-

Fantom (FTM) could soar by 50% to the $0.85 level if it breaches the $0.64 level.

-

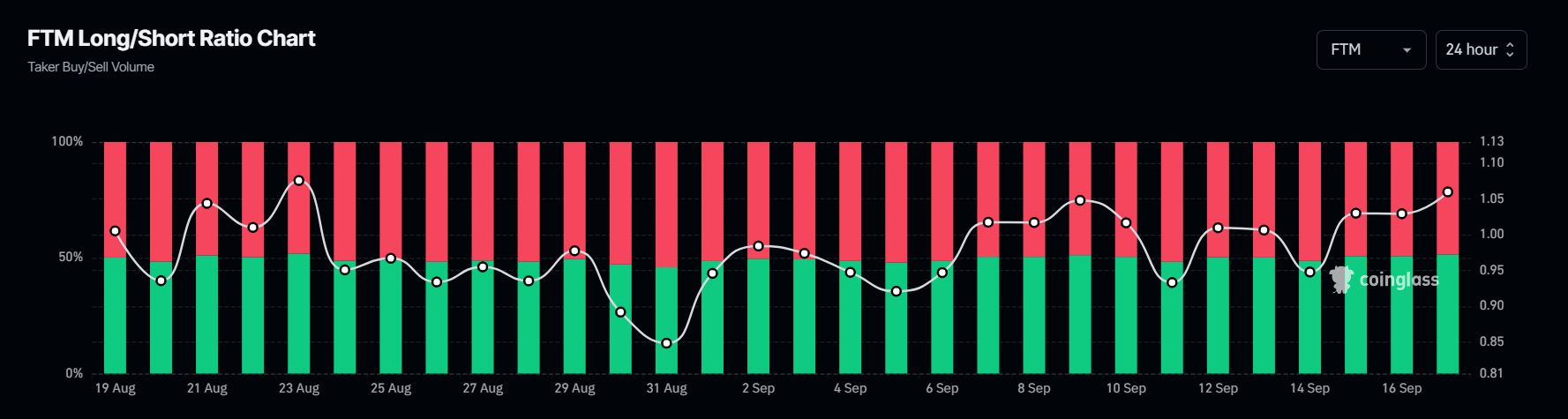

FTM’s Long/Short ratio currently stands at 1.0597, indicating strong bullish sentiment among traders.

-

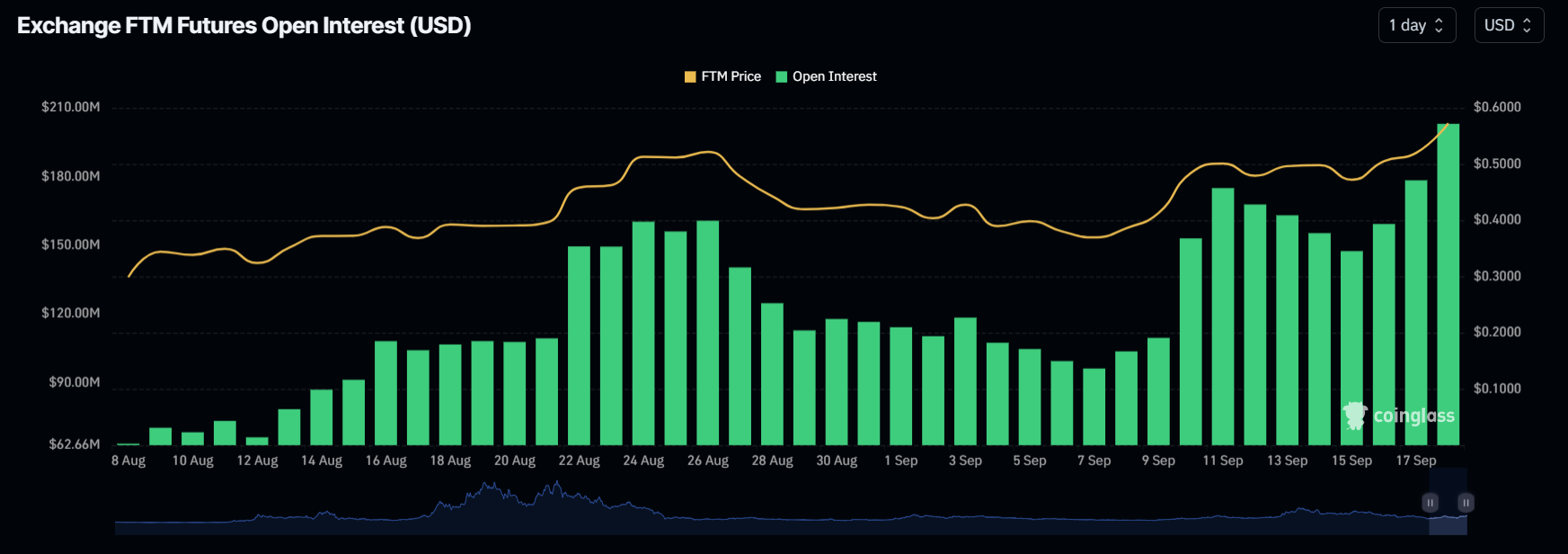

FTM’s future open interest has skyrocketed by 25% in the last 24 hours, showing growing interest from traders

Amid this ongoing market reversal, Fantom (FTM) is poised for a significant upside momentum following a strong bullish price action pattern breakout. On September 17, 2024, while the overall cryptocurrency market struggled to gain momentum, FTM’s price surged by over 9% in the past 24 hours.

Fantom (FTM) Price Analysis

At press time, FTM is trading near $0.566 and has experienced a price surge of over 9% in the last 24 hours. During the same period, its trading volume has skyrocketed by 15%, indicating higher participation from traders and investors following the recent breakout.

FTM Technical Analysis and Upcoming Levels

According to expert technical analysis, Fantom (FTM) appears bullish, having broken a strong resistance level of $0.54 and the neckline of a bullish inverted head-and-shoulders pattern. Following this breakout, FTM has cleared the path for an upside rally.

Currently, there is one hurdle that FTM might face near the $0.64 level. If it breaches that level, there is a strong possibility it could soar by 50% to the $0.85 level.

Additionally, FTM is trading above the 200 Exponential Moving Average (EMA) on the daily time frame. The 200 EMA is a technical indicator that traders and investors use to determine whether an asset is in an uptrend or downtrend.

FTM’s Bullish On-chain Metrics

However, this bullish outlook is further supported by the on-chain metrics. According to the on-chain analytic firm Coinglass, FTM’s Long/Short ratio currently stands at 1.0597, indicating strong bullish sentiment among traders. Additionally, FTM’s future open interest has skyrocketed by 25% in the last 24 hours, showing growing interest from traders and investors following a bullish breakout.

Traders and investors often use the combination of rising open interest and a long/short ratio above 1 to build their long/short positions.

Currently, 51.5% of top traders hold long positions, while 48.5% hold short positions. This data suggests that bulls are dominating the asset and have the potential to support the upcoming price rally.

coinpedia.org

coinpedia.org