As the mixed month of July came to a close, August has proven to be a more positive month in comparison — particularly for some of the major cryptocurrencies on the market, such as Tron and Monero.

However, it is worth noting that the market is not out of the woods just yet and the sentiment among traders clearly reflects this, with the Crypto Fear and Greed Index standing at just 26 out of 100, indicating considerable fear.

But why does the market seem to be fearful and what potential catalysts and headwinds could be on the way for the global crypto market? — As always, there are multiple factors at play that shape the direction of the market and identifying them can help traders be more informed with their decisions.

The see-saw effect of the crypto market has only accelerated in August, albeit with more positive news for projects with higher market capitalization.

As customary, traders look at the price of Bitcoin first and foremost, which has slid by 5% over the past 30 days.

Going forward, traders with even modest exposure to the crypto market, such as prop traders, could be looking at more short-term pain before the market bounces back.

Propfirmsthatpay.com features some of the top prop trading firms with exposure to the crypto market, particularly BTC and ETH.

Top 5 Gainers of August

Helium has led the charge when it comes to the gainers of the month of August. Major projects, such as TRON and Monero, have also posted double-digit gains over the past 30 days.

Heading into September, a Federal Reserve rate cut could be the necessary catalyst to shift more of the market towards positive returns.

Helium (HNT) +55%

Helium was one of the top-performing coins of the month of July and August has been even better in that regard — delivering over 50% in returns to investors.

This puts the annual returns for Helium investors at 380%, making the coin one of the top-performing projects of the year.

Whether Helium is able to maintain the bullish momentum is largely dependent on the broader market, as the bearish sentiment has been one of the largest headwinds for Helium and other cryptocurrencies — predominantly caused by an uncertain macroeconomic climate outside of the crypto market.

Sui (SUI) +23.3%

2024 has been a decent year for Sui investors, as the coin has gained over 60% over the past 12 months. The month of August has been a very positive one as well, thanks to a 23% increase in the market value of the crypto.

However, such returns are unlikely to inspire confidence in investors at the moment, due to bearish market sentiment and macroeconomic headwinds.

Therefore, while the month has been broadly positive for Sui investors, the future performance of the project is still largely uncertain for September.

