Main Takeaways

-

This blog recaps the recent Binance Research report discussing key developments in crypto markets over the past month.

-

In August 2024, the cryptocurrency market experienced a 13.1% drop in total market capitalization due to global macroeconomic concerns and weak U.S. unemployment data. A flash crash across both equity and cryptocurrency markets happened, but the recovery followed quickly, boosted by expectations of a potential rate cut in September 2024 and higher-than-expected second-quarter GDP growth in the U.S.

-

In August, the NFT market saw a 10.7% decline in sales volume to US$383M. However, CryptoPunks stood out in sales. NFT games like Guild of Guardians, Sorare, DeGods and y00ts defied the trend, seeing significant gains in trading volume.

Thanks to Binance Research, you can take advantage of industry-grade analyses of the processes shaping Web3. By sharing these insights, we hope to empower our community with the latest knowledge from the field of crypto research.

This blog explores key Web3 developments in August 2024 to provide an overview of the ecosystem’s current state. We analyze the performance of crypto, DeFi, and NFT markets before previewing major events to look out for in September 2024.

Crypto Market Performance in August 2024

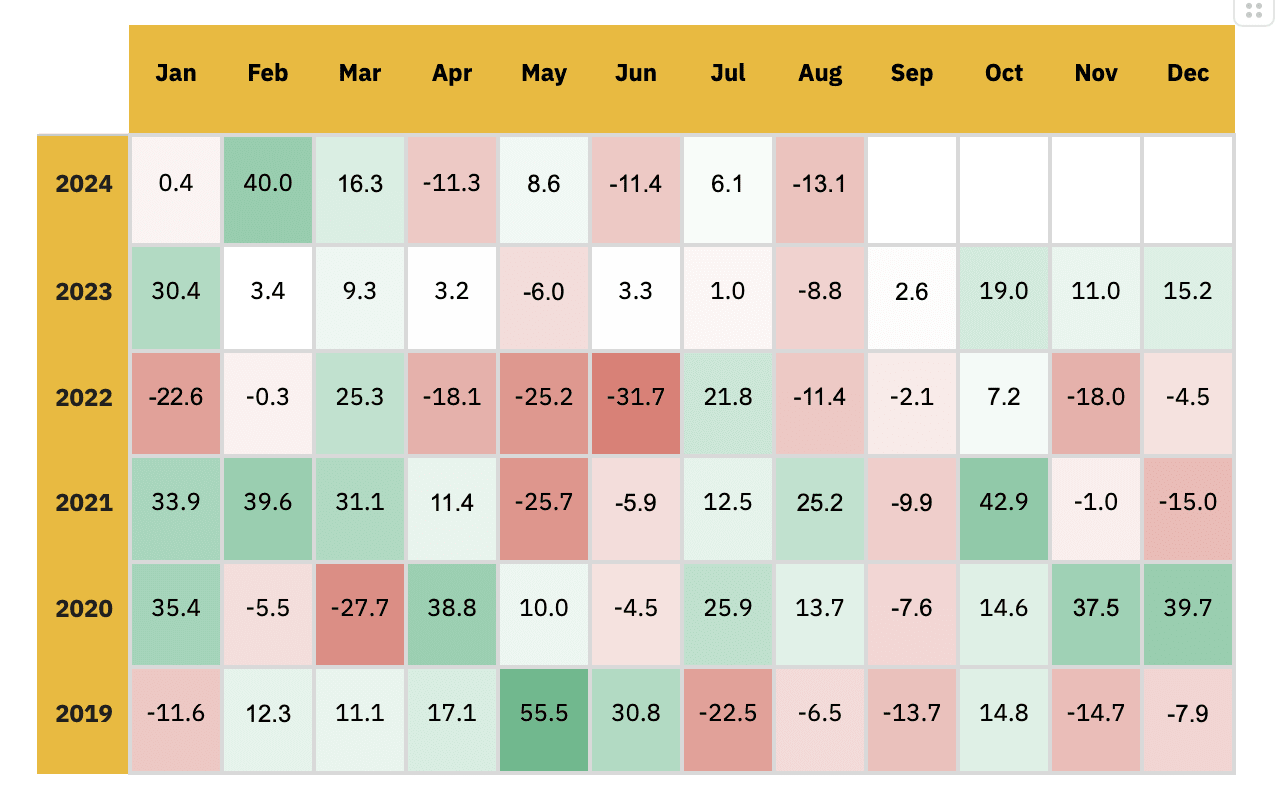

