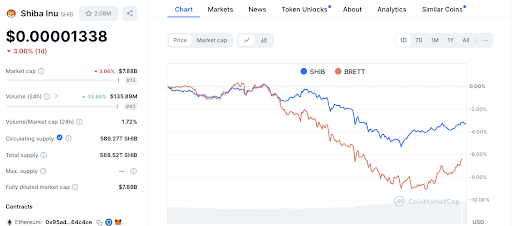

In the battle of blockchain ecosystems, Shiba Inu ($SHIB) on Ethereum and Brett ($BRETT) on Base present intriguing cases of how tokens perform and recover. Over the past 24 hours, both cryptocurrencies have faced downward pressure, but $BRETT has experienced a more pronounced decline compared to $SHIB.

While $SHIB has seen a more modest drop of around -2% to -4%, $BRETT has fallen sharply, approaching -8% to -10%. Both tokens are showing signs of recovery, yet $BRETT’s volatility remains higher, underscoring its more turbulent market behavior.

$SHIB: A Gradual Decline with Stabilizing Signs

Shiba Inu ($SHIB) has seen a slight drop in price, currently trading at $0.00001338, down 3.24% in the last 24 hours. Despite the decline, $SHIB’s market cap remains robust at $7.89 billion, highlighting its continued popularity.

The volume of trades has increased to $135.1 million and thus acts as an indication of its growth by 32.55% increase. Such a rise in trading activity indicates a possible fluctuation in the short term.

The recent high for $SHIB was around $0.00001385, which now acts as a significant resistance level. The price briefly found support near $0.0000132, hinting at buying interest at this level.

Read also: Shiba Inu Community Votes Against Burning 37.5 ETH, Favors Multisig Wallet

However, a series of lower highs and lows suggests a prevailing bearish trend. If $SHIB fails to hold above $0.0000132, further declines are possible. Conversely, a break above $0.00001385 could signal a potential recovery.

$BRETT: Higher Volatility, Steeper Drops

In contrast, Brett ($BRETT) has experienced a more pronounced decline, with its current price at $0.07677, down 6.35% in the last 24 hours. $BRETT’s market cap stands at $760.81 million, reflecting its position in the market. The volume has surged to $14.99 million, a 74.89% increase, indicating heightened trading activity around current price levels.

The token’s recent high of $0.08197 is a critical resistance point. $BRETT has pulled back from this peak and briefly found support at $0.076 before a slight bounce. If this support level fails to hold, the price could test further support at $0.074.

The rise in trading volume indicates that those in the market are either seeking to fix the price or are speculating on more declines in the market. For a bullish reversal, $BRETT needs to close above $0.08197. Failure to maintain support at $0.076 could lead to additional downward movement.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com