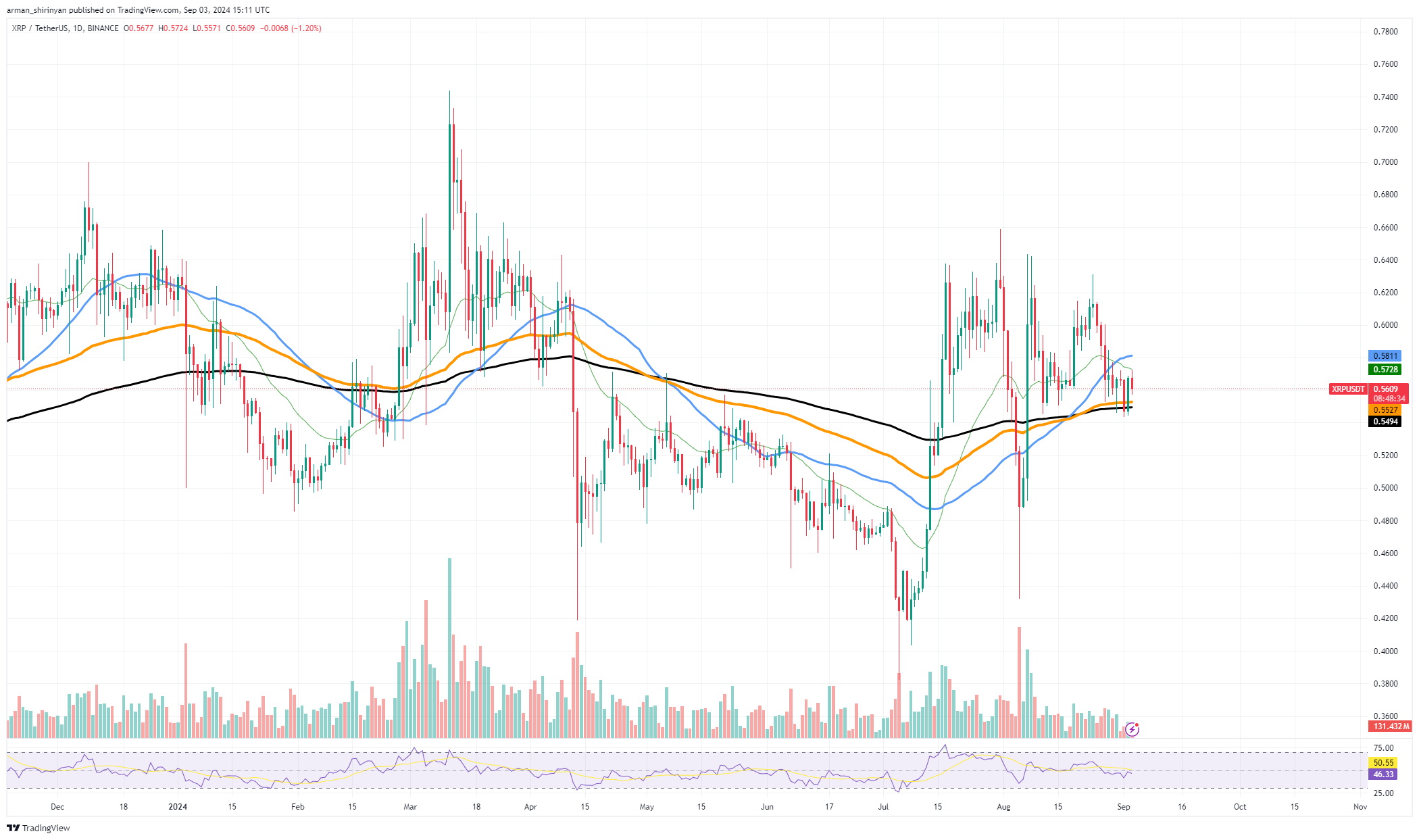

With resilience evident after a significant bounce off the 200-day Exponential Moving Average, XRP looks ready for another attempt at recovery. The 26-day EMA is the next significant resistance level to keep an eye on as this technical rebound indicates that XRP might be prepared to rise higher.

XRP has found support at this crucial level, which frequently serves as a boundary between bullish and bearish trends. It is currently trading slightly above the 200 EMA. As buyers step in to protect the asset from further declines, the bounce from this support is a sign of strength.

The 26 EMA, a shorter-term indicator that may either cap the price in the near future or, if broken, indicate a possible upward trend, is the next immediate obstacle for XRP. It will take persistent buying pressure for XRP to break above the 26 EMA. The asset may move higher and reach the next target, which is approximately $0.60 if the price can close above this resistance level.

This would probably draw in more buyers. If this breakthrough holds, it might lead to a more significant rally that tests the recent highs reached earlier in the year. In order to be considered bullish, XRP would need to hold its position above the 200 EMA and decisively break through the 26 EMA.

A renewed push toward higher levels could result from this, as it would confirm the reversal of the current downward trend. The possibility of a sustained rally is increased by the relative strength index, which indicates that XRP has more room to rise before entering overbought territory.

Shiba Inu gets ready

With its price having reached what many in the market view as a reset point, Shiba Inu (SHIB) may be on the verge of an important turning point. With this reset, it appears that SHIB is preparing for an upward move, possibly making up ground loss and pushing past resistance levels.

Though there may be a breakthrough indicated by the technical indicators, a number of factors indicate that any upward movement is more likely to be gradual than explosive. After a protracted downturn, SHIB's current state indicates that it has stabilized around a price level.

Since this consolidation stage frequently comes before a change in momentum, SHIB's current position may be paving the way for a slow rally. The asset's price is making a reversal attempt, and traders are keeping a close eye on it to see if it can break through nearby resistance levels, especially those that surround the 50-day and 100-day moving averages.

But even with this promise there are still a number of challenges. A major obstacle that SHIB has to deal with is the low trading volume. A surge in volume is usually necessary to maintain momentum for any significant price movement, especially a breakthrough.

Regrettably, the low trading volume of SHIB at the moment suggests that there may not be sufficient buying pressure to propel a substantial price increase. SHIB market liquidity has also been limited, which makes a sudden increase in price even less likely. Low liquidity can cause volatility to rise, but in SHIB's case, it has caused a more stagnant market with more gradual and subdued price movements.

Tron value swings

Even though Tron has seen a tremendous upswing in value recently, it might have peaked at last. TRX is exhibiting signs of exhaustion after hitting the crucial $0.17 threshold, which seems to be a local top.

A price reversal could be approaching soon. After an incredible run, the price action suggests that TRX has peaked, and the market may be preparing for a retracement. There are several crucial price levels to keep an eye on that may dictate TRX's future course, as traders and investors search for signs of the way forward.

The amount of $0.15, or the immediate support level below the current price, is the first level to keep an eye on. For TRX, a break below this mark may signal the beginning of a more substantial slide, as it has historically offered some stability.

TRX might consolidate here before making another attempt at a push higher - if it can maintain above $0.15.

The next critical level is approximately $0.14, which is an important psychological support if TRX is unable to sustain $0.15. Because it aligns with prior resistance points that have now become possible sources of support, this level serves as both a technical and psychological anchor. A decline below $0.14 might intensify the selling pressure and drive TRX down.

Last but not least, $0.13 is a crucial level of long-term support. The 100-day moving average, a reliable support level in trending markets, bolsters this level. A break below this level would indicate a more significant correction of TRX, potentially erasing a significant portion of the gains made during the recent upswing.

u.today

u.today