Main Takeaways

-

The upcoming FOMC meeting on September 17-18, 2024, is likely to introduce significant policy changes that impact the digital-asset market.

-

Lower borrowing costs are expected to create a more conducive investing environment for risk assets like crypto. Certain crypto-specific factors such as post-halving cycles and seasonality could also contribute to positive market dynamics.

-

Investors are optimistic about the potential for renewed growth in digital assets, given the anticipated shift in U.S. monetary policy.

The Federal Open Market Committee (FOMC) – the U.S. Federal Reserve System’s monetary policy-setting arm – is scheduled to meet in the middle of next week, on September 17-18, 2024. Following Fed Chair Jerome Powell’s remarks at the recent Jackson Hole Symposium, where he indicated that “time has come” for policy to change, the markets expect the upcoming FOMC meeting to yield the first in a series of interest rate cuts.

Such a shift is set to recalibrate the economic landscape and will likely have significant effects on crypto markets, known for their sensitivity to macroeconomic changes. With lower borrowing costs on the horizon, crypto investors are evaluating various scenarios that can unfold, including energized innovation and growth in the crypto space and rebounding prices. Some, however, remain cautious in their assessments. Read on for more context around the expected interest rate cuts and the changes they can bring to the world of digital assets.

A Primer on Interest Rates And Recent Fed Policy

Central bank interest rates are a key tool in shaping monetary policy, directly influencing the broader economy. By adjusting the rates, central banks can encourage people and businesses to borrow and spend more (by lowering them) or help cool down an economy that’s too “hot” (by raising the rates). These changes ripple through to everything from the interest on personal loans and mortgages to the investment decisions on Wall Street and consumer goods prices.

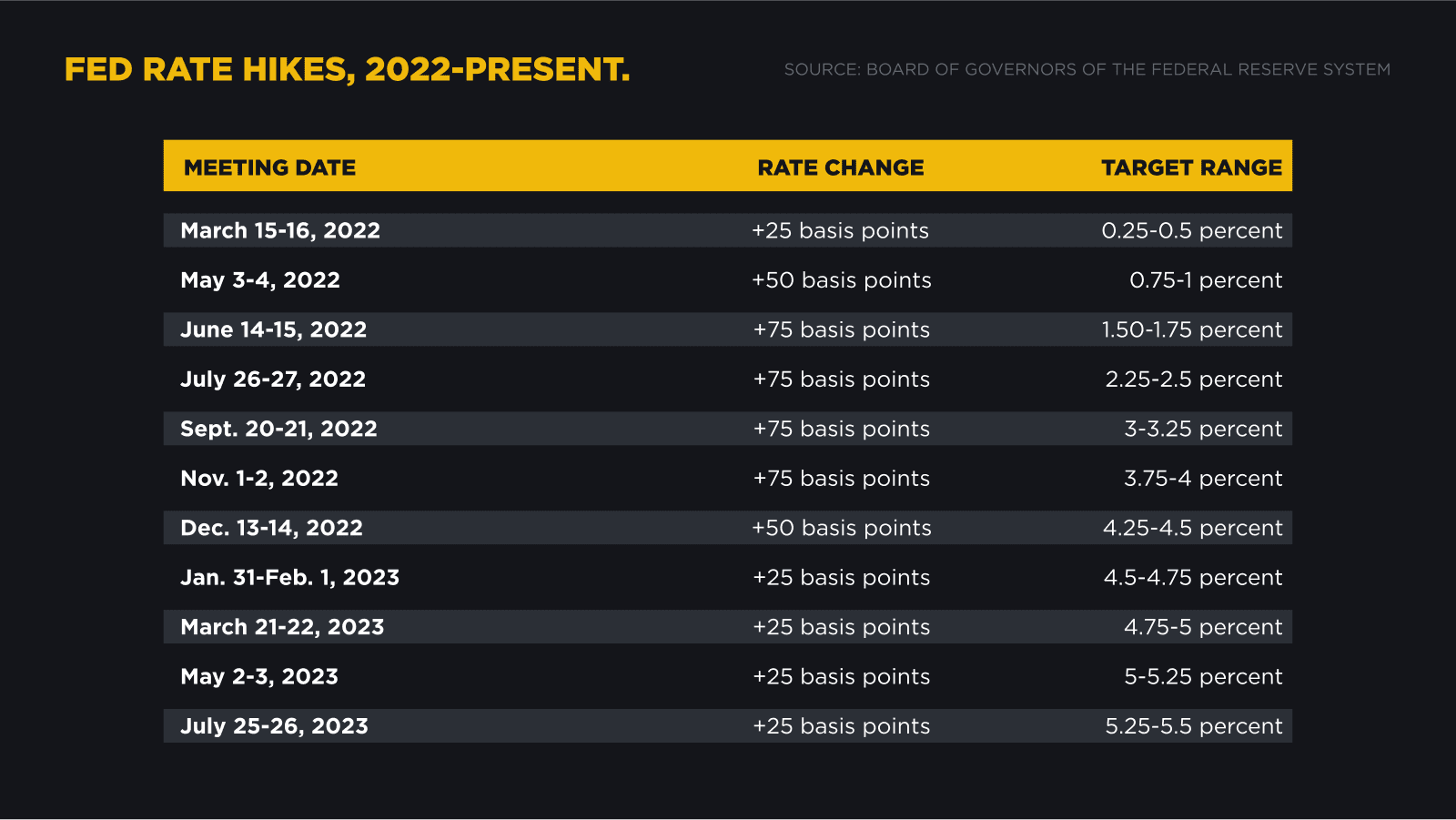

The current U.S. rates of 5.25%-5.50% are at their highest in 23 years after two and a half years of aggressive measures aimed at combating inflation, which has dropped from 7.1% to a more sustainable 2.5%. In the wake of the COVID-19 pandemic, the Federal Reserve initiated a series of rate hikes to curb the climbing inflation – 11 in just over a year – to keep inflation in check without tipping the economy into a recession.

