Uniswap price (UNI) hovers near the $6 mark and has surged by over 5% this week. Considering the latest surge with volume rise of over 12%, an upcoming surge of over 10% is anticipated.

UNI price is showing promising signs of recovery and is heading to revisit the 20-day EMA mark. After weeks of performing terribly, altcoin has seen a reversal pattern, potentially staging a rebound.

Recent price movements show a base buildup formation around the $5.20 mark. This bottom formation signaled a turning point where the altcoin has completed the retracement phase and is ready to plot a reversal.

Can Uniswap Crypto Cross the $7 Mark?

Forming strong support around the $5 mark, Uniswap price has shown a recovery and made multiple doji candlesticks, representing indecisiveness and reflected signs of buyer accumulation.

Going forward, Uniswap Crypto is looking to stretch the recovery. It has been setting eyes on the $7 mark to revisit in the coming sessions.

UNI Price Chart | Source: Santiment

At press time, the UNI price traded at $5.98 with an intraday rise of over 2.30%, conveying bullish signs. Ranked at 22 with a market cap of $5.34 Billion, UNI has a total supply value of 1 billion.

$UNI wolf pattern goes crazy @eliz883 pic.twitter.com/b9Hho3SYmw

— Kaizen (@Ka1zen_X) August 29, 2024

Tweet by @kaizen | Source:X

If the demand spikes, UNI could target the 50-day EMA mark, close to $7, and may trigger a reversal soon. Meanwhile, the Relative Strength Index (RSI) oscillated below 50, showing muted buying pressure.

Similarly, the Chaikin Money Flow (CMF) exhibited moves around the zero mark, underscoring low capital inflows.

On a positive note, its Advance Decline Ratio (ADR) was above 1 at 1.89. It suggested increased buying activity and an overall positive outlook among investors.

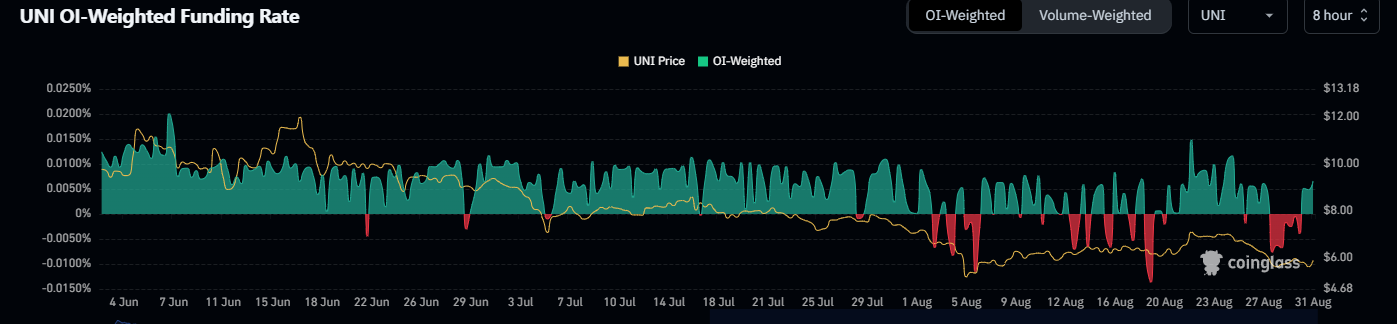

Bullish Signals In the Futures Market

The positive funding rate showed that more speculators were willing to buy UNI. Similarly, the Futures Open Interest rose over 2.10% to $73.20 Million, which means that traders are hoping for a rise.

Funding Rate Data | Source: Coinglass

As such, traders are waiting for a cross above the $6 mark to add fresh longs. Defying the market trend, the altcoin conveyed signs of bottoming out and may lead a reversal toward the $7 mark in the coming sessions.

UNI’s Total Value Locked (TVL) recently started rising to $4.536. This means that the protocol has begun to attract investors to its network. Also, the new addresses have noted a rise, which conveyed investors have gained interest in it, underlining a positive outlook.

TVL Data | Source: DeFiLlama

Uniswap crypto seemed poised for a recovery after making a base around the $5 mark. In addition to this bullish outlook, if bulls succeed to close above the $6.20 mark, a short covering move can be seen ahead.

The immediate support zone was placed around the $5.20 mark, followed by the $4.30 mark. Conversely, the upside barrier of $ 6.30, followed by $7, needed to be breached for an apparent reversal.

thecoinrepublic.com

thecoinrepublic.com