Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

Six-figure standard

Mass adoption is a chicken and egg problem.

By raw numbers alone, we’re likely well on track to build enough infrastructure to support the next wave of users.

There are now dozens of layer-1 and layer-2 networks, interoperability protocols and other types of financial plumbing ready to pipe onchain activity across our multichain future.

But whether it’s truly enough depends on how big a wave we’re talking about.

Another one or two million users — especially really active ones — could probably fit, as long as they spread themselves out across all the different blockchain networks available.

That’s rather than, say, all clamoring onto Ethereum mainnet. Doing so would inevitably make the chain far too expensive to use.

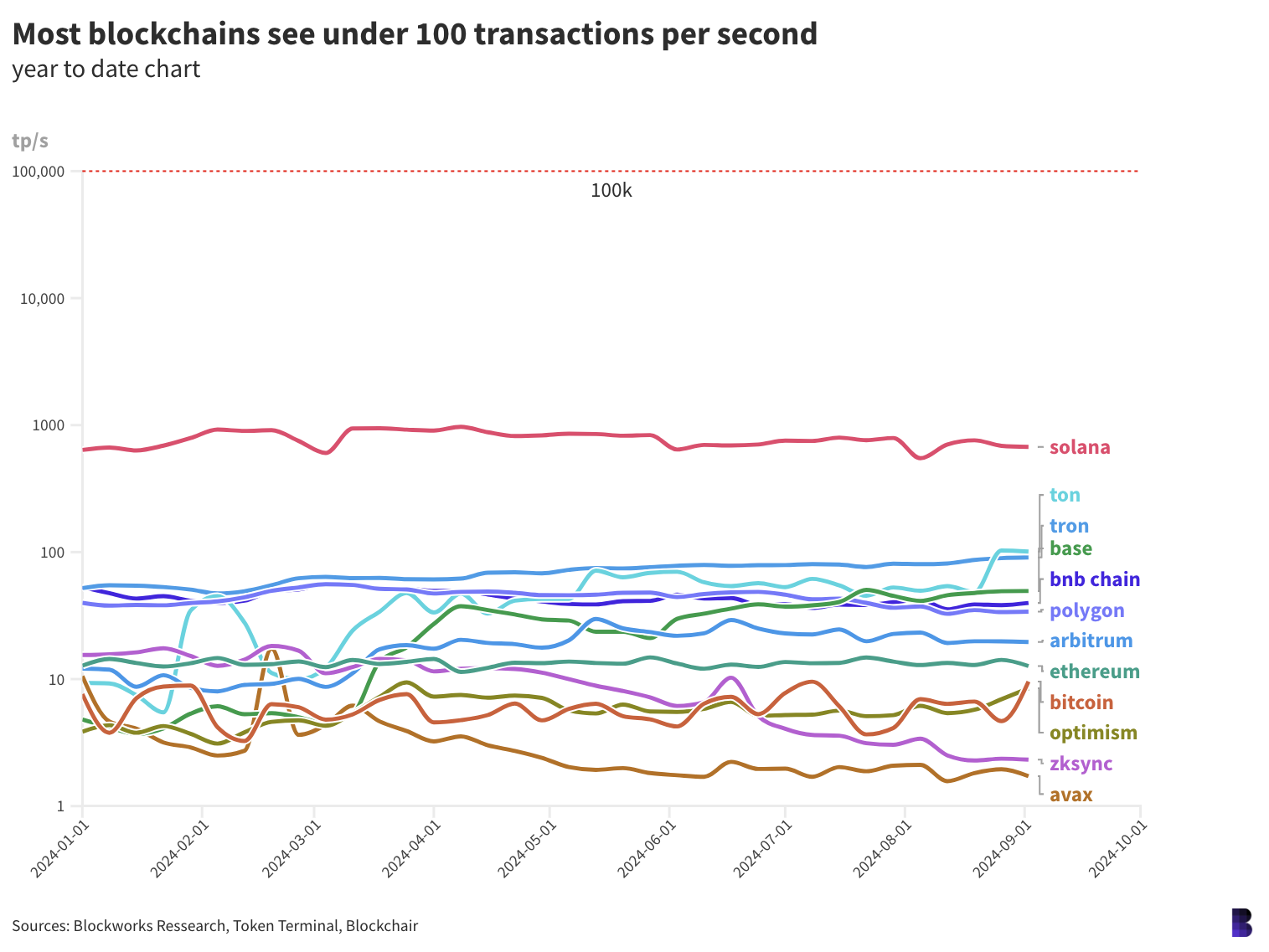

But while blockspace is becoming cheaper due to its growing abundance (compared to user demand), app developers are still limited by how many transactions can be processed at any one time. Transactions per second, or throughput.

Crypto itself is a permissionless sandbox. Of course, some use-cases quickly attract boogeymen like the SEC, CFTC and DOJ. But developers and entrepreneurs can mostly build whatever they want — as long as it doesn’t need to use the chain too frequently.

That presents the riddle: Would crypto have more users if it had more entirely onchain consumer apps?

Would crypto have more consumer apps if the underlying networks could handle more traffic without going offline?

MegaETH is weaving much of its future value proposition on the answer to both questions being a resounding “yes.”

The project is to be an Ethereum layer-2 network hinged on a souped-up centralized sequencer that aims to process transactions onchain in real-time, or at least, at 100,000 transactions per second.

That way, developers could build the high-performance apps of their dreams and onboard all the newbie users hungry for onchain speed. For scale, Visa touts that it can handle 65,000 transactions per second.