In August 2024, the cryptocurrency market saw a significant 13.1% decline in total market capitalization, driven by global macroeconomic concerns and weak U.S. unemployment data, which amplified fears of a recession. On August 5, the Bank of Japan's decision to raise interest rates caused considerable disruption in global stock markets, particularly affecting Asian indices such as the MSCI Asia Pacific and Japan's Nikkei 225, which experienced sharp intraday losses. This volatility extended to the cryptocurrency market, leading to over US$819 million in liquidations within a single day. Despite this "flash crash," the market began to stabilize after U.S. Federal Reserve Chairman Jerome Powell suggested a potential rate cut in September. Additionally, the U.S. Bureau of Economic Analysis revised second-quarter GDP growth to 3%, surpassing expectations.

Monthly crypto market capitalization decreased by 13.1% in August

Source: CoinMarketCapAs of August 31, 2024

Source: CoinMarketCapAs of August 31, 2024

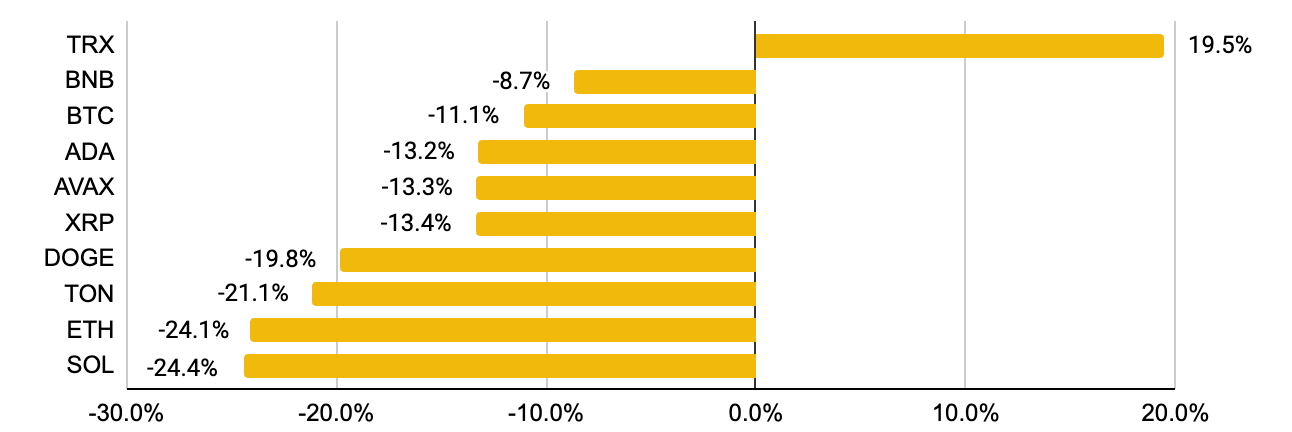

Monthly price performance of the top 10 coins by market capitalization

Source: CoinMarketCapAs of August 31, 2024

TRX outperformed the market with a 19.5% gain in August, driven by the launch of the SunPump memecoin launchpad, leading to a 65.6% increase in trading volume and a 245.2% surge in TRON DEX trading volumes, which surpassed US$3B.

Despite a 9.1% decline, BNB remained relatively stable. BNB Chain's Meme Coin Innovation Battle attracted significant interest, leading to increased memecoin launches on the four.meme platform.