As we approach the next FOMC meeting, the financial world is abuzz with speculation, with analysts and investors offering varying forecasts of the magnitude of the expected cuts.

Tremendous retail interest is also evident in prediction markets like Polymarket. As of September 13, 2024, betting odds suggest a strong popular belief that a rate cut is forthcoming, with as much as 70% probability assigned to a 25 basis points decrease and a 29% chance for a more aggressive cut of 50+ basis points.

With digital asset prices fluctuating below the highs seen just a few months ago, the slashing of interest rates could be just what is needed to give the crypto market a much-needed boost – yet, as always, what we know about markets’ past behavior should not be seen as a blueprint of what’s to come.

A Boon For Crypto Prices?

The anticipated rate cuts are likely to have a profound impact on digital asset prices. Historically, cryptocurrencies like bitcoin have often reacted negatively to rate hikes aimed at curbing inflation. Conversely, rate cuts are generally seen as bullish for cryptocurrencies, which are considered risk assets.

As borrowing costs decrease, investors find it cheaper to take out loans, leading to increased liquidity in the financial system. This influx of capital can drive up demand for higher-yielding, riskier assets, including crypto. For example, between February 2020, when the Fed brought rates close to zero, and February 2022, when rate hikes came back, the price of BTC saw a whopping 375% increase.

In addition to thriving on increased liquidity, bitcoin can benefit from its anti-inflationary qualities. While the U.S. economy appears to be relatively robust in the buildup to the rate hiking cycle, the chances of inflation picking up again are far from negligible.

Lower interest rates can stoke fears of inflation, as they typically lead to increased spending and borrowing. In such scenarios, investors may turn to cryptocurrencies to protect their purchasing power, driving up demand and prices. Experts predict that the Federal Reserve could cut rates by as much as 175 basis points over the next nine months, potentially providing a significant boost to the crypto market.

Moreover, a reduction in interest rates often results in a weaker U.S dollar. Cryptocurrencies are frequently viewed as a hedge against currency devaluation, making them more attractive as an alternative store of value when the dollar weakens.

Still, there are voices suggesting that rate cuts will not necessarily trigger the positive dynamics that optimists anticipate. One concern is that their beneficial effects on digital assets are already priced in. Some observers also point out that rate cuts of varying magnitude could exert varying effects on crypto.

According to this logic, a standard 25 basis-point cut would likely lead to the easing of recession fears and contributing to digital asset prices gradually going up, while more aggressive cuts could signify more serious recession concerns, which would in turn put downward pressure on the prices of risk-on assets.

Crypto-Specific Factors

Beyond macroeconomic factors, BTC and other digital assets have their own unique features that could influence their prospects amid rate cuts. Some of them have to do with hypothesized cycles of crypto’s price performance and observed seasonality.

One key factor is the recent Bitcoin halving, which has historically led to BTC price increases 6-18 months afterward. While past performance does not guarantee future results, the halving, which took place this April, could provide a directional indicator for investors. Coupled with the potential for easier transition between equities and crypto thanks to the availability of spot ETFs, the increased liquidity resulting from rate cuts could have both the appetite and the means to flow into crypto markets.

Outside of the hypothesized post-halving cycle, September historically ranks among the weakest months for digital-asset markets, with prices usually picking up from October on. Should this dynamic play out again, expected rate cuts could provide additional momentum as prices bounce off the bottom.

Bottom Line

On balance, do crypto investors have more reasons to be optimistic than otherwise? The effects of Fed rate cuts on the digital-asset market are impossible to predict with certainty — yet, there are some indicators suggesting that the Federal Reserve enacting policy change in the second half of September could be good timing for crypto investors’ perspective.

As the FOMC prepares for its September, the anticipated interest rate cuts could usher in a new era of economic recalibration, potentially invigorating the crypto markets. While the exact outcomes remain uncertain, the prospect of lower borrowing costs and increased liquidity offers a promising landscape for digital assets.

Historical trends and unique crypto-specific factors, such as the recent Bitcoin halving and seasonal market behaviors, further bolster the optimism that these policy changes could catalyze growth and innovation in the crypto space, providing a hopeful outlook for investors.

Further Reading

-

The Role of Digital Assets in Investment Portfolios

-

Binance Research: Key Trends in Crypto – September 2024

-

It’s Live – What Now? The Potential Effects of Ether Spot ETFs on the Market and Staking Economics

Disclaimer: Digital asset prices can be volatile. The value of your investment may go down or up and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not liable for any losses you may incur. Options trading, in particular, is subject to high market risk and price volatility. Past performance is not a reliable predictor of future performance. Before trading, you should make an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances, including the risks and potential benefits. Consult your own advisers, where appropriate. This information should not be construed as financial or investment advice. To learn more about how to protect yourself, visit our Responsible Trading page. For more information, see our Terms of Use and Risk Warning.

binance.com

binance.com