Most altcoins tend to move per BTC’s price movement; presently, Mantra (OM) is an exception. It has a BTC correlation score of negative 0.06, which is why it does not follow BTC’s sentiment despite being the most dominant crypto.

BTC is nearly 2% up, and many other cryptocurrencies resonated with its sentiment intraday. However, most of the other altcoins have not shown growth similar to OM. It grew more than 12% intraday and has been bullish since the start of 2024.

Only a few remained optimistic in the third quarter of 2024, despite multiple odds, and OM is one of those exceptions. This quarter, it remained bullish by withstanding the sell-off from ATH of $1.41. After the fall, it still holds 8.49% gains in positive.

The Mantra crypto’s price has remained over the 200-day EMA band, indicating a strong uptrend. The OM crypto’s recent intraday surge has pierced both 20-day and 50-day EMA bands simultaneously.

The price has developed a new peak each time; it took support on a dynamic upward trendline. The past two touches have manifested tremendous gains, and the third point of contact, near $0.900, could display a new ATH ahead.

Mantra (OM) Onchain Insights

The MANTRA infrastructure is accelerating RWA tokenization. Users’ belief in the ecosystem of Mantra seems pretty high.

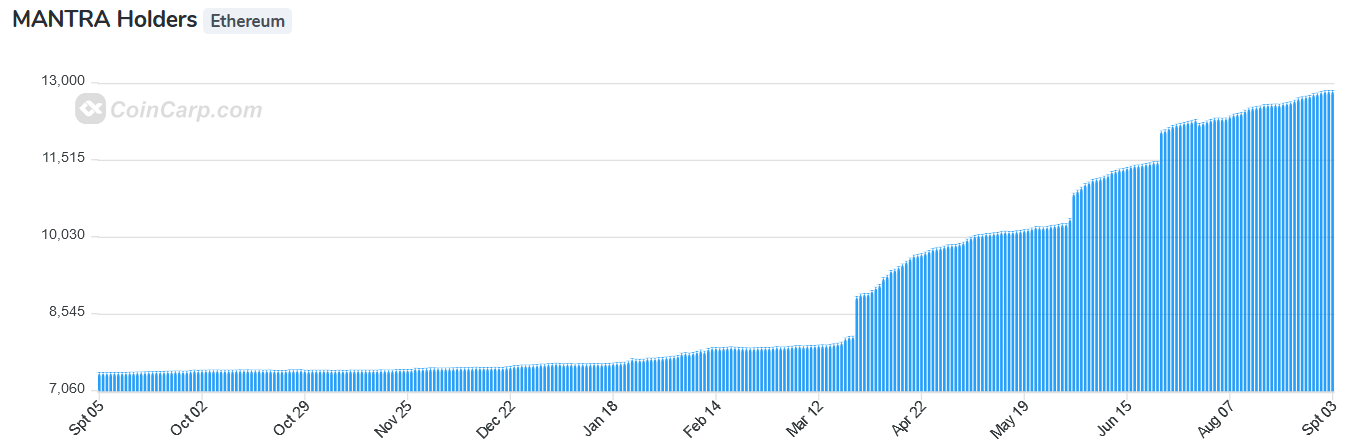

Despite the fact that the profit bookers sell off at peak levels, the demand has not shattered in the slightest. The total holders’ addresses in Mantra crypto are 12894, and the top 10 holders have the majority of the holdings, per Coincarp.

