Injective (INJ) price showed roller coaster moves for the last two weeks. It retested the lower trajectory support zone of $15 and initiated a bounce.

It streamed by over 15% in the last two sessions, showing a follow-on buying momentum. Defying the selling pressure, the INJ crypto is set to scratch the $20 mark and is peeking to spread the gains.

This week, Injective crypto showed stability and crossed the 20-day EMA mark, which signified bullish strength. While trading inside a falling channel, the INJ token’s price came closer to the trendline barrier and attempted a breakout.

When writing, the Injective price traded at $18.01 with an intraday rise of over 2.64%. It boasted a market cap of $1.77 Billion.

INJ Price Prediction: Will Uptick In Buying Pressure Fuel the Reversal?

Bulls battled strongly to compel a recovery for INJ price since the beginning of this month. The past few hours saw both the price jump and OI increase, symbolizing a bullish view of the market.

Technical indicators play a critical part in comprehending the potential of the altcoin. The Relative Strength Index (RSI) curve was at 50, close to the midline region.

The ongoing price action indicated that bulls gained traction and were eyeing to extend the gains. However, the $23 mark was the one that INJ bulls must beat to flip the market structure bullishly on the daily chart.

@CryptoBoss tweeted that the INJ price has formed a kind of double bottom pattern and is ready to teleport the gains.

$INJ teleport season soon? pic.twitter.com/m14yv0xOw5

— CryptoBoss (@CryptoBoss1984) September 10, 2024

The MACD indicator presented a bullish crossover, and a potential upswing could be seen in the coming sessions.

Since Mid-June, Injective crypto has been retracing the gains and corrected by over 50% from the $32 mark.

In case of a successful breakout above the trendline hurdle of $22, the INJ crypto could rally toward the $25 mark. Accompanied by volume surge, the price action signified buyers’ accumulation and suggested a short-term bounce in the coming sessions.

Rise In Investor Confidence

Following the price surge, the active address data noted an uptick. It displayed the growing investor confidence and increased liquidity.

Additionally, the velocity line showed fluctuations, indicating heightened trading activity among the investors.

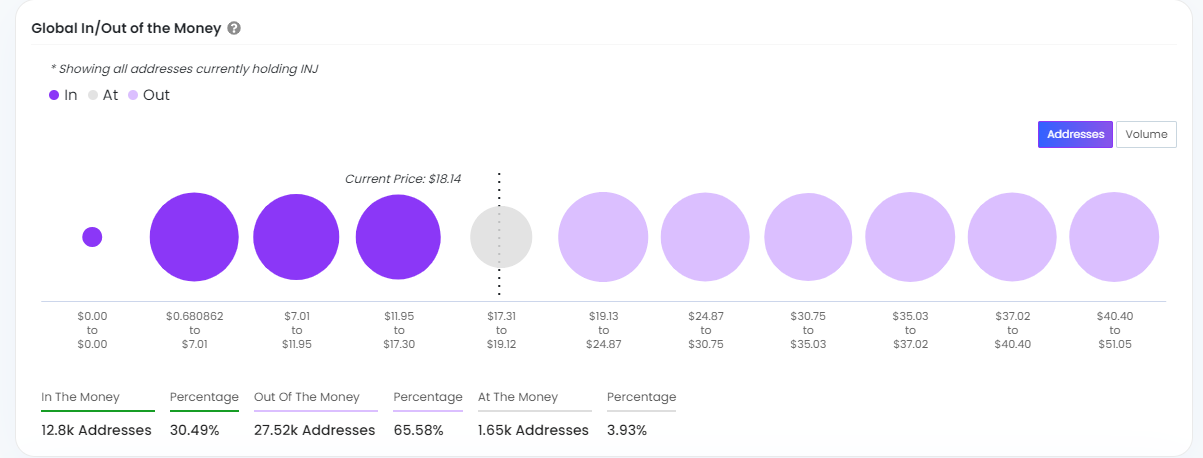

The Global In/Out of the Money (GIOM) indicator showed that 30% of the holders were making money at the current price level. More than 68% of the out-of-the-money holders were facing unrealized losses at the time of writing.

The Futures Open Interest data indicated a rise in the long additions, which meant traders were hoping for a price surge.

Overall, the metrics suggested that it could be a lucrative short-term buying opportunity for INJ traders to chase the reversal rally.

The $15 area was the prompt support level, which might act as a magnet. However, the$20 and $22 levels were the nearest resistance zones to keep an eye for further upswing ahead.

thecoinrepublic.com

thecoinrepublic.com