On Aug. 28, most altcoins, including Fantom, Sui, FET and Lido DAO, saw double-digit drops, while Bitcoin, the largest crypto asset, dropped 6% over the past day.

At the time of writing, Fantom (FTM), a scalable blockchain platform for DeFi, was down 14% in the last 24 hours. In the same timeframe, the daily trading volume of crypto assets hovered around $294 million while its market cap had slumped by 14%, which now stands at $1.219 billion.

Sui (SUI), the native token of the Sui blockchain network, also dropped 11.8%, exchanging hands at $0.8302, according to data from crypto.news. In the same period, the token had a daily trading volume of $343 million. Meanwhile, the crypto asset’s market cap fell to $2.16 billion, bringing it down to the 44th largest cryptocurrency per CoinGecko.

Artificial Superintelligence Alliance (FET), a partnership between blockchain networks Fetch.ai, SingularityNET, and Ocean Protocol to create decentralized AI is also being affected by the recent Bitcoin price action. At press time, it was down 13.7% in the last 24 hours, being traded at $1.22 with a daily trading volume of $525.6 million. The token’s market cap had fallen to $3 billion.

Lido DAO (LDO) was also seen in the red with a drop of 13%, trading at $1.04 at the time of publication. Its daily trading volume stood at $109.3 million, while the token also witnessed a drop in its market cap to $938 million. The crypto asset has fallen to 80th rank among the top 100 leading cryptocurrencies.

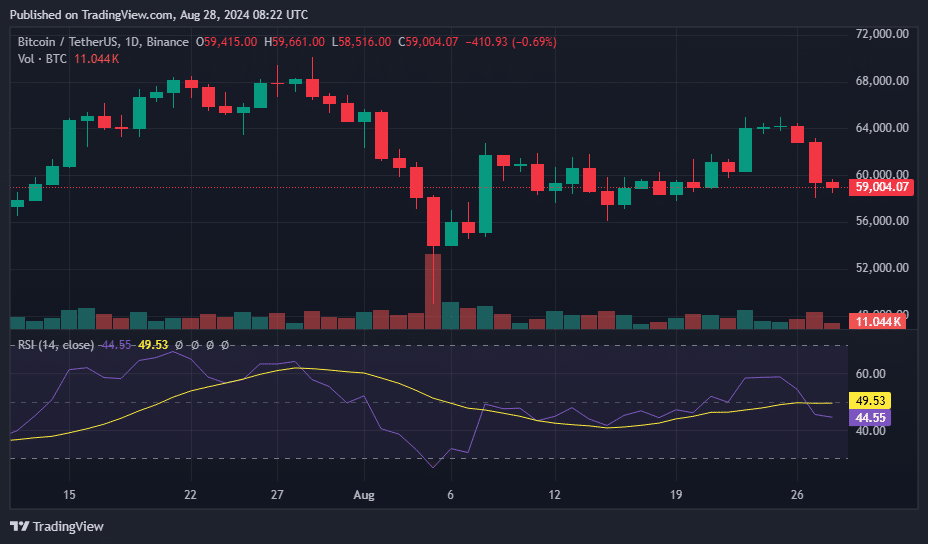

Bitcoