In the last two weeks, $AAVE crypto showcased a notable correction from $148.7 to the $117.8 support, registering a loss 20%. A bearish reversal indicates a healthy correction for buyers to regain strength.

Sustaining at the abovementioned support, $AAVE surged nearly 10% intraday, reaching $130.57.

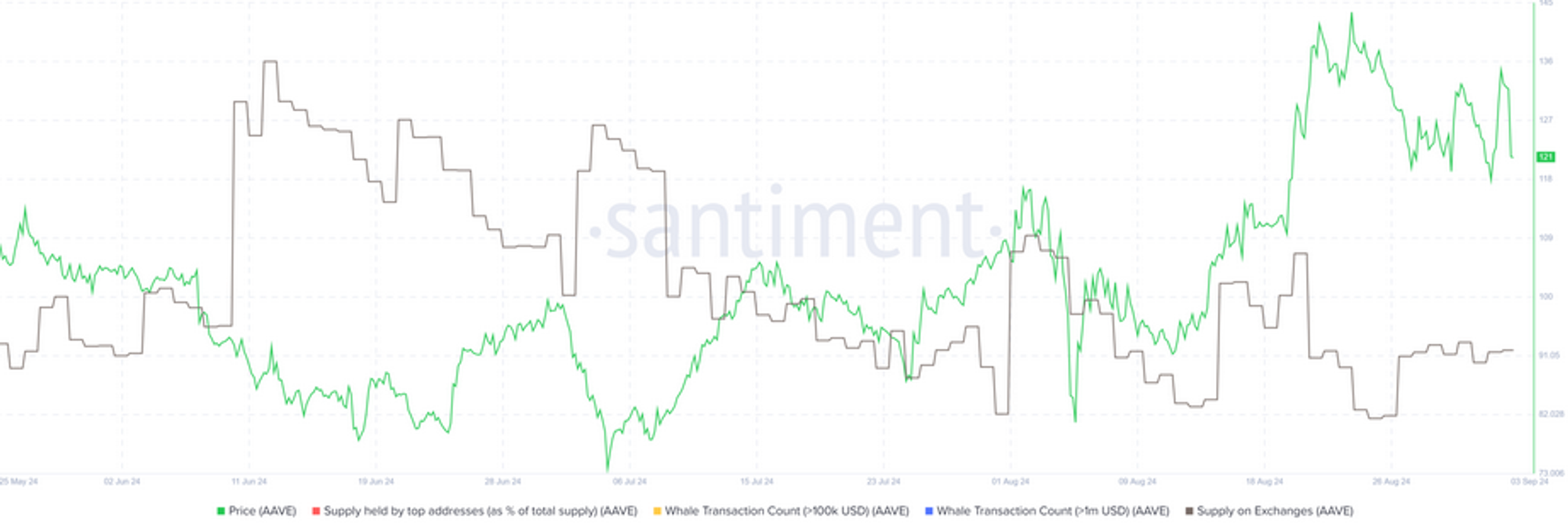

Similarly, data from Santiment displays that the $AAVE supply on exchanges has declined since the third quarter’s beginning. This indicates that investors are withdrawing $AAVE from exchanges. This suggests a shift from selling to holding strategies for $AAVE.

Supply held by top addresses | Source: Santiment

Moreover, its price has seen a notable increase on the daily chart, illustrating upward movement as other cryptos struggle to stabilize.

$AAVE crypto follows a separate price action and is less likely to tend to $BTC’s price movement and sentiment. This is due to a lesser correlation to $BTC, which was at 0.49.

Derivatives Data Insights on $AAVE

According to Coinglass, Aave experienced spectacular trading activity as of writing. The trading volume for Aave advanced by 180.61%, reaching a substantial $1.08 Billion, for the current trend.

Derivatives $AAVE Volume chart | Source: Coinglass

The open interest in Aave crypto derivatives has also seen a notable surge intraday. It signifies increased contracts for the current trend, as OI has climbed by 7.59% to $150.66 Million.

OI & Liquidations chart | Source: Coinglass

Correspondingly, the 24-hour liquidations data showcases that more shorts have built than longs, with a short ratio of 1.0186. Precisely, the shorts liquidated were $654.39K, while the longs were only $541.15K.

The derivatives data highlights an elevated investor interest and continued bullishness for Aave crypto in the coming session.

At the Current Price, How Many Are in Green?

