-

$BTC, $ETH, $SOL, and $DOGE have experienced price declines of 1.95%, 1.85%, 2.10%, and 2.35%, respectively, in the past hour.

-

Bitcoin could drop to $54,000 or lower if the bearish trend continues.

-

53.14% of top Bitcoin traders hold short positions, while 46.86% hold long positions.

After a brief recovery on September 10, 2024, the overall crypto market once again appears for a massive decline. Following the release of the United States Consumer Price Index (CPI) and the opening bell of the US market, major cryptocurrencies including Bitcoin ($BTC), Ethereum ($ETH), Solana ($SOL), and others, have fallen significantly.

Crypto Market Massive Recent Decline

According to the coinmarketcap, in the past hours $BTC, $ETH, $SOL, and $DOGE have experienced price declines of 1.95%, 1.85%, 2.10%, and 2.35%, respectively.

This price decline suggests that investors and crypto enthusiasts aren’t happy with the latest CPI report. Although CPI has dropped to 2.5%, significantly lower than the previous month’s 3.0%, it indicates that inflation is cooling down.

The Potential Reason for Bitcoin Price Decline

However, the potential reason behind the market sell-off is the notable Bitcoin dump by short-term holders and miners.

A prominent crypto analyst made a post on X (previously Twitter) stating that Bitcoin short-term holders seized the recent price jump on September 10, and offloaded nearly 14,816 $BTC worth $850 million. In another post, the analyst noted that Bitcoin miners have also sold off a significant 30,000 $BTC worth $1.71 billion in the past 72 hours.

Based on the historical price momentum, if $BTC closes a daily candle below the $56,000 level, there is a high possibility that it could drop to $54,000 or lower if the bearish trend continues.

Bearish On-chain Metrics

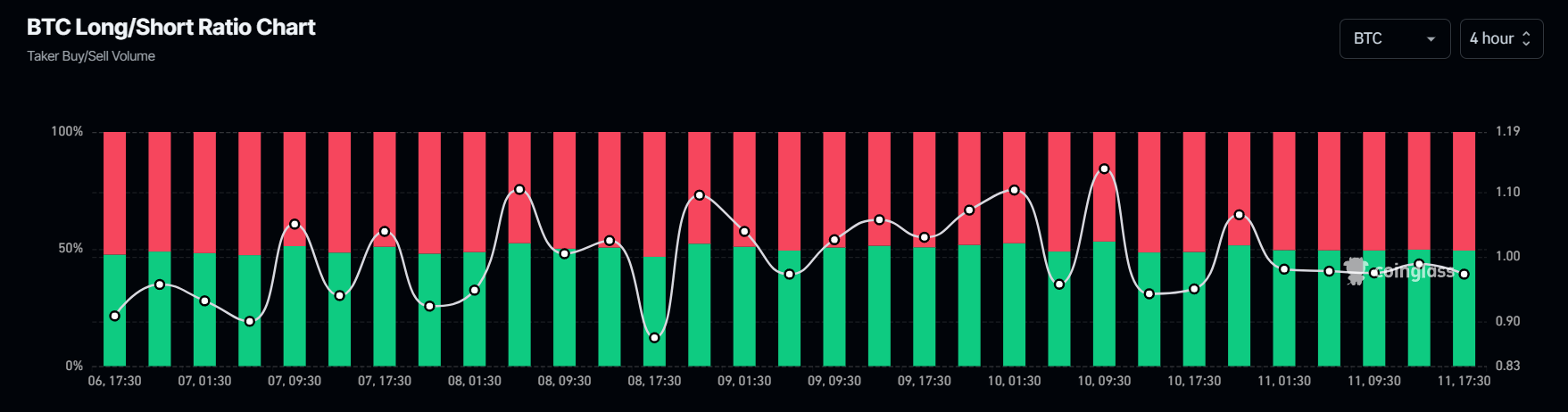

However, this bearish outlook is further supported by on-chain metrics. Coinglass’s $BTC Long/Short ratio currently stands at 0.881 (the value below 1 indicates bearish market sentiment). Additionally, $BTC’s future open interest has also dropped by 1.5% and continues to decline.

Meanwhile, 53.14% of top Bitcoin traders hold short positions, while 46.86% hold long positions, highlighting that bears are currently dominating the asset and have the potential to create additional selling pressure.

coinpedia.org

coinpedia.org