BTC declined by 11.1% due to macroeconomic and geopolitical factors, with spot BTC ETFs seeing a net outflow of US$142M, and Grayscale's GBTC experiencing an US$838M outflow.

ADA, AVAX, and XRP each saw declines around 13%, while DOGE dropped by 19.8%. TON experienced a 20.4% decline on the news of Telegram founder Pavel Durov’s arrest, exacerbated by a six-hour network outage caused by congestion from the popular memecoin DOGS.

ETH posted a 24.9% decline, with a decrease in on-chain activity, low gas fees, and significant outflows from DeFi TVL. Concerns arose over large ETH liquidations and sales by key players, alongside underperformance of spot ETH ETFs.

SOL saw the largest drop among top coins, falling by 24.4%. Initial interest in memecoin trading seems to have somewhat faded due to instances of rug pulls and hacks, leading to a 27.7% decline in Solana DEX trading volume and reduced on-chain activity.

Decentralized Finance (DeFi)

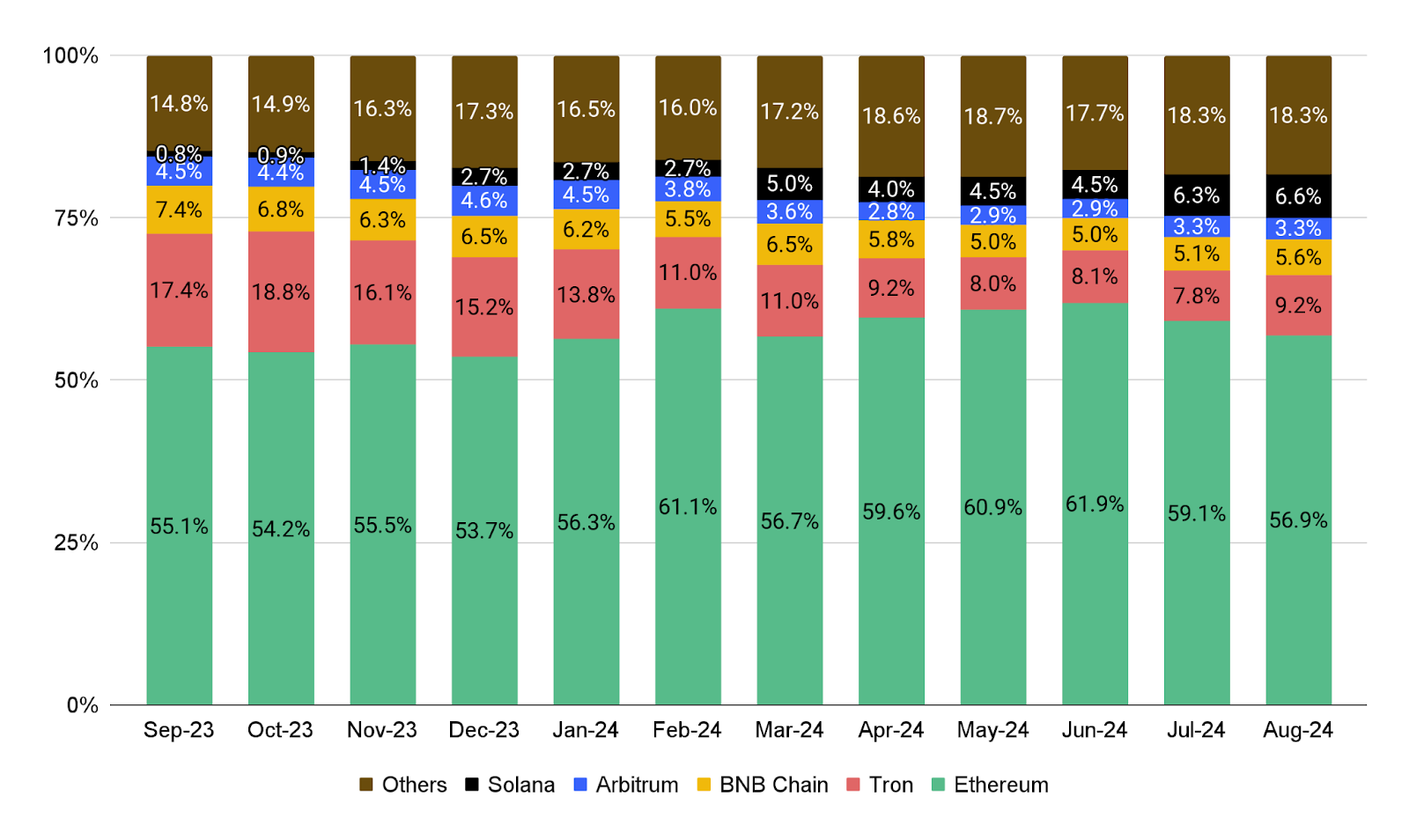

In August, the DeFi Total Value Locked (TVL) saw a 15.8% decrease, reflecting the overall market downturn, with significant outflows from major chains like Ethereum and Solana. Notably, alternative chains such as TON and Blast experienced even steeper declines, with TVL drops of 51.78% and 30.7%, respectively. Despite this widespread decline, Sui stood out as a significant gainer, achieving a 35.63% increase in TVL due to increased interest in native DeFi applications and developments like the Grayscale Sui Trust announcement and the rollout of the Mysticeti consensus engine.

In the restaking sector, Symbiotic attracted strong interest with a 38.1% rise in TVL, driven by their ongoing points program and the expansion to 14 new networks, along with the addition of assets like WBTC and ETHFI. The lifting of asset caps in mid-August also contributed to an influx of deposits. Meanwhile, SUN experienced a remarkable 42.4% surge in TVL following the launch of Sunpump on August 9, driven by the launchpad's facilitation of over 69,400 tokens, which attracted speculative traders and generated over US$45.8 million in revenue within a month.