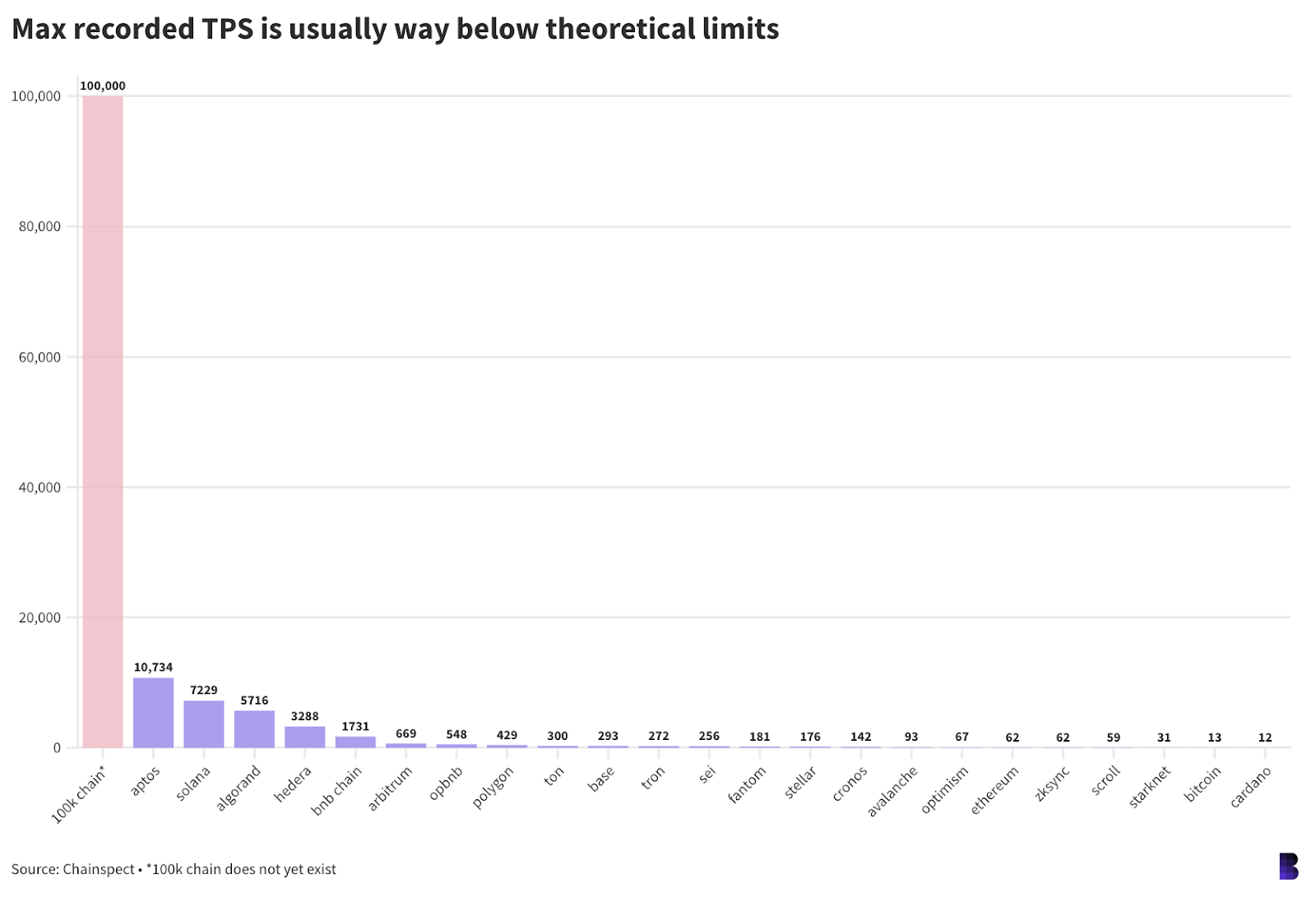

It’s early days for MegaETH. But in any case, that 100,000 number is turning out to be an increasingly common benchmark.

TON bragged last October that it had surpassed that amount on a testnet implementation, but in reality, it keeps breaking at around 300 transactions per second. Aptos has previously claimed it could theoretically reach 160,000 per second but so far only reached 10,734, per Chainspect.

More recently, Ava Labs expressed hope in pushing Avalanche to eventually hit six figures with a new scaling solution.

It could be that some of these networks reach their theoretical limits, some of which are close to 100,000. And their odds would certainly be better if there were more users to get them there, as blockchain networks today are rarely truly at capacity, and if they are, it’s usually temporary.

Whether that would suddenly make crypto’s next killer app appear is anyone’s guess. Better to keep building, just in case.

— David Canellis

Data Center

- BTC is up 1.5% on the day and ETH is flat as markets trend sideways. (BTC: $59,200; ETH: $2,510).

- KLAY, FLOKI and MATIC are the worst hit over the past week, losing between 19% and 18%.

- Daily Base stablecoin transfer volume is at another all-time high beyond $5.44 billion, according to Blockworks Research data.

- Over $550 million has flowed out of Arbitrum bridges in the past week, per DeFiLlama. $457 million has otherwise flowed into Ethereum bridges.

- Native ETH staking yield is at a record low of 3%, down from 3.55% at the start of the year.

No improvement

Binance exec Tigran Gambaryan’s trial restarted yesterday, and the situation continues to look bleak for the American, who just passed the six-month mark in Nigeria.

Gambaryan was initially detained in February and has been held in the country since. His health has deteriorated while in prison, including bouts of pneumonia, and Gambaryan now suffers from a herniated disk. According to a family spokesperson, he’s also suffered from malaria and tonsillitis.

A video shared on X depicts a distressed Gambaryan attempting to walk into the courtroom. He was, per a spokesperson, unable to use his wheelchair. According to Gambaryan in the video, officials were told not to offer aid.

“This is f*cked up,” Gambaryan says. He then points to the guard walking next to him and exclaims, “He was told not to help me.”

“Why can’t I use a goddamn wheelchair? This is a show!” Gambaryan adds. “I’m f*cking innocent.”

Binance CEO Richard Teng shared the video, calling for the “inhumane treatment” to end.

