Toncoin (TON) has narrowly avoided a 41% price drop, with shifting market conditions now suggesting a potential uptrend for the Telegram-linked coin.

Both market indicators and the fact that TON holders are refraining from taking profits support this optimistic outlook.

Toncoin Gets Another Life

From a technical perspective, Toncoin’s macro momentum presents bullish signals. The Moving Average Convergence Divergence (MACD) indicator is forming a double-bottom bearish divergence, which often suggests a potential price uptick could be on the horizon.

This indicator is also close to noting a bullish crossover, as the bars on the histogram suggest receding bearishness. Toncoin’s price could considerably benefit from this shift in sentiment.

Read more: 6 Best Toncoin (TON) Wallets in 2024

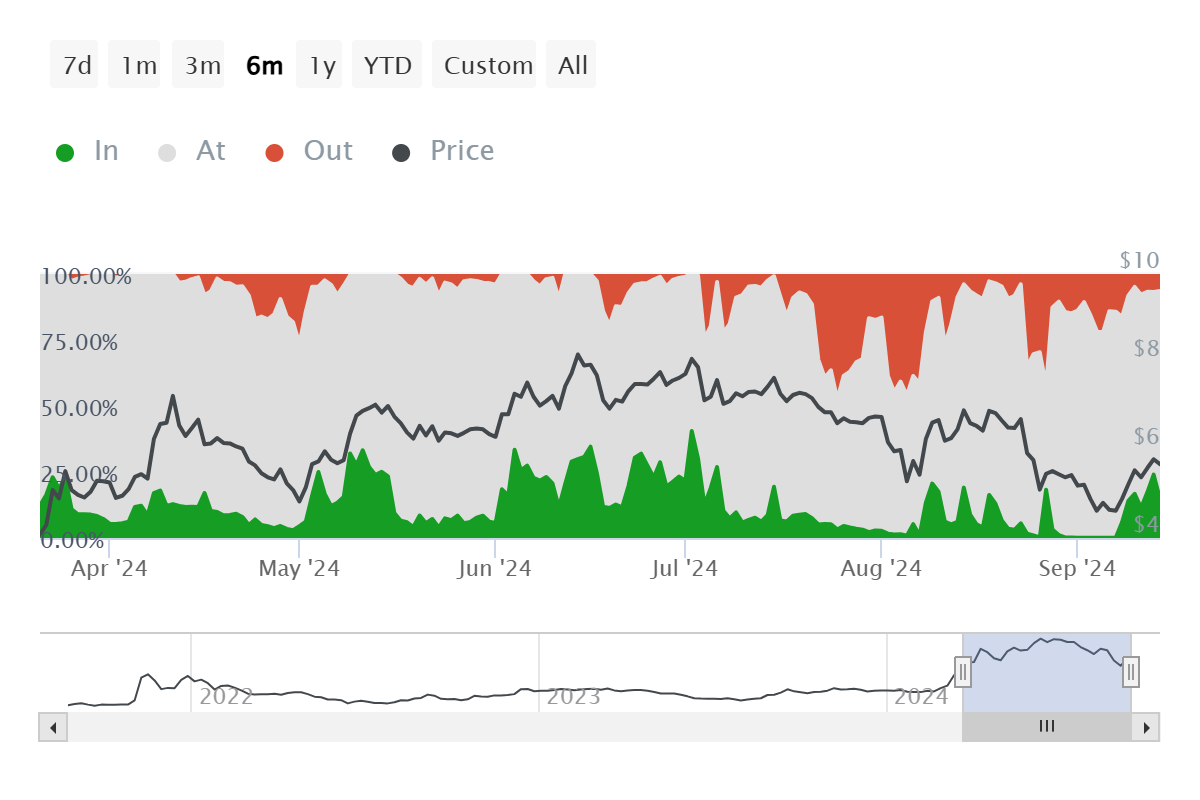

The market sentiment surrounding Toncoin appears relatively stable at the moment. According to the latest data, active addresses by profitability show that selling pressure is currently low. Investors in profit make up less than 16% of all active addresses, which is typically a bullish sign.

A figure exceeding 25% would usually indicate bearish momentum, as increased selling could drive the price downward. Fortunately, that scenario is not in play at the moment, allowing Toncoin some room to recover. For now, the market’s cautious optimism suggests that further price gains could be within reach, assuming other factors align favorably.

TON Price Prediction: Rise Ahead

Toncoin is currently trading at $5.62, nearing the invalidation of the bearish head-and-shoulders pattern that initially signaled a potential 41% drop to $2.79. The bearish outlook would be officially invalidated if Toncoin can flip $6.04 into support. Achieving this would confirm a shift in sentiment, potentially laying the groundwork for sustained upward momentum.

If $6.04 is successfully breached, Toncoin could aim for $7.09, a critical resistance level. Reaching this mark would generate significant profits for investors, reinforcing confidence in the cryptocurrency’s longer-term potential. Such a rise would likely attract more buyers, further boosting Toncoin’s price trajectory in the coming weeks.

Read more: What Are Telegram Bot Coins?

However, failure to reclaim the $6.04 level could trigger a retracement to $4.80, the breakdown point. Should Toncoin fall through this support, it may drop to $4.29, which would invalidate the current bullish thesis and put additional downward pressure on the market.

beincrypto.com

beincrypto.com