TVL share of top blockchains

Source: DeFiLlamaAs of August 31, 2024

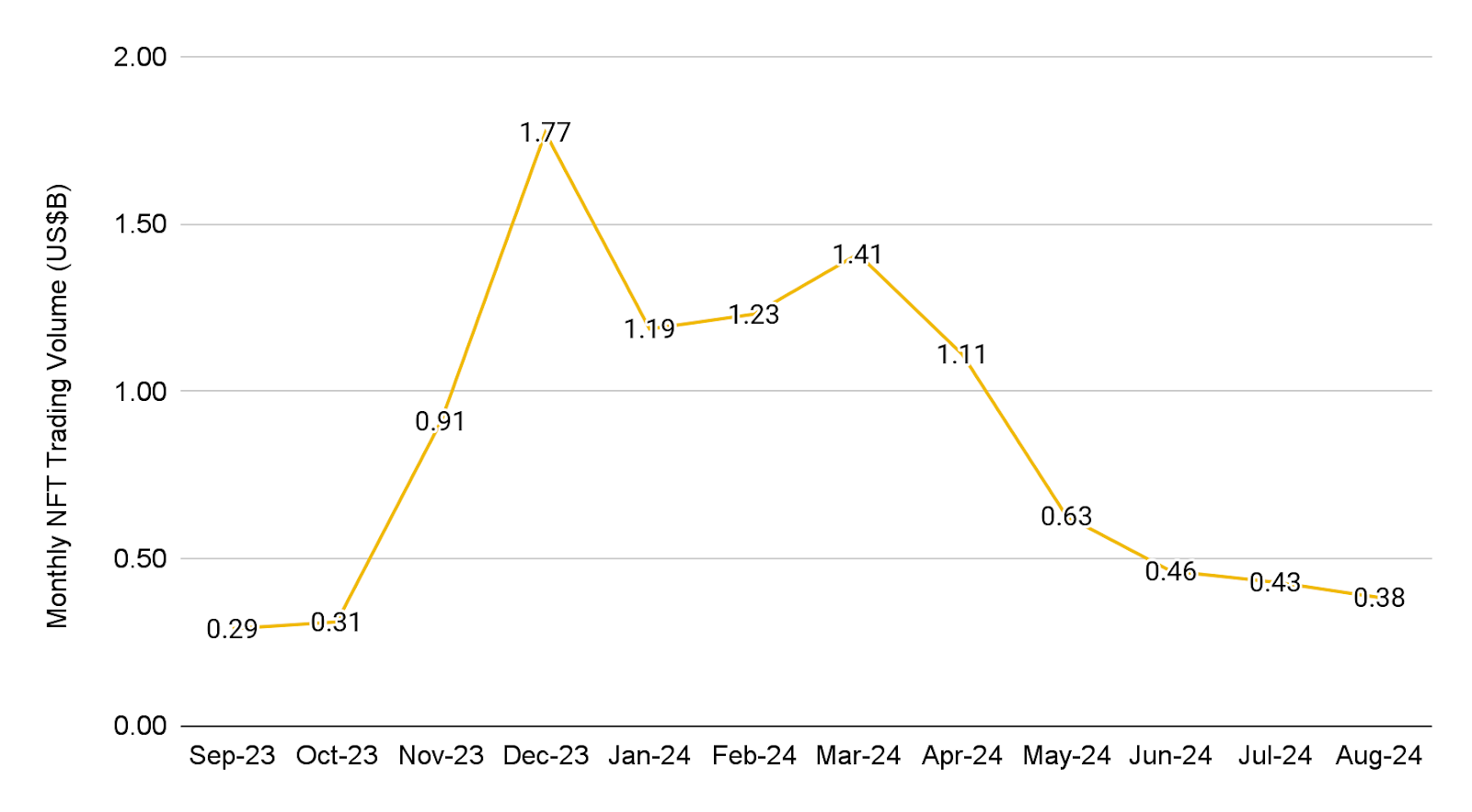

Non-Fungible Tokens (NFTs)

Monthly NFT trading volume

Source: CryptoSlam As of Aug 31, 2024

Source: CryptoSlam As of Aug 31, 2024

In August, the NFT market saw a 10.7% decline in sales volume to US$383M, but the CryptoPunks collection stood out with US$18.0M in sales. Games like Guild of Guardians and Sorare defied the trend, with Guild of Guardians surging by 151.2% to US$14.6M in trading volume, and Solana collections DeGods and y00ts also seeing significant gains.

While Ethereum collections like CryptoPunks and Bored Ape Yacht Club saw brief recoveries, top Ordinals collections continued to decline. Overall, major chains like Bitcoin, Ethereum, and Solana experienced sharp drops in NFT volumes, but Mythos managed a 14.3% increase, driven by strong activity on its DMarket in-game item marketplace.

Upcoming Events and Token Unlocks

To help users stay updated on the latest Web3 news, the Binance Research team has summarized notable events and token unlocks for the month to come. Keep an eye on these upcoming developments in the blockchain space.

