Amid the broader cryptocurrency recovery, the SUI blockchain has experienced a notable surge, ascending over 16% in value within the last 24 hours. This increase coincides with the debut of the Grayscale Sui Trust, aimed at eligible investors, marking a pivotal moment in the token’s market trajectory.

Grayscale Catalyzes SUI’s Market Rally

Grayscale Investments, a leading issuer of digital asset investment vehicles, recently announced the initiation of its Grayscale Sui Trust. This new trust mirrors the operational framework of existing spot Bitcoin and Ethereum ETFs, focusing on the SUI blockchain.

Grayscale Sui Trust is open to eligible accredited investors seeking exposure to $SUI, a third-generation blockchain designed to help address scalability and transaction costs.

Click below to learn more about Grayscale Sui Trust or reach out to us: https://t.co/WgCAFA7E8L pic.twitter.com/gic7kJDzF6

— Grayscale (@Grayscale) September 11, 2024

Currently, the Trust has an asset base of about $892,213 and focuses on institutional investors, thus enhancing market liquidity for the token. Specifically, the launch of Grayscale Sui Trust can be seen as a significant event in the current situation where the cryptocurrency market is still recovering.

For instance, SUI, a layer one blockchain created by the former Meta blockchain architects, has consistently seen an increase in its daily average trading volume. As seen on CoinMarketCap, it surged by 113% to approximately $527.31 million, which can be attributed to increased market trading and investment interest.

Technical Indicators and Market Sentiments

Advertisement

From a technical standpoint, the token has been testing a major resistance level, currently priced at around $1.03. This level has been tested multiple times since the crypto market downturn on August 5, with no previous breakthroughs.

However, if the altcoin manages to sustain a close above this resistance, converting it into a support level, it may set a bullish market tone for the near future. In such a scenario, potential future price movements could witness the token reaching the next liquidity range between $1.17 and $1.44.

These figures align with the daily 0.618 and 78.6% Fibonacci retracement levels, respectively, suggesting possible price targets should the current momentum continue.

Market Optimism Reflected in On-Chain Data

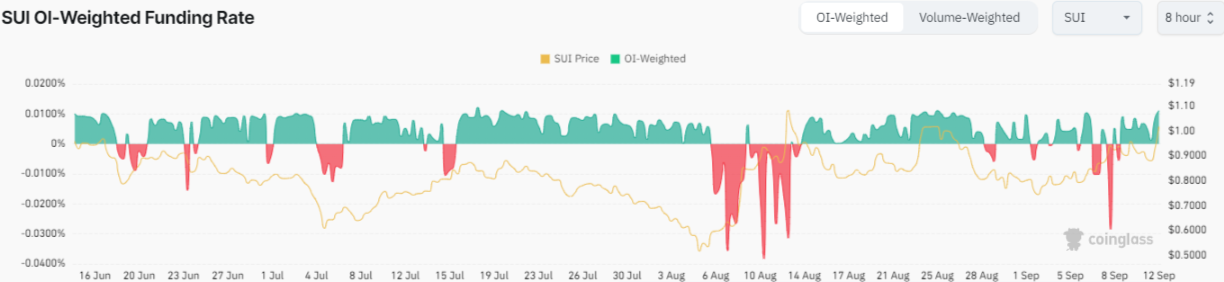

On-chain metrics from Coinglass indicate a substantial +59.01% increase in total open interest for the token, escalating from $212 million to $302.26 million within a day. Additionally, the aggregated funding rates have turned positive, now at 0.0111%, signaling a shift toward bullish market sentiment.

The SUI Relative Strength Index (RSI) is currently at 66.50, which suggests that while the asset is approaching overbought territory, there is still room for growth before any significant consolidation or pullback might occur.

Advertisement

Also Read: Grayscale Launches First Ripple Trust Fund in US; XRP Price Surges 8%

cryptonewsz.com

cryptonewsz.com