Edo Farina, CEO of Alpha Lions Academy, recently warned $XRP holders about their investments, stating that 95% of them are at risk of being left behind.

According to him, this risk arises from neglecting fundamental cryptocurrency principles, such as self-custody. In a video shared on X, he highlighted five critical mistakes that he believes many $XRP investors are making.

Farina warned that these mistakes could lead to significant financial losses, especially as $XRP is expected to surge to unprecedented levels soon.

Keeping Tokens on Exchanges

According to Farina, one of the most glaring mistakes is holding $XRP on centralized exchanges. “When you keep your $XRP on platforms like Binance or Coinbase, you’re giving up self-custody,” he explained.

He emphasized that funds on centralized exchanges are not on the blockchain but are controlled by a third party. “Not your keys, not your crypto,” he stressed.

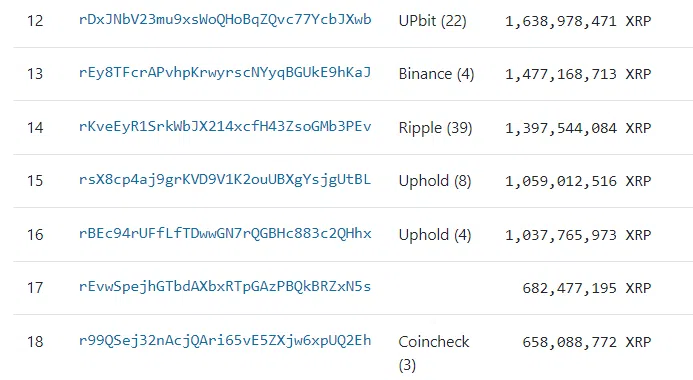

Data from $XRP Ledger explorer XRPScan shows that centralized exchanges like Upbit, Binance, Uphold, and Coincheck are among the largest holders of $XRP, aside from Ripple. These exchanges collectively hold several billions of $XRP tokens for investors.

Farina believes it is risky to primarily store crypto on exchanges. He urged $XRP investors to take control of their assets by moving them to cold wallets, where they have full control over their private keys.

Storing Private Keys Digitally

Meanwhile, Farina also highlighted the risks associated with storing private keys digitally. He noted that many investors mistakenly believe their keys are safe on their phones, computers, or digital notes.

However, Farina cautioned against this practice, especially in 2024, when digital threats are more sophisticated than ever. “If someone gains access to your email or you click a malicious link, they could steal your $XRP,” he warned.

As a result, he recommended using physical options free from digital interference. “Keep your keys in a secure, physical location, ideally protected from water and other damage,” he advised.

Impatience

Another significant mistake Farina noted is the lack of patience among $XRP holders. He criticized those who obsessively check the price daily, reacting emotionally to minor fluctuations.

“$XRP adoption isn’t going to happen overnight,” he said. He likened $XRP to a piece of infrastructure rather than just a crypto asset. He emphasized that its adoption, which will drive its price, will take time as it aims to transform global money transfers, particularly within the banking sector.

Timing $XRP Market

Farina also warned against the dangers of trying to time the market. He described this strategy as a common pitfall for many inexperienced traders who attempt to buy low and sell high based on short-term market movements.

“There will come a day when the market doesn’t retrace, and you’ll be left behind,” he cautioned.

Over-Reliance on Technical Analysis

Finally, Farina criticized the excessive reliance on technical analysis (TA) among $XRP traders. He contended that $XRP often moves independently of standard market trends, stressing that traditional TA is unreliable for $XRP price forecasts.

While acknowledging that support levels and some aspects of TA have validity, Farina noted that overly optimistic price predictions are like fortune-telling. He stressed that these predictions could disrupt one’s dollar-cost averaging (DCA) strategy and lead to emotional decision-making.

thecryptobasic.com

thecryptobasic.com