During the same period, its trading volume dropped by 11%, indicating lower participation among traders amid market uncertainty.

Cardano (ADA) Technical Analysis and Upcoming Level

Despite the whales’ bullish activity, ADA still appears bearish according to expert technical. It has been in a downtrend since April 2024, as has been it trading below the 200 Exponential Moving Average (EMA) on a daily time frame. The 200 EMA is a technical indicator that traders and investors use to determine whether an asset is in an uptrend or downtrend.

Based on the ADA’s price momentum, if it closes a weekly candle above the $0.35 level, there is a high possibility it could soar by 30% to the $0.45 level, to its next resistance level.

Bullish On-chain Metrics

However, the on-chain metrics support whales’ bullish sentiment. Currently, Coinglass’s ADA’s Long/Short ratio stands at 1.02, indicating bullish market sentiment among traders. Additionally, ADA’s future open interest has also increased by 2.7% in the last 24 hours, revealing growing interest among traders amid ongoing struggling phase.

coinpedia.org

coinpedia.org