Despite positive developments, $XRP Price is still struggling with price issues, which has caused some analysts to compare it to Bitcoin in its early stages.

$XRP was trading at $0.574 on August 29 after Bitcoin pulled back from the recent high of $65,000. The token’s performance has been quite poor, with a 6% drop in the month to date, which has been quite disappointing to many investors.

$XRP Price Underperforms Amid Market Volatility

Despite the high expectations for the token, it has underperformed other major coins such as Solana ($SOL) and Bitcoin.

$SOL has increased by 565% in the year, while Bitcoin has gained 119% of its value since the beginning of the year. Similarly, $XRP has increased by only 5% in the year so far, which demonstrates its continued poor performance.

This performance has improved especially after certain events occurred, for instance, the end of Ripple’s four-year lawsuit and Ripple stablecoin launch. Nevertheless, although the demand for $XRP has increased, and more companies are integrating the asset into their payment products, the price of $XRP has not followed suit, as would be expected.

Market Analysts Draw Parallels with Bitcoin’s Early Days

To this end, some market analysts have sought to console the investors by comparing the current state of $XRP to the early days of Bitcoin. MOLT MEDIA analyst pointed out that Bitcoin was once laughed at when its price was below $1. At the time, people doubted the value of Bitcoin, but now it is trading at around $60,000.

This comparison indicates that $XRP could be overemphasized and underestimated in a similar manner as Bitcoin was more than ten years ago. Ripple’s proponents believe that $XRP is well positioned for future growth given the potential of the global payments market, which is worth several trillion dollars. While Bitcoin was primarily considered as a digital currency, $XRP is touted as a payment protocol for cross-border transactions which is a big market.

The lawsuit ended just two days ago, and the $XRP community is already reacting impatiently. It's astonishing how quickly $XRP holders expect gains, they're probably the most impatient investors in crypto. Remember, nothing goes up in a straight line. Bitcoiners waited 15 years for…

— Mr. Huber🔥🦅🔥 (@Leerzeit) August 9, 2024

Another $XRP advocate Mr. Huber also called for calm among the investors referring to the fact that Bitcoin has taken 15 years to reach its current value. He pointed out that $XRP has been around for almost the same time and may take similar time to grow.

Analysts Predict Bold Price Targets for $XRP Price

However, there are still some analysts who have placed high price targets on $XRP and expect it to rally substantially. Long-term technical analysis provided by Analyst Javon Marks suggested that $XRP could possibly hit $150. He pointed out a descending triangle pattern which indicates a possible breakout and may result to massive price fluctuation.