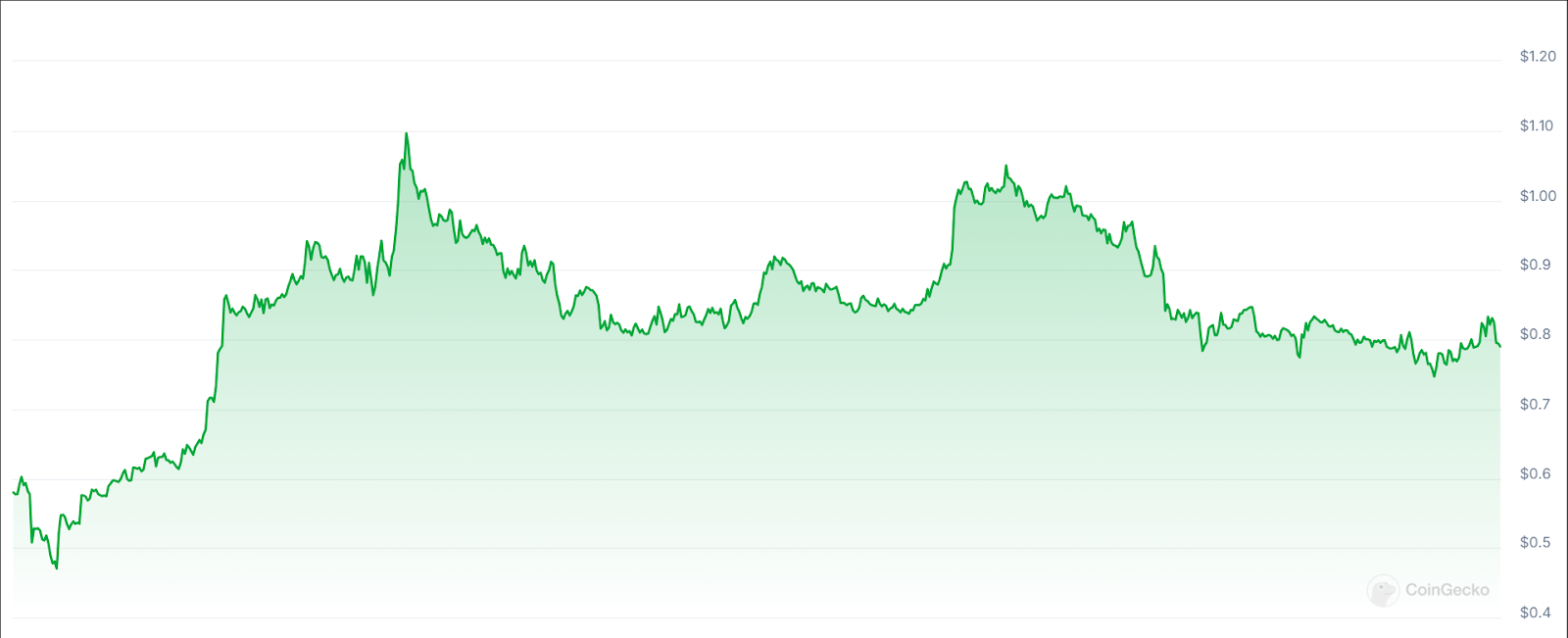

TRON (TRX) +19.2%

Tron is one of the largest cryptocurrencies in the world in terms of market capitalization. The annual performance, as well as the month of August, have been very positive for investors.

The month saw a 19% increase in market value, while the annual performance stands at 97%, placing Tron among the top performers of the past 12 months.

Thanks to robust investor confidence and strong annual performance, Tron is more likely than most to retain some of the gains posted in August. However, the same macroeconomic factors also affect Tron’s long-term performance and value.

Tron’s decentralized internet infrastructure also gives the project more utility than most projects — giving investors some safety leverages for the long term.

THORChain ($RUNE) +18.5%

Another top-performer of 2024, THORChain has returned over 160% to its investors over the past 12 months. Part of this growth came in August, which saw the coin grow by over 18% in market value.

The cross-chain swap network provided by THORChain is largely dependent on the activity on the global crypto market. Due to bearish market conditions, the volume of swaps have shown decrease, which also adversely affects the performance of the $RUNE coin.

A bullish turn on the market is likely to positively affect the activity on the THORChain as well. Therefore, investors will be looking forward to positive news in the coming months.

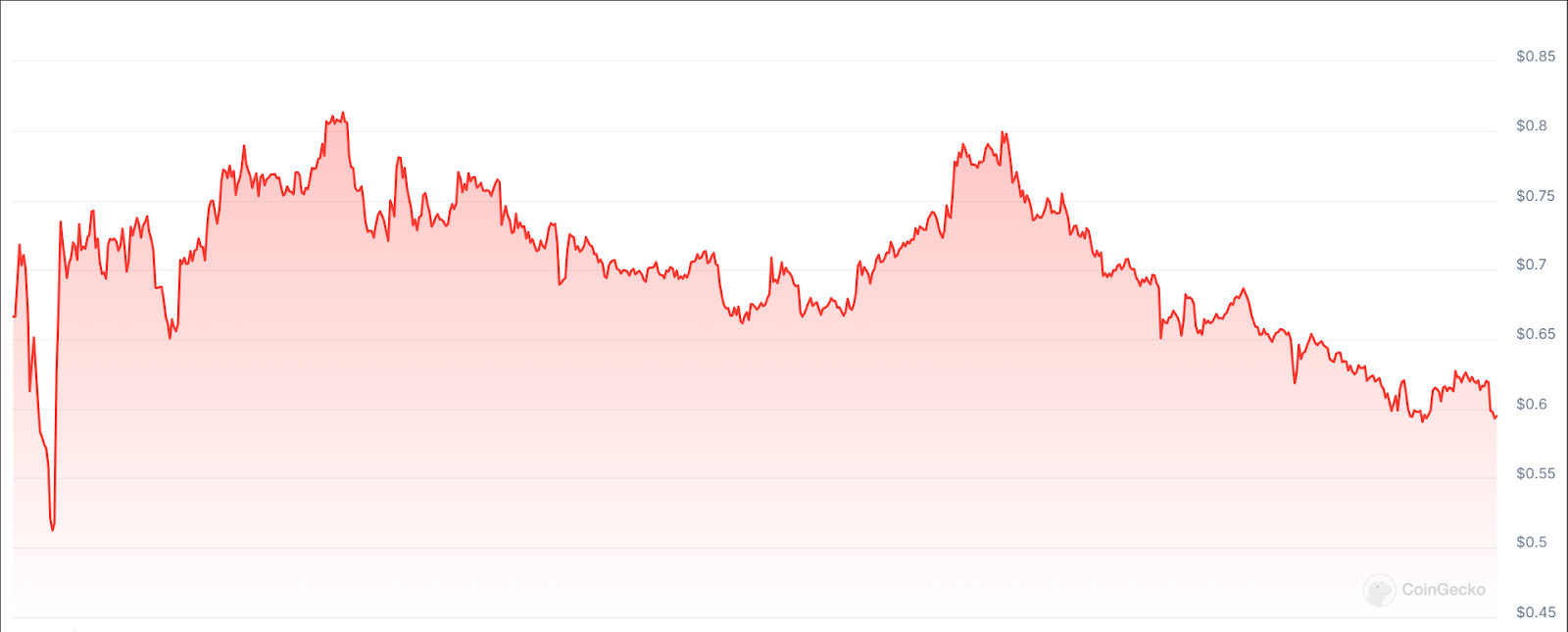

Monero ($XMR) +14.3%

Monero, another major cryptocurrency with a market capitalization of $3.2 billion, has posted moderate returns for its investors, with an annual performance of just under 24%.