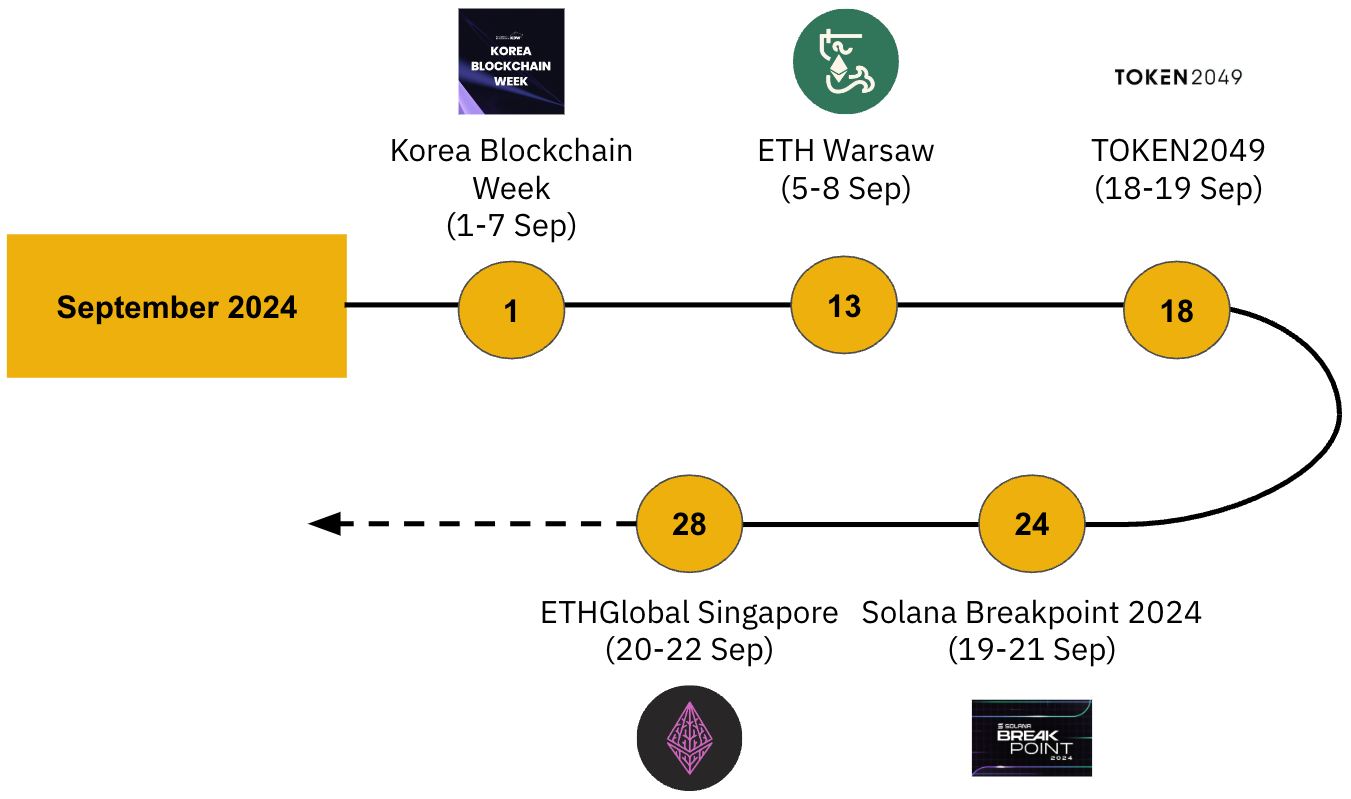

Notable Events in September 2024

Source: Binance Research, CoinMarketCap

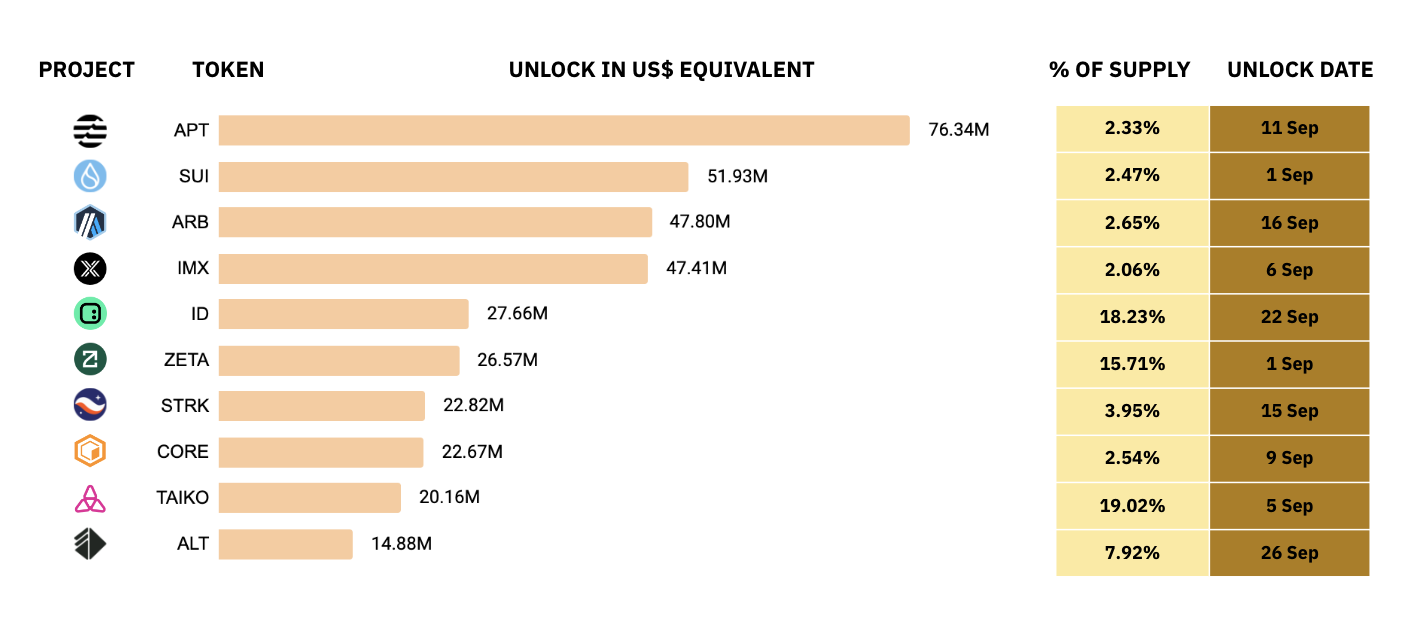

Largest token unlocks in US$ terms

Source: Token Unlocks, Binance Research

Binance Research

The Binance Research team is committed to delivering objective, independent, and comprehensive analyses of the crypto space. We publish insightful takes on Web3 topics, including but not limited to the crypto ecosystem, blockchain applications, and the latest market developments. This article is only a snapshot of the full report, which contains further analyses of the most important charts from the past month. The full report also discusses the US federal cut rate that is impending on the horizon, the continuous downtrend of median gas prices on Ethereum, the latest leading memecoin launchpad, Pump.fun, and the continuous rise of stablecoins usage.Read the full version of this Binance Research report here.

Further Reading

-

Binance Research : Key Trends in Crypto - August 2024

-

Binance Research : Key Trends in Crypto - July 2024

-

Blockchain in the Modern Payments Landscape: Synergy and Transformation

Disclaimer: This material is prepared by Binance Research and is not intended to be relied upon as a forecast or investment advice and is not a recommendation, offer, or solicitation to buy or sell any securities or cryptocurrencies or to adopt any investment strategy. The use of terminology and the views expressed are intended to promote understanding and the responsible development of the sector and should not be interpreted as definitive legal views or those of Binance. The opinions expressed are as of the date shown above and are the opinions of the writer; they may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Binance Research to be reliable, are not necessarily all-inclusive, and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given, and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Binance. This material may contain ‘forward-looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader. This material is intended for information purposes only and does not constitute investment advice or an offer or solicitation to purchase or sell in any securities, cryptocurrencies, or any investment strategy, nor shall any securities or cryptocurrency be offered or sold to any person in any jurisdiction in which an offer, solicitation, purchase, or sale would be unlawful under the laws of such jurisdiction. Investment involves risks.

binance.com

binance.com