Over the past few months, there has been an expectation that Bitcoin ($BTC) would lag behind altcoins in terms of performance. However, this hasn’t materialized, as only six out of the top 50 altcoins have outperformed $BTC over the last 90 days.

Currently, Bitcoin’s dominance stands at 57.18%, indicating that its market capitalization has been growing faster than that of the average altcoin. Despite this strong performance, BeInCrypto identifies three altcoins that are expected to outperform $BTC in the near future, providing detailed analysis and reasoning for this forecast.

Tron ($TRX)

Tron ($TRX), the cryptocurrency linked to controversial blockchain billionaire Justin Sun, recently hit a three-year high of $0.17. This milestone helped $TRX break into the top 10 cryptocurrencies by market capitalization, overtaking Cardano ($ADA). Over the last 30 days, $TRX’s price has increased by 15%, outperforming Bitcoin ($BTC) during the same period.

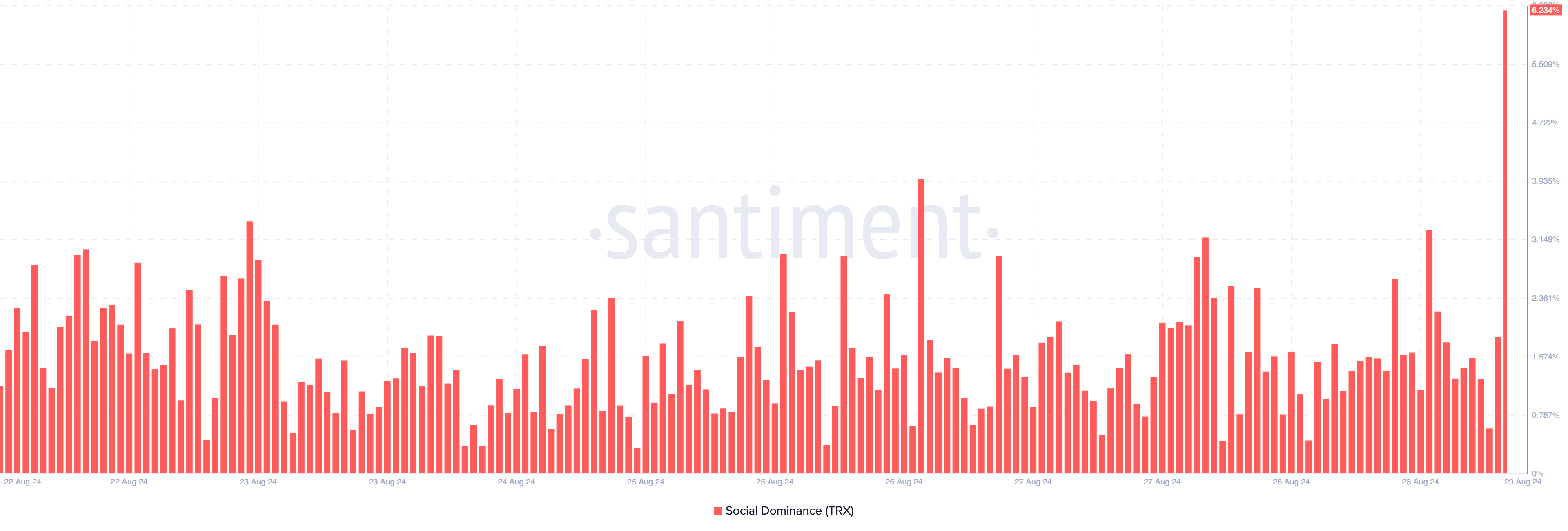

This price surge is largely due to the launch of the meme coin generator SunPump in August, which has driven up demand for $TRX. The altcoin’s rising social dominance, now at 6.23%, indicates growing attention toward the project.

From a technical perspective, Tron’s On Balance Volume (OBV) line has been increasing on the daily chart, indicating strong buying pressure. A higher OBV reflects more buying activity, which is often a precursor to further price increases.

If the accumulation of $TRX continues, the price could potentially drop to $0.14 before bouncing back to its recent high of $0.17, and possibly even reaching $0.19 in September.

Read more: Who Owns the Most Bitcoin in 2024?

However, this optimistic outlook could be challenged if Bitcoin outperforms top altcoins next month. In that case, $TRX’s upward momentum might face resistance, and the predicted price targets could be harder to achieve.

Aave ($AAVE)

Over the past 30 days, $AAVE’s price has risen by 18.68%. This cryptocurrency, which serves as the governance token for the decentralized finance (DeFi) protocol Aave, has recently attracted significant interest from whales. This surge in interest places $AAVE among the bullish altcoins that could potentially outperform Bitcoin ($BTC) in September.

Aave has also proposed increasing its involvement with the Real World Assets (RWA) sector by integrating BlackRock’s BUIDL infrastructure. If this proposal is approved soon, it could lead to a spike in demand for $AAVE.

On August 5, $AAVE’s price dropped below $80. However, the altcoin began forming Higher Lows (HL), eventually reaching $146.49 on August 24. At this level, the Relative Strength Index (RSI) indicated that the token was overbought.

The RSI measures momentum; a reading of 30.00 or below signals that an asset is oversold, while a reading of 70.00 or above indicates that it is overbought. As shown, the RSI hit the overbought region last Saturday.

Following this, $AAVE’s price dropped to $118. The RSI has since remained above the 50.00 neutral line, suggesting that a bullish reversal could be possible. For this to happen, bulls need to defend the $118.01 support level and break past the resistance at $129.64.

If successful, $AAVE could become one of the altcoins to outperform Bitcoin in September. However, if the support at $118.01 fails, the altcoin’s price might face a significant decline.

Cardano ($ADA)

Cardano’s position in this list is largely influenced by its upcoming major upgrade on September 1, known as the Chang hard fork. This upgrade will introduce on-chain governance to the Cardano blockchain for the first time, marking the initial phase toward the project’s ultimate goal, Voltaire.

$ADA holders have shown considerable optimism leading up to the event. In 2021, a similar hard fork on the Cardano network led to a 130% price surge within a month. If history repeats itself, $ADA could see exceptional price performance in September. Currently, $ADA is trading at $0.35, down from $0.40 just three days ago.

The Moving Average Convergence Divergence (MACD) indicator suggests that this recent price dip could be a buying opportunity for market participants. The MACD is used to gauge momentum and helps traders identify potential entry and exit points.

A positive MACD reading indicates bullish momentum, signaling a good time to buy, especially after a downtrend. A negative reading, conversely, points to bearish momentum and a potential time to sell.

Read more: 10 Best Altcoin Exchanges In 2024

For $ADA, the MACD currently indicates bullish momentum. If this trend continues, the price could rebound to $0.40 soon, and if buying pressure intensifies, it might even reach $0.44.

However, there is a risk of invalidation if the hard fork becomes a “sell the news” event, where the price drops following the anticipated event. In that case, $ADA’s price could decline to $0.32.

beincrypto.com

beincrypto.com