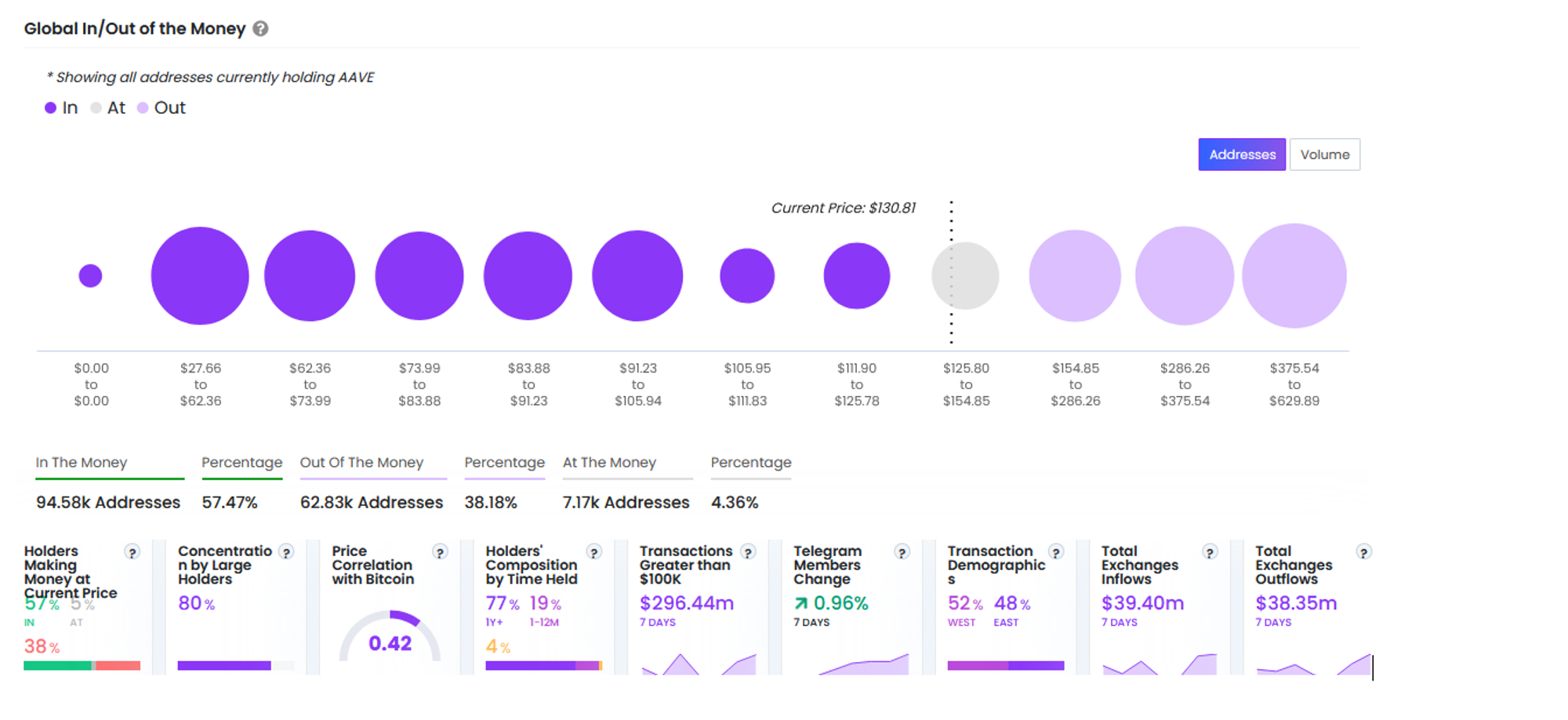

The concentration by large holders was 80%. Which 59.48% were whales, and 20.44% were investors. Number of holders’ addresses have increased seamlessly, showcased demand. The retail holding was a minimum of 20.07%.

Per the financial data, 57.47% of the total holders were in green at the time of writing. 38.18% of the holders are in red with 4.36% in breakeven.

Financial data, and On-chain data | Source: IXFI

Additionally, transactions greater than $100K surged, and in the past 7 days, nearly $296.44 Million worth of transactions were completed.

A Glance at the Daily Chart of $AAVE

$AAVE is up over 70%, driven by the descending triangle pattern’s breakout. The $80 demand zone has proved itself to be robust; despite several dips, it has not lost its resilience.

The price over the long term seems bullish, as $AAVE managed to sustain above the 50-day and 200-day EMA bands over the past few months.

Aave crypto price is displaying signs of stepping into a bullish market phase over the long term. As of writing, the possible targets are $153 and $160.42. If the pace continues, it may hit $200, marking a gain of over 50% by the September-end.

thecoinrepublic.com

thecoinrepublic.com