Chainlink’s (LINK) price is not faring too well owing to uncertain market conditions, which have resulted in losses for investors.

While there is hope for recovery, it may not be the path set for LINK as the broader market continues to bar a rally.

Chainlink Might Need to Wait

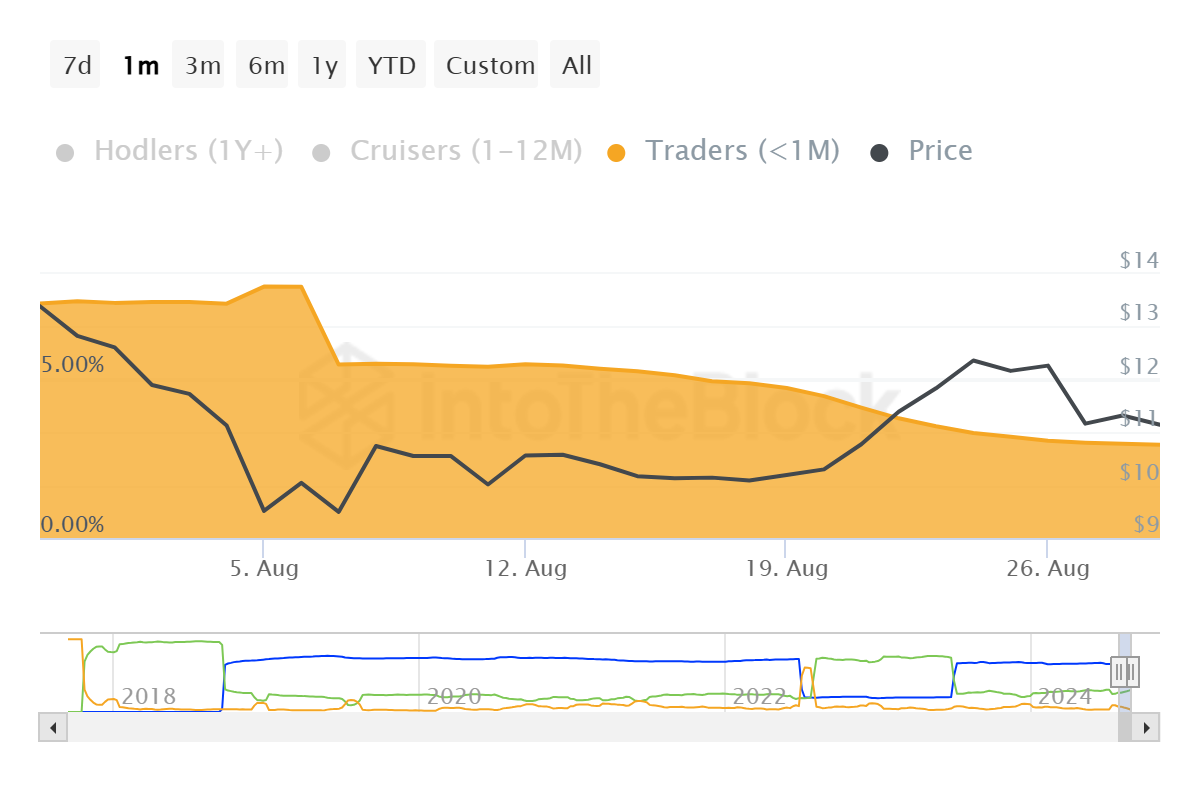

Chainlink’s price is currently facing bearish pressure despite a key group of investors losing their power over the altcoin. These are the short-term holders, who typically hold for less than a month. This makes them more likely to sell quickly, but the market has seen their dominance decline significantly.

Their domination has dropped from 7.37% to just 2.9% over the past four weeks. This reduction is generally viewed as a positive sign, suggesting less immediate selling pressure in the market.

The decline also indicates a more stable base of long-term investors, which might support LINK’s price stability in the short term. With fewer transient investors in the mix, there’s a lower risk of abrupt sell-offs, potentially providing a more solid foundation for price growth.

