Despite an intense bearish phase, the $NEAR price shows RSI divergence near critical support. Is it enough for a bullish comeback?

AI tokens are on a downhill path as the crypto market’s bearish phase progresses. The situation worsened when the Department of Justice ordered a subpoena to NVIDIA, causing the AI crypto market cap to drop to $25.55 billion.

With top AI tokens losing critical levels, the $NEAR token hangs tight with the hope of a double-bottom reversal pattern. Will the Near protocol rise again?

$NEAR Trapped in a Falling Channel

In the daily chart, the $NEAR token shows a falling channel pattern, accounting for a fall from $8.28 to the current market price of $3.73. Further, the ongoing bear cycle within the channel accounts for a 25% drop and registers nine out of ten bearish candles.

Currently, the AI token is trading at $3.73 with a long-tail rejection before hitting the $3.49 level.

Further, the crucial EMAs in the daily chart maintain a declining trend following the death cross between the 50 and 200-day EMAs.

However, on bullish support, the bullish divergence in the RSI line is clearly visible. This projects a high likelihood of another positive cycle to challenge the overhead resistances.

Unique Accounts Drop With Daily Transaction Going Strong

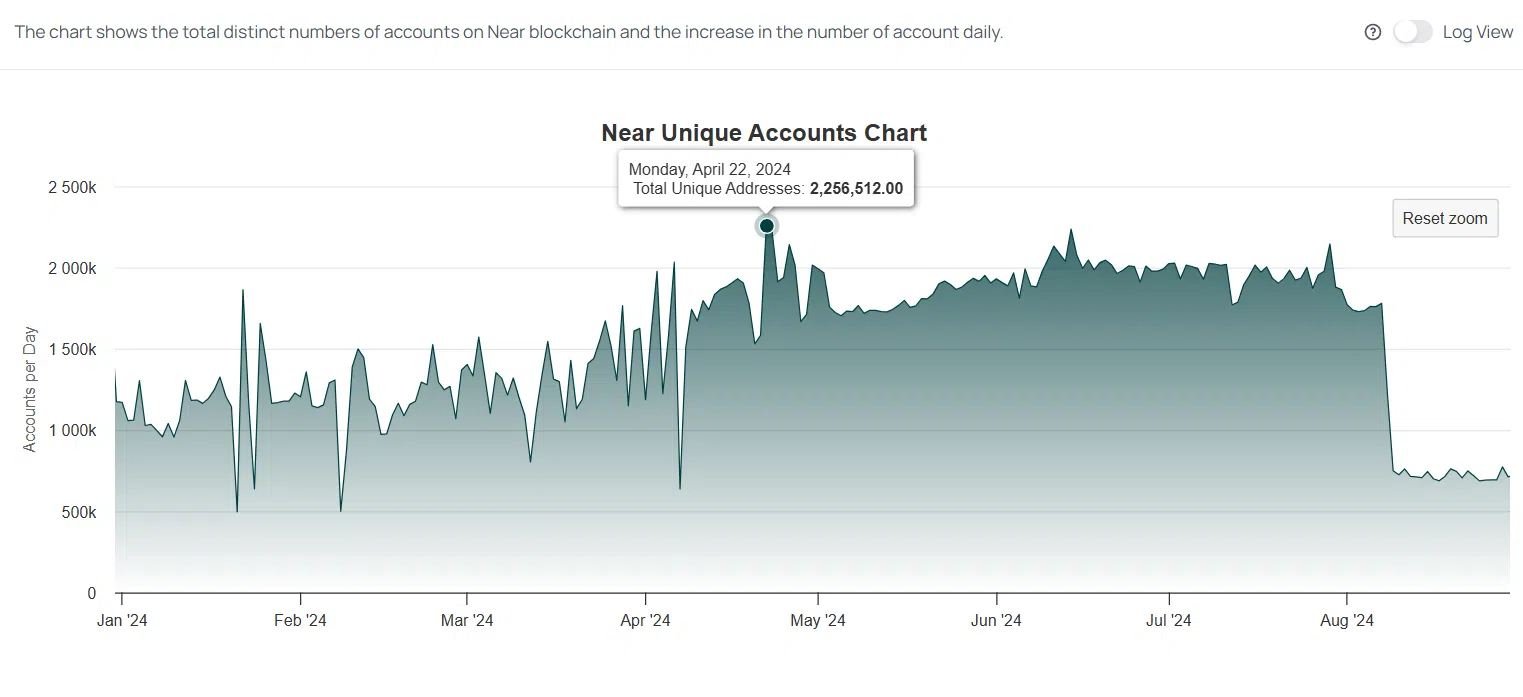

Amid the bearish continuation, data from Near Blocks, a Near Protocol blockchain explorer, reveals a significant decline in the number of unique accounts on the $NEAR protocol. The number has dropped dramatically from 2.25 million unique accounts in April to around 700,000 currently.

