Cryptocurrencies are recovering after a notable crash with “September Effect” fears and favorable macroeconomic data like US jobs and CPI. As the cryptocurrency market heats up for a 2024 crypto bull run, two tokens stand out with strong momentum.

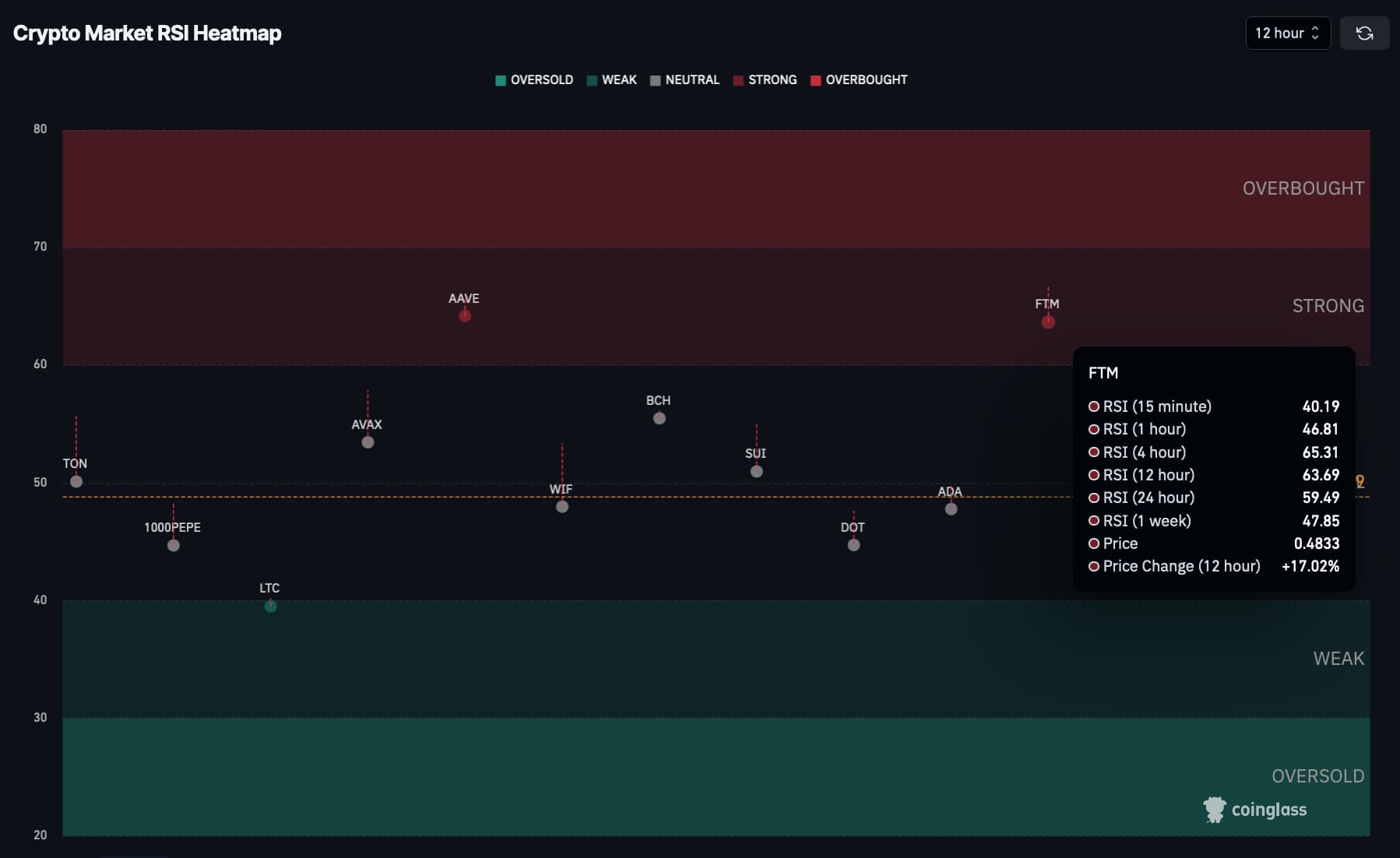

On September 11, Finbold retrieved data from CoinGlass‘s Relative Strength Index (RSI) heatmap, especially in the 12-hour time frame. Notably, the market’s average RSI shows a strengthening momentum nearing the 50-point neutrality indicator, currently at 48.79.

With continuous downward revised jobs data – indicating a worrying economic situation in the United States – and a diminishing year-over-year (YoY) Consumer Price Index (CPI) inflation, the Federal Reserve will likely decide on the first interest rate cut in years, likely fueling the strong momentum.

Today, the CPI YoY data release shows a 2.5% inflation. This is below last month’s 2.9% results and within the market expectations, validating the recent trend.

Aave ($AAVE) is building up strong momentum

First, Aave ($AAVE) stands out as one of the most successful decentralized finance (DeFi) protocols in the crypto space. It is, knowingly, one of the most used platforms by cryptocurrency investors who can lend and borrow tokens from each other.

Currently, the $AAVE token trades at $147.7, up 17.36% in the last 12 hours, building up solid momentum. Looking at its Relative Strength Index, $AAVE shows a “strong” condition, with over 60 RSI points in four different time frames.

Precisely, with 64.22, 64.2, 61.69, and 64.49 in the four-hour, 12-hour, daily, and weekly charts, respectively.

The crypto and DeFi investor, “flow,” on X, forecasts $AAVE to reach $160 per token in the next few days. According to him, Aave’s fundamentals will bring further growth to the asset. However, the short-term price target is slightly above the current exchange rate, and there is significant resistance to testing first.

Nevertheless, indicators like the RSI should not be considered in isolation. As things develop, traders should look for insights from data, analysts, and price charts to make good financial decisions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com