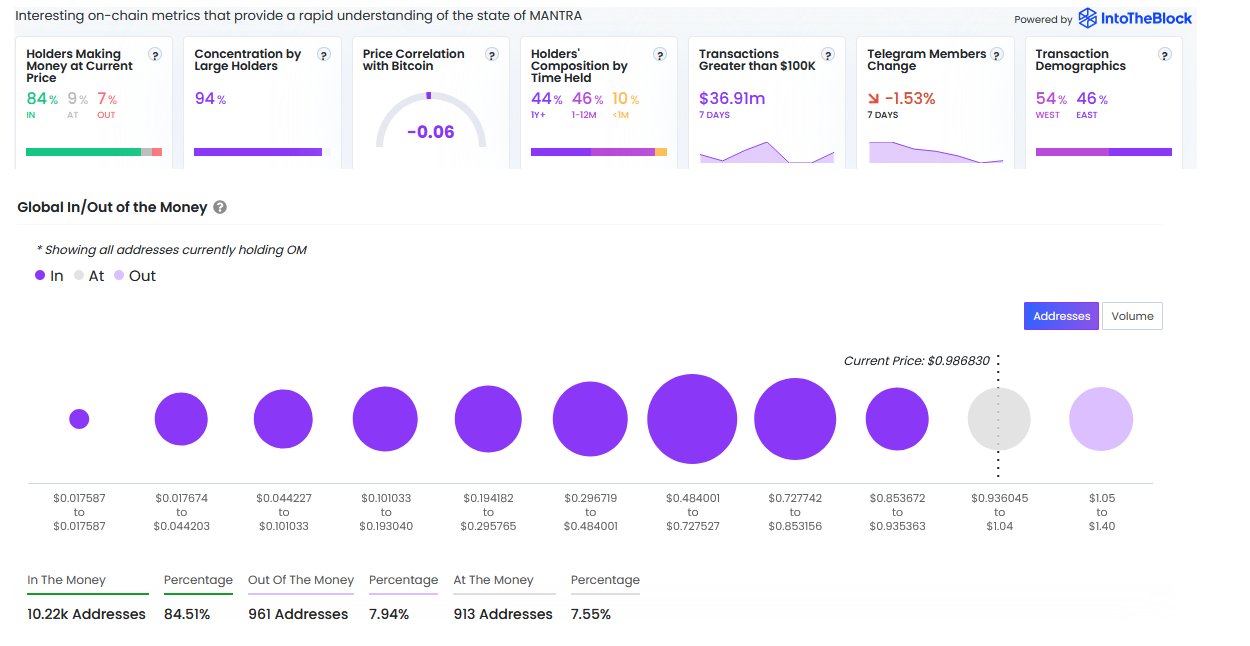

Similarly, per an on-chain research website, from the current OM price to the bought price, 84.51% of its holders are in profit. The only ones that could be in loss are those who could have bought at peak, making 7.94% of addresses. Meanwhile, no profit no loss, addresses were 7.55%.

This signified that many holders have not participated in the sell-off from the peak and are more confident in its price growth. The financial data of holders also have shown that the in-green holders are investors, and loss-bearing holders are cruisers.

Similarly, the holder’s composition by time held has shown that 90% of holders are traders and investors. While holders keeping a hold of the token in possession for less than a month are cruisers.

The financial and on-chain data showed optimism, based on the holder’s pattern of the OM crypto.

Unfolding OM Crypto Price on Daily Chart

Over the daily chart, the third quarter of the year has entered its final month, and OM price has shown potential. It could even surpass its previous peak.

OM crypto ATH happened on July 22nd but fell nearly 40% in a sell-off. However, in the past two weeks, some gains have been recovered, and now from the peak, it’s only 28% down.

From a technical standpoint, from the peak, two descending trendlines have characterized a pattern, precisely the falling wedge. This suggests that sellers might be losing momentum as lines narrowed.

The intraday surge has led to the breakout of this pattern today and validated the bullish theory. The other strong factors, like trendline support and high volume-based horizontal support at $0.909, firmly support the bullish bias.

A massive rally could pop out if buyers take advantage of the bears’ exhaustion. This breakout of the wedge has signaled a probable start of a surge toward a new all-time high (ATH). Still, the 1.10 might pose resistance to the price, which needs to be monitored.

In this month, if OM breaks past $1.10, it could potentially surpass its ATH in September. However, the bullish thesis could still be invalidated, and DYOR is a must. If the lowest points of the wedge, followed by the prolonged upward trendline, are breached, the price might stumble to further lows.

thecoinrepublic.com

thecoinrepublic.com