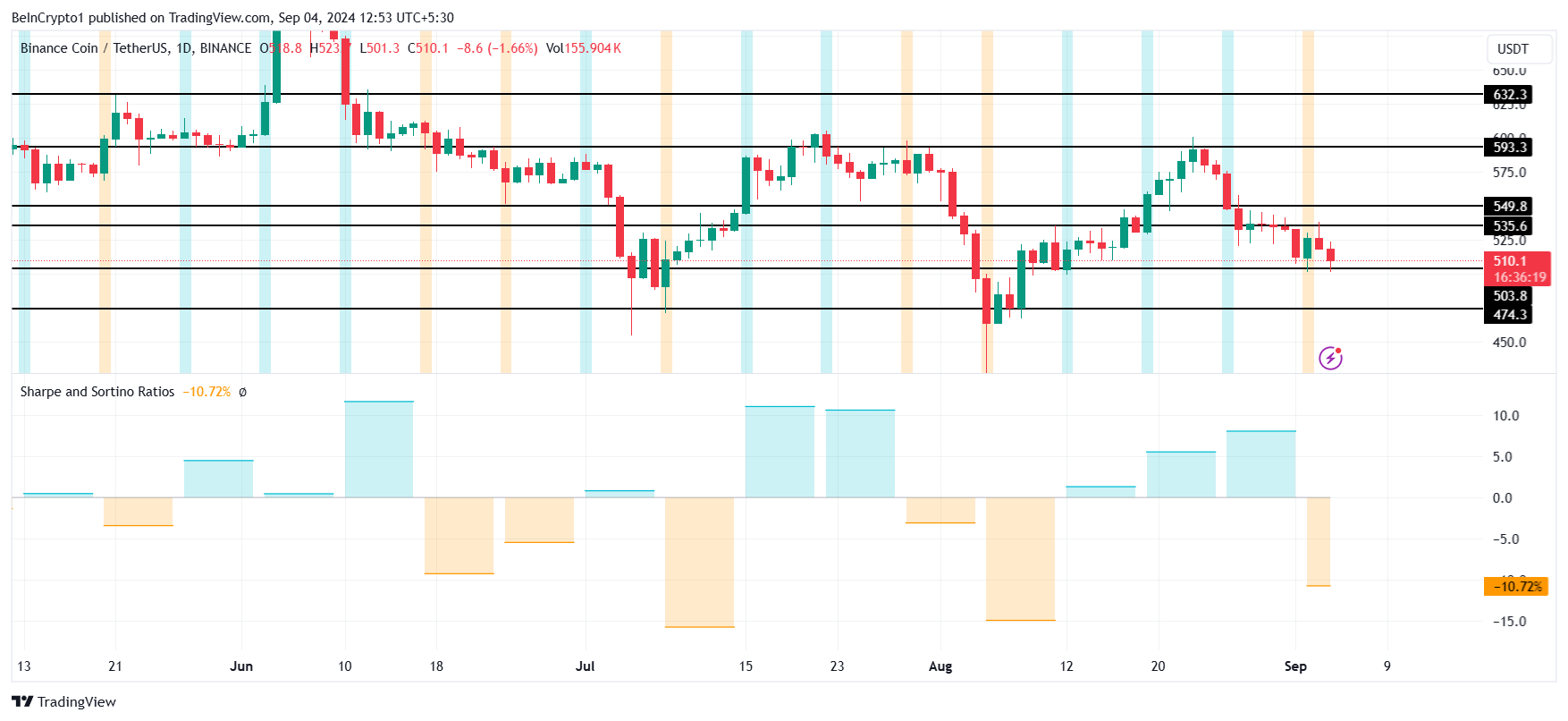

BNB, the native crypto of the BNB chain, has recently experienced a significant decline, with its price falling by 13% over the past 11 days.

The drop came after multiple unsuccessful attempts to convert the $520 resistance block into support. However, despite the recent downturn, there is potential for recovery.

BNB Holders Look Beyond the Bearishness

The Sharpe Ratio, a key indicator of risk-adjusted return, currently stands at -10.72% for BNB price. Negative Sharpe Ratios typically indicate increased volatility and risk but also set the stage for potential gains.

As historical data suggests, upward trends have often followed periods of negative Sharpe Ratios. This could mean that BNB’s current position might be an opportunity for investors seeking a rebound.

Read More: How To Trade Crypto on Binance Futures: Everything You Need To Know

This forecast is also in line with the market sentiment surrounding BNB. On-chain metrics reveal that BNB holders are increasingly optimistic about a potential recovery. Investor sentiment plays a crucial role in crypto markets, where psychological factors can drive price movements.

As sentiment turns more positive, it could lead to increased buying pressure, supporting a potential bounce back for BNB. This optimism will prove to be a key factor that could influence BNB’s recovery trajectory.

BNB Price Prediction: Hope Drives the Rise

BNB’s price has declined by 13% in the past 11 days, falling from above $520 to its current level of $510. Historically, this price range between $520 and $497 has often been a consolidation zone before a rally. If BNB follows this pattern, it could be setting up for a recovery phase.

The indicators suggest that BNB could once again breach the $520 resistance level, paving the way for a potential rise above $550. If BNB manages to break through this barrier, it could note an extended rally, challenging the resistance block of $575 to $619.

Read more: Binance Coin (BNB) Price Prediction 2024/2025/2030

However, if BNB fails to overcome the $520 resistance, it may continue to consolidate within the current range. A failure to breach this level could dampen investor optimism and lead to further declines. Losing the $497 support would be particularly detrimental, potentially invalidating the bullish thesis and signaling deeper losses.

beincrypto.com

beincrypto.com