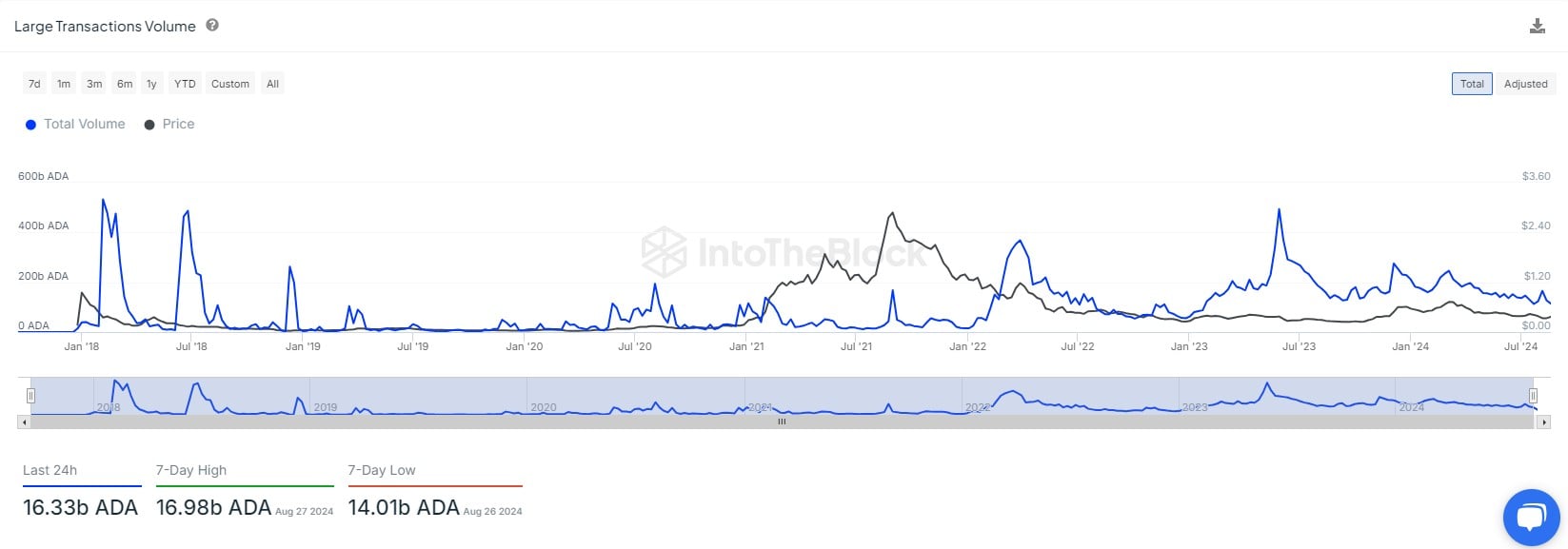

Cardano (ADA) has witnessed increased activity in the last 24 hours, with large transactions skyrocketing to 16.33 billion tokens. Despite a tempered outlook in the market, this move raises speculations about the entrance of bulls that might change the game.

Whales increasingly accumulating ADA

Data from IntoTheBlock revealed large transactions for ADA soared to 3,580 in the past day. Typically, this suggests large wallet movement by whales or institutional investors, which could lead to bullish or bearish positioning.

The increased large investor volume was also reinforced by the 16.98 billion ADA recorded in the past week.

The increased transaction volume in ADA follows a recent announcement regarding the Chang hard fork date. According to reports from U.Today, the hard fork team agreed to upgrade the mainnet Sept. 1. As Cardano approaches community-driven governance, large holders may anticipate a positive impact on ADA. This may be contributing to the increased on-chain activity.

Meanwhile, ADA’s price has displayed sideways movements in the past few weeks, coinciding with a broader market decline. Within 24 hours, ADA’s price decreased by 3.2% to trade at $0.3469. The trading volume declined by 1.6% to $268 million within the same time frame.

The large transaction shift might help ADA change its downtrend moving forward.

Potentials for ADA's recovery

Based on technical analysis, ADA is trading below the critical EMA level and has yet to achieve a clear breakthrough.

ADA’s success may depend on overcoming the next crucial resistance at $0.350, aligning with the increased large transaction activity. On the contrary, a drop below this level could see a further decline in ADA’s price.

Surprisingly, analysts think ADA’s present price point is a great opportunity for traders and investors who understand market dynamics. The spike in Cardano’s “power users” in the second quarter of this year further reinforces this perspective.

u.today

u.today