Read More: How To Buy Chainlink (LINK) and Everything You Need To Know

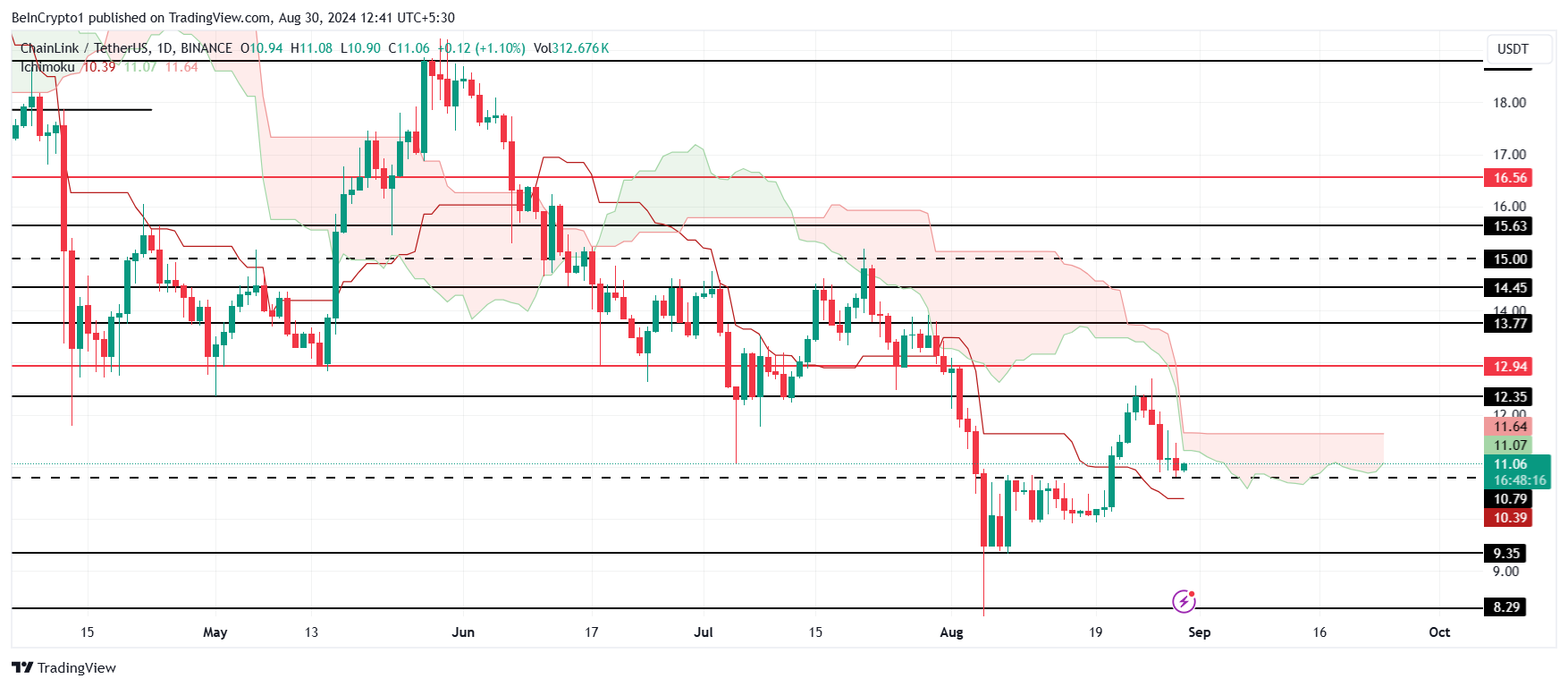

Despite this encouraging development, the Ichimoku Cloud analysis presents a bearish outlook for LINK. The cloud remains positioned above the candlesticks, indicating potential extended bearish conditions. This technical signal suggests that LINK may face continued downward pressure in the near term.

Recent price action showed a brief 30% increase in LINK’s value, which almost triggered a bullish signal. However, this positive momentum was short-lived, and the price soon fell back, preventing the indicator from turning bullish.

