On-chain data shows meme coin Pepe ($PEPE) is at its most overvalued since the start of the year. This follows a whale withdrawing 4 trillion tokens worth $28.40 million from Bybit.

While some may rush for gains, caution is advised.

Pepe Holders Need To Look Before Leaping

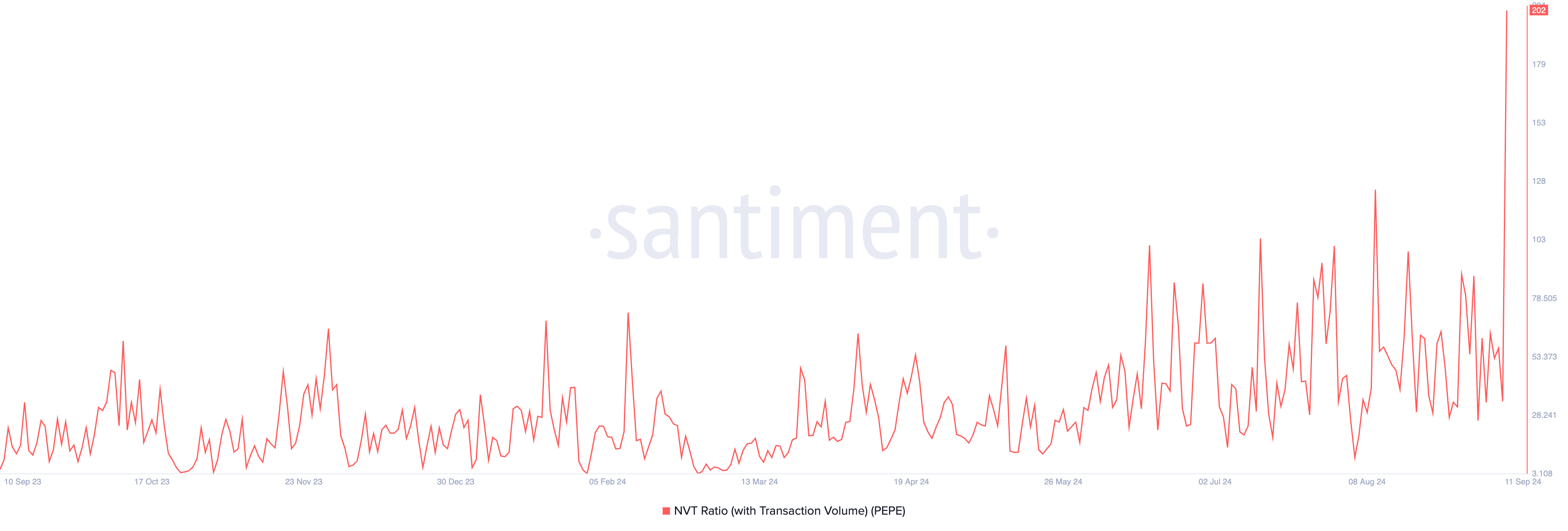

$PEPE’s Network Value to Transaction (NVT) ratio has soared to its highest level since the beginning of the year. This metric, which compares $PEPE’s market capitalization to the value of its tokens transacted daily, currently sits at 202, having risen by 494% over the past 24 hours.

An asset’s NVT ratio spike indicates that its market capitalization is increasing faster than the volume of transactions on its network. This signals that the asset is overvalued, and the current market conditions do not support such movements.

The quick increase in $PEPE’s NVT ratio over the past 24 hours hints at market speculation. The fact that the ratio spiked after a whale removed over $28 million worth of tokens from an exchange makes this even more likely.

Additionally, the negative divergence between $PEPE’s price and trading volume in the past 24 hours reinforces this outlook. $PEPE is trading at $0.0000071, down 4%, while its trading volume surged by 70%.

The volume spike without a price increase indicates weak buying interest from $PEPE market participants.

Read more: Pepe ($PEPE) Price Prediction 2024/2025/2030

$PEPE Price Prediction: Can It Lose One Zero?

The declining Chaikin Money Flow (CMF) for $PEPE further confirms reduced buying pressure. At present, the CMF, which tracks the flow of capital into and out of the market, is below zero and trending downward, signaling market weakness and increased liquidity exit.

If $PEPE holders continue to remove capital from its market, the token’s value will drop to $0.0000059.

Read more: 5 Best Pepe ($PEPE) Wallets for Beginners and Experienced Users

However, if market sentiment improves and demand rises, the meme coin could erase a zero and trade at $0.000010.

beincrypto.com

beincrypto.com