-

Solana-based Dogwifhat ($WIF) is poised for a potential 12% price correction in the coming days.

-

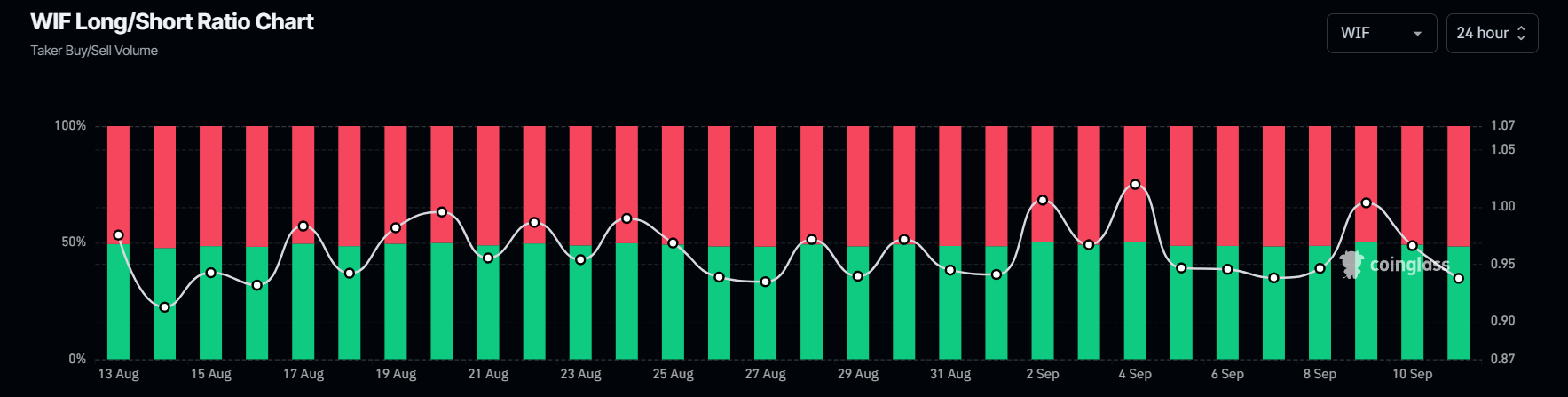

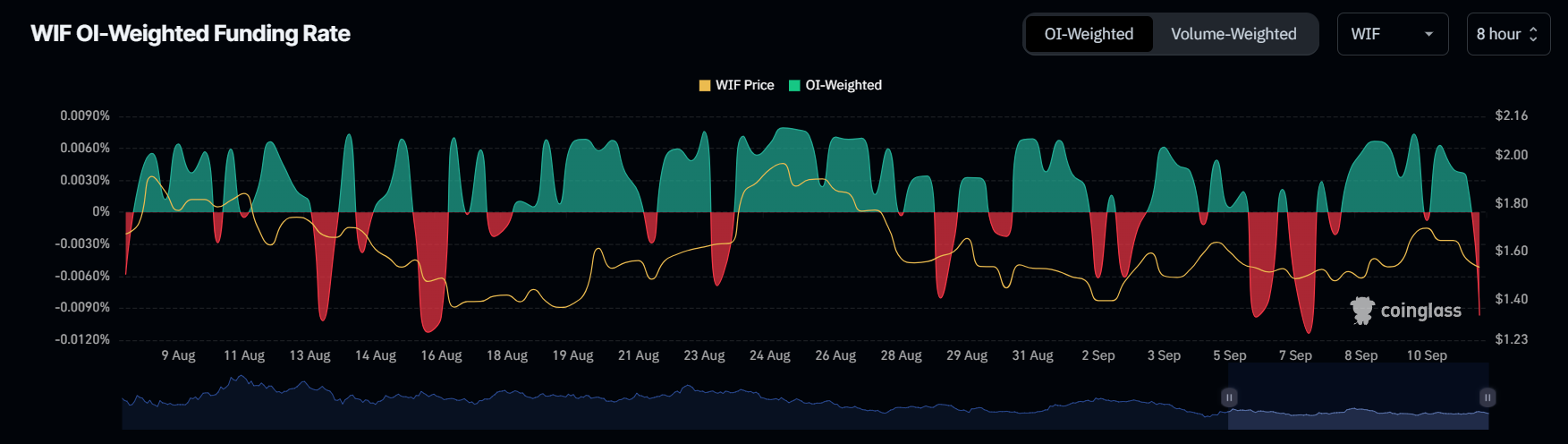

$WIF’s on-chain metrics such as $WIF’s long/short ratio, $WIF OI-weighted funding rates, and future open interest are flashing bearish signals.

-

$WIF price could fall by 12% to the $1.3 level if it closes a candle below the $1.5 level.

In the current bearish market sentiment, Solana-based Dogwifhat ($WIF) is poised for a potential price correction in the coming days. On September 11, 2024, $WIF experienced a price drop of over 8% and is now there at a crucial level. However, the on-chain metrics such as $WIF’s long/short ratio, $WIF OI-weighted funding rates, and future open interest are flashing bearish signals.

$WIF Price Performance

As of writing, $WIF is trading near $1.53 and has experienced a price drop of over 8% in the last 24 hours. Meanwhile, its trading volume has increased by 10% during the same period, indicating higher participation from traders and investors despite the price drop.

Dogwifhat ($WIF) Technical Analysis and Upcoming Levels

According to expert technical analysis, $WIF appears bearish and is trading below the 200 Exponential Moving Average (EMA) on a four-hour time frame. Additionally, it is currently at a crucial support level of $1.516.

If fails to hold this level and closes a four-hour candle below the $1.5 level, there is a high possibility $WIF price could fall by 12% to the $1.3 level in the coming days.

Bearish On-chain Metrics

$WIF’s bearish outlook is further supported by the on-chain metrics. Coinglass’s $WIF Long/Short ratio currently stands at 0.927, suggesting bearish market sentiment. According to the data, a long/short ratio below 1 indicates a bearish sentiment and vice-versa. Meanwhile, the $WIF OI-weighted funding rate is -0.0097%, further indicating bearishness.

Additionally, its future open interest has also declined by 10%, indicating traders are either closing their positions or have been liquidated due to the recent price drop, and are currently hesitant to build new positions.

Whales Scoop Up $WIF Despite Bearish Sentiment

Despite this bearish outlook, whales and investors appear to be showing interest in $WIF, as it has experienced a notable price decline in recent days. According to the on-chain analytic firm Lookonchain, two whales have accumulated a significant 20.58 million $WIF tokens, worth $33.35 million from Binance and Bybit in the past two weeks.

coinpedia.org

coinpedia.org