While the number of unique accounts has experienced dips throughout the year, these were typically followed by quick recoveries. However, over the past three weeks, the trend has not rebounded, highlighting a concerning lack of new unique accounts.

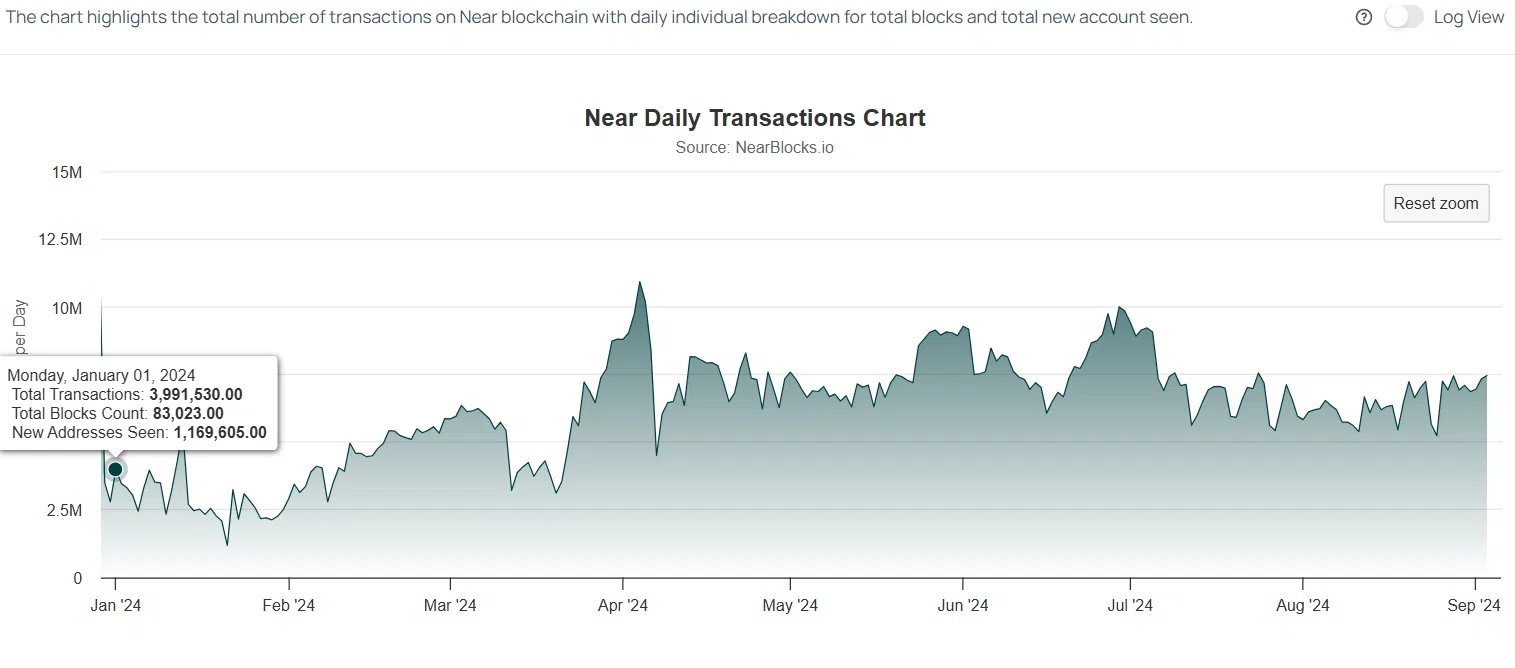

On a positive note, year-to-date transaction growth has shown improvement. Starting the year with 3.991 million total transactions on January 1 and 1.169 million new addresses, the latest data indicates 7.459 million total transactions, with 712,000 new accounts maintaining a steady flow.

Will $NEAR Price Rise Again?

Despite the bear channel and the declining trend in crucial EMAs, the demand at $3.495 support level for the $NEAR token stands strong. With a lower price rejection and an early reversal, the intraday bullish pin bar candle teases a comeback.

Based on the Fibonacci level, the upcoming resistances are at 23.60% and 38.20% levels at $4.62 and $5.32.

thecryptobasic.com

thecryptobasic.com