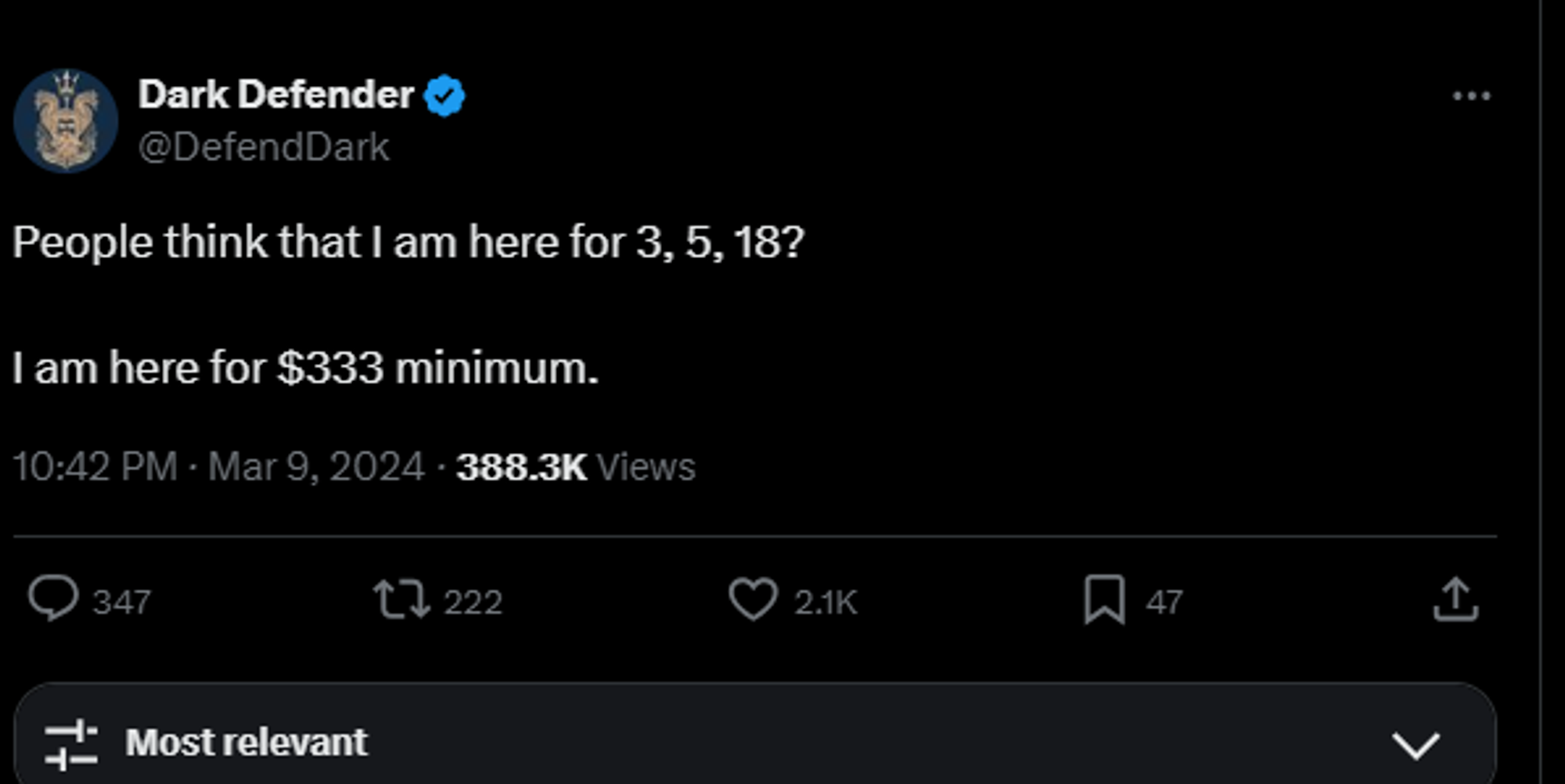

Another analyst, Dark Defender, has placed a target of $333, stating that $XRP may break through crucial resistance levels. According to him, if $XRP is able to overcome these hurdles, it could lead to a possible surge in its price.

A more daring prediction comes from analyst Flash, who forecasted $XRP could rise to $587. His analysis is based on a symmetrical triangle pattern on $XRP’s weekly chart, which he believes signals a major breakout. Despite skepticism from some market participants, Flash remains optimistic about a potential 100,000% price increase.

Potential for a Breakout as Investors Show Confidence

Despite recent setbacks, on-chain data indicates that bullish traders remain hopeful for a potential breakout. $XRP reached a 20-day high of $0.63 before retracting by 8% due to profit-taking. However, $XRP’s exchange reserves have fallen below 3 billion coins, suggesting a growing trend toward long-term holding among investors.

This decrease in exchange reserves typically reflects investor confidence in an asset’s future prospects, as fewer tokens are available for trading. At the start of August, $XRP exchange deposits were at 3.12 billion coins but dropped to 2.97 billion by August 29. This reduction represents a significant withdrawal, potentially signaling a bullish outlook.

The Keltner Channel and Balance of Power indicators also suggest that $XRP is at a critical juncture. If the price can bounce off the current support level of $0.59, a run towards the $0.63 resistance level is likely. Breaching this threshold could lead to a rally towards the $0.70 mark, potentially triggering further upward momentum.

thecoinrepublic.com

thecoinrepublic.com