“He must be allowed to go home for medical treatment and to be with his family,” Teng added.

Gambaryan later told the judge that he’s not receiving adequate medical care and hasn’t been able to communicate with his legal team or embassy representatives. That’s not the first time we’ve heard this from folks representing his family, either.

The prosecutor for Nigeria’s Economic and Financial Crimes Commission (EFCC) pushed back on a new bail application filed by Gambaryan’s lawyers on medical grounds, arguing that the US executive isn’t suffering from ill health. But then, according to a family spokesperson, the prosecutor also claimed that Gambaryan is refusing treatment, which doesn’t seem to add up.

We’ve covered Gambaryan’s detention before, but ICYMI: The US citizen was held in Nigeria after flying there to meet with government officials when Nigeria accused Binance of money laundering. Nigeria then charged Binance and Gambaryan with said violations, which is what keeps Gambaryan in a prison cell.

Nigerian officials also sought tax evasion charges against both Binance and Gambaryan but dropped the charges against Gambaryan himself over the summer.

Before either of these trials commenced, Binance ended support in Nigeria — shortly after Gambaryan was detained.

“It is useful to point out that Nigeria has never been a big market for Binance. The Government has said that we made $26B in revenue from Nigeria in 2023. That is not the case. The $21.6B figure is the total transaction volume from 2023. To provide an understanding of transaction volume: if a person were to take $1000 and trade it 1000 times, that would represent $1m in transaction volume,” Teng wrote in a blog post last week.

US officials Rep. Chrissy Houlahan and Rep. French Hill visited Gambaryan back in June, calling for a “humanitarian release” at the time.

“The US Government must do more to help Tigran. I urge them to use every available tool to free an innocent American who is at risk of permanent damage,” Yuki Gambaryan, Tigran’s wife, said in a statement. I’ve reached out to folks at Houlahan’s and Hill’s offices.

Gambaryan is due back in court tomorrow, so we’ll continue to monitor how this plays out.

— Katherine Ross

The Works

- SEC Commissioner Mark Uyeda thinks that the regulatory agency should create a registration statement that’s customized for crypto securities.

- The WazirX hacker has begun to move funds over to Tornado Cash to wash them, per Arkham Intelligence data.

- Metaplanet, the Japanese company that adopted bitcoin as a reserve asset earlier this year, announced that it teamed up with SBI VC Trade for custody, transactions and management of its bitcoin.

- The SEC is not happy about the FTX estate paying out some creditors in stablecoins and other crypto, adding that it “reserves its rights to challenge transactions involving crypto assets.”

- Libre is adding a few new digitized funds to the NEAR blockchain, opening the door for real-world assets to be transferred across multiple blockchains, CoinDesk reported.

The Riff

Q: Does mass adoption matter anymore?

I actually suspect that MegaETH and all the other 100k hopefuls might be right.

Games are the most obvious example. We need games that are entirely onchain. Otherwise, Web3 gaming is a poor and clunky imitation of games that already exist. But it’s difficult to do with the current throughput challenges, especially at scale.

Crypto is probably hitting its limits in terms of the payments narratives. Chain abstraction — tucking away the blockchain underneath slick UX — will likely get us further.

But the true final form seemingly involves a feeling of boundlessness when it comes to crypto app development.

So, mass adoption might matter, but there’s more important things to achieve before that.

— David Canellis

Yes.

That’s still the light at the end of the crypto tunnel, and the goal may be lofty — but it’s reachable.

Most of the conversations I have with folks end up segwaying into mass adoption and either the projects they’re eyeing that have potential, or what they think mass adoption means for crypto.

Like I said: it’s a lofty goal. But it’s an achievable one. Perhaps the parameters just need to be narrowed so that it feels like it’s achievable or that we can treat it as a little runway for the larger endgame.

But it’s possible — and it still matters. Dream big, right?

— Katherine Ross

blockworks.co

blockworks.co