-

$BONK has outperformed major cryptocurrencies including Bitcoin ($BTC), Ethereum ($ETH), and Solana ($SOL).

-

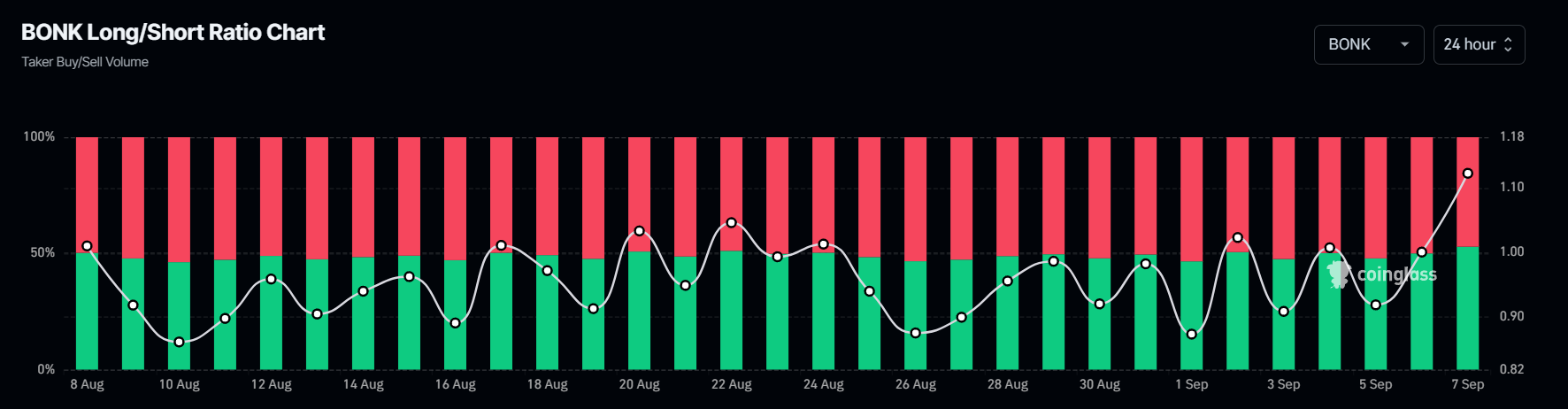

CoinGlass’s $BONK Long/Short ratio, currently stands at 1.112, indicating strong bullish sentiment.

-

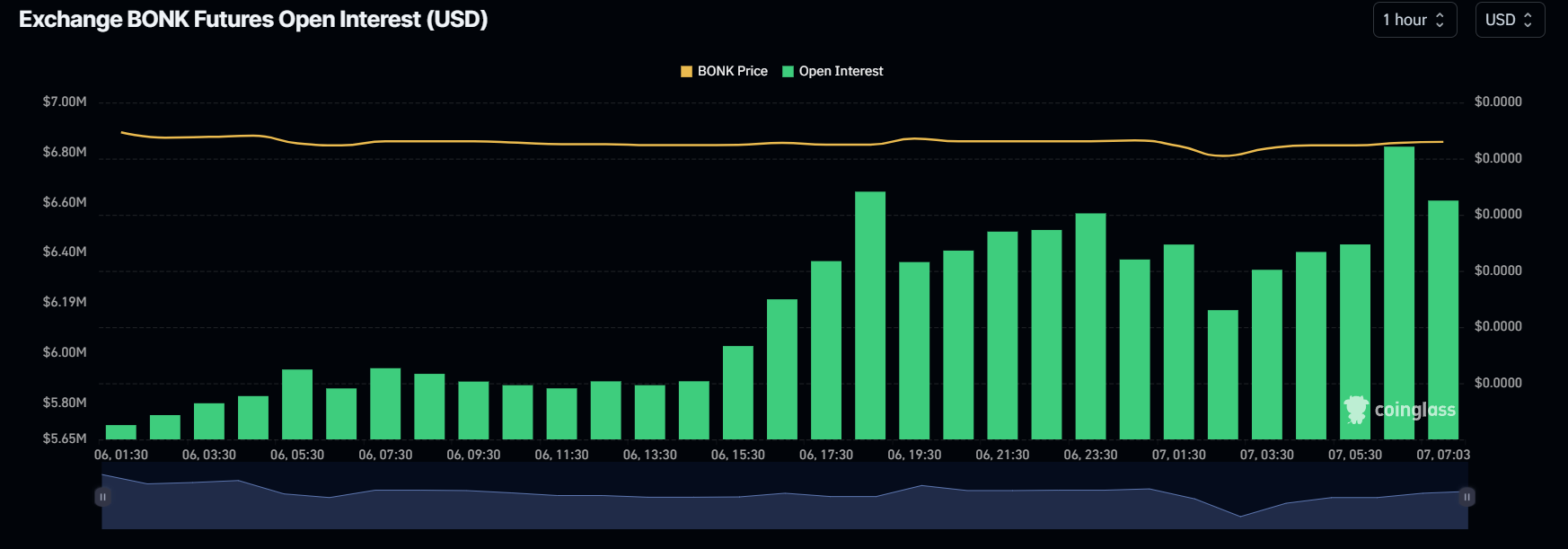

$BONK’s open interest has also increased by 16% in the last 24 hours, indicating growing interest from traders.

Bonk ($BONK), the popular Solana-based meme coin, is defying the market trend and is poised for a massive price surge despite bearish sentiment. With an impressive 4% price surge, it has gained significant attention from the crypto community resulting in its open interest skyrocketing by 16% in the last 24 hours.

$BONK Outperforms Major Cryptos

With a strong bullish intention, $BONK has outperformed major cryptocurrencies including Bitcoin ($BTC), Ethereum ($ETH), Solana ($SOL), and $BNB ($BNB). At press time, it is trading near the $0.0000162 level and has experienced a price surge of over 4% in the last 24 hours. Meanwhile, $BONK’s trading volume has increased by 72%, during the same period, indicating higher participation from traders amid the recent market crash.

$BONK Price Prediction

According to expert technical analysis, $BONK is near a crucial support level of $0.000015 level and is currently facing strong resistance from a descending trendline and a horizontal level at $0.0000164. If $BONK’s price momentum continues and breaks out of both hurdles, it could soar by 30% to the $0.0000213 level in the coming days.

Meanwhile, the Relative Strength Index (RSI) is in oversold territory, signaling a potential bullish price reversal in the coming days.

Bullish On-Chain Metrics

In addition to the technical analysis, key on-chain metrics also support $BONK’s bullish outlook. CoinGlass’s $BONK Long/Short ratio, a sentiment indicator that highlights trader views and market sentiment, currently stands at 1.112, the highest level since August, indicating strong bullish sentiment.

Additionally, the data shows that 53% of top traders hold long positions, while 47% hold short positions, which also backs this bullish outlook.

On the other hand, $BONK’s open interest has also increased by 16% in the last 24 hours, indicating growing interest from traders amid the ongoing price momentum.

The combination of rising open interest with a Long/Short ratio above 1 is a strong bullish sign. Traders often use this combination to bid their trades on either side.

coinpedia.org

coinpedia.org