A bulk of these returns can be attributed to the month of August, as the coin gained 14% over the past 30 days of trading.

However, mediocre returns and an uncertain market climate does not inspire much confidence in Monero as a long-term investment.

Going forward, the likelihood of major bullish runs among $XMR investors seems less likely. However, a positive market shift can also boost the returns for Monero investors as well.

Top 5 Losers of August

Meme coins were particularly hard hit throughout August 2024, which is understandable, as fear on the market typically affects the most speculative instruments in an outsized fashion.

Coins such as DOGS and $BONK both fell double digits in value, while the Telegram native coin Notcoin was hit by the news surrounding Pavel Durov and the ongoing investigation concerning the founder and CEO of Telegram.

DOGS (DOGS) −33.7%

As we have already mentioned above, meme coins do not fare well during periods of fear on the market and DOGS holders were quick to sell off their holding while they were able, resulting in a drop of over 33% throughout the month of August.

However, it must be mentioned that the coin only had its ICO in late August — entering the market on the 27th. Therefore, this is a major caveat for DOGS investors, as the coin is very young and only entered the market during a bearish period, which resulted in its price also falling alongside the market.

Looking forward, a rejuvenated crypto market will be essential in order to boost DOGS and for crypto investors to see how much tangible potential there really is with investing in the project.

Notcoin ($NOT) −29.8%

Notcoin is a Telegram native cryptocurrency that was launched on May 16, 2024. While $NOT is also quite young to the markets, its performance has largely been driven by the news surrounding Telegram, which have been anything but positive in August.

Pavel Durov, the founder and CEO of the company, was detained in France on 24 August on charges of an alleged lack of content moderation on Telegram, as well as a refusal to work with the authorities. The news have affected the prices of bot Notcoin and Toncoin (TON) rather negatively, with the former dropping nearly 30% in price.

The future performance of $NOT depends on the outcome of the investigation surrounding Durov and Telegram, which poses a danger for even the staunchest long-term investors in the project.

Maker (MKR) −28.9%

Maker is one of the cryptocurrencies that have enjoyed a lot of growth over the past 12 months. While the coin has returned over 50% over the course of the year, the month of August has been much less forgiving for its investors — shedding its market value by just under 30%.

Maker’s price drop is in line with the broader market performance, as the fear prevalent on the market affects its long-term investor base and their outlook on the viability of the project.

MakerDAO is the project behind the Dai stablecoin, which is the third largest stablecoin by market capitalization — only behind the likes of USDT and USDC.

While the demand for DAI is relatively high, Maker’s performance in the short-term is primarily dictated by the broader market trends.

Bonk ($BONK) −15%

Bonk has been one of the highest-performing meme stocks of the past year — gaining a whopping 6920% over the course of the past 12 months.

The coin had its ICO in late 2022 and has since been one of the top performers on the market.

However, the month of August saw the coin post double-digit losses, closing the month with a 15% decline in value.

Due to the fact that Bonk is a meme coin, much of its performance depends on the broader crypto market trends. Therefore, once the market turns bullish, the performance of $BONK is likely to turn positive as well.

Ondo (ONDO) −14%

Off the back of a disappointing month in July, Ondo investors saw a less dramatic, but nonetheless negative performance in August as well — losing 14% of its market value in the process.

This puts the annual performance of the coin at over 170%, which is one reason why long-term investors are unlikely to be panicking due to short-term losses.

However, bullish market sentiment is essential for Ondo to turn its fortunes around and close the month of September with positive returns.

Conclusion

August has been another mixed month for the broader crypto market. Some major coins, such as Monero and TRON enjoyed double-digit growth over the month, while meme coins dropped significantly.

The overall market sentiment has also worsened, as crypto investors brace an uncertain economic climate and upcoming U.S. presidential elections. Macroeconomic factors, such as interest rates have also affected the choices made by long-term investors.

Heading into September, the market is unlikely to experience a drastic bullish shift. However, a more positive shift in sentiment could be on the cards, especially if the Federal Reserve goes through with a 0.25 bps rate cut.

cryptonews.net

cryptonews.net