BinaryX has been catching the attention of investors with its recent price surge. While it’s currently riding a bullish wave, the big question is: how long will this momentum last? In this article, we’ll take a closer look at the factors driving BinaryX’s price up and whether a bearish trend could be around the corner.

How has the BinaryX Price Moved Recently?

As of today, BinaryX is priced at $1.43208 with a 24-hour trading volume of $270.39 million. Its market cap stands at $535.18 million, giving it a market dominance of 0.03%. Over the past 24 hours, BinaryX's price has surged by 16.62%.

BinaryX hit its all-time high of $217.87 on November 14, 2021, while its lowest price was recorded on August 17, 2023, at $0.170775. Since reaching that all-time low, the price rebounded to a cycle high of $1.74912. Currently, market sentiment around BinaryX remains bullish, though the Fear & Greed Index reflects a score of 29, indicating fear in the market.

BinaryX has a circulating supply of 373.71 million BNX out of a maximum supply of 21 million BNX. Over the past year, the supply increased by 369.78 million BNX, resulting in an inflation rate of 9,409.68%.

Why BinaryX (BNX) Price is UP?

BinaryX (BNX) is currently experiencing a price surge, and several key factors contribute to this upward trend. As a major player in the GameFi ecosystem, BinaryX is at the forefront of transforming gaming by introducing sustainable economic models that enhance player experiences.

This forward-looking vision has attracted increased investor interest, pushing up BNX's price. Additionally, the platform operates on the Binance Smart Chain (BSC), benefiting from the chain’s security and scalability. With a BEP-20 token structure and a strong Certik audit score of 83, BNX has earned trust within the community, further bolstering its market value.

A significant recent development driving BNX’s price increase is the decision to burn 74% of its total tokens. By drastically reducing the supply, this token burn has created a supply-demand imbalance that typically drives prices up. Investors view this burn as a positive move, increasing scarcity and potential future value.

Combined with BNX’s strong fundamentals in the GameFi sector and the robust security of the Binance Smart Chain, the token burn has likely amplified bullish sentiment around BinaryX, contributing to the current price rise.

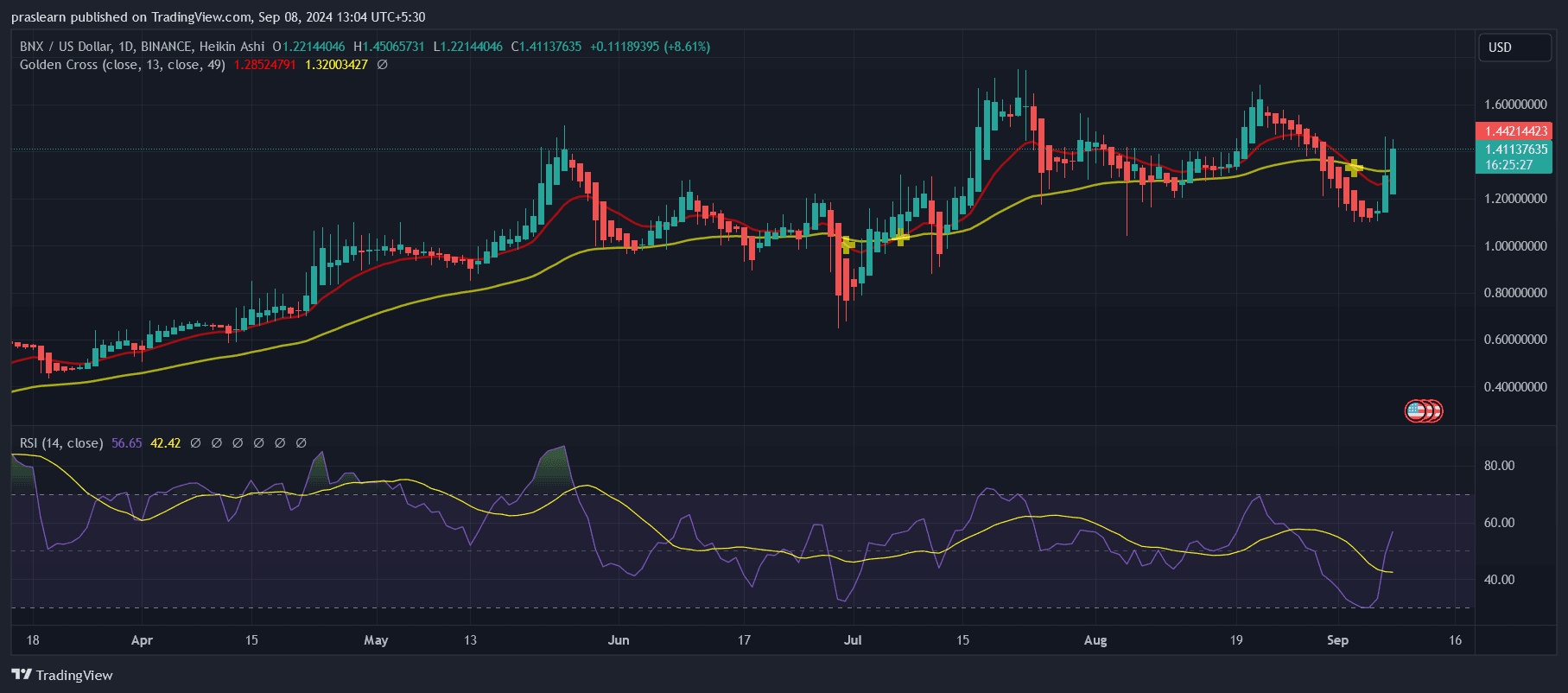

BinaryX Price Analysis: Bullish Now, Bearish Later?

BinaryX (BNX) has shown impressive performance, with a staggering 580% price increase over the past year, outperforming 94% of the top 100 crypto assets, including giants like Bitcoin and Ethereum.

This significant growth can be attributed to its strategic moves within the GameFi ecosystem, strong token fundamentals, and recent token burn, which boosted investor confidence by creating scarcity. Additionally, BNX enjoys high liquidity relative to its market cap, making it attractive for both retail and institutional traders.

However, while the current outlook remains bullish due to its recent upward momentum, there are signs of potential bearish pressure on the horizon. BNX is currently trading below its 200-day simple moving average, a technical indicator often seen as a sign of weakening market strength.

Moreover, despite its strong yearly performance, the token has only experienced 14 green days in the last 30 days, reflecting a 47% bullish activity. It’s also worth noting that BNX is down 99% from its all-time high, and the inflation rate of 9,409.68%—due to the massive creation of tokens—poses risks to its long-term sustainability.

Given these factors, while the immediate trend for BinaryX remains bullish, with positive market sentiment fueled by the token burn and solid performance, the long-term outlook suggests potential volatility.

The high inflation rate and historical market downturn could lead to bearish trends, especially if liquidity weakens or broader market conditions shift.

cryptoticker.io

cryptoticker.io