LINK Price Prediction: Seeing Sideways

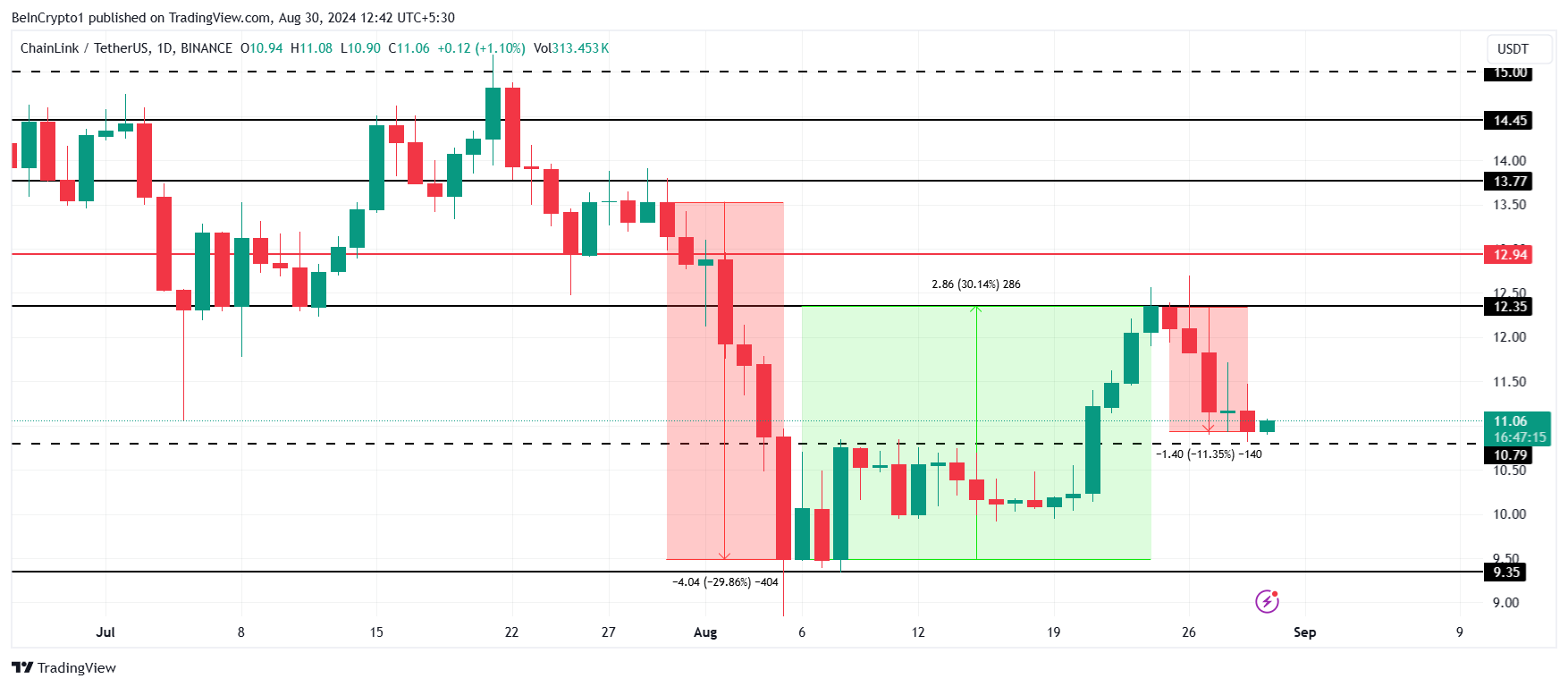

Chainlink’s price, from the looks of it, could continue moving sideways after the 11% drop in the last four days. Currently trading under the resistance of $12.35 and above the support of $10.79, the altcoin is changing hands at $11.06. Even though this range has not been tested as consolidation in the past, the aforementioned factors point to this future.

In the event that Chainlink’s price falls through the support of $10.79, a drop to $9.35 is possible. This price is the current critical support floor, and a drop in it would erase the recent 30% gains.

Read More: Chainlink (LINK) Price Prediction 2024/2025/2030

However, for Chainlink to recover the 30% losses from the July crash, the resistance of $12.35 must be breached. This will enable a rise toward $13.00, and flipping this level into support would push LINK to $13.77. This will invalidate the bearish-neutral thesis and the July crash.

beincrypto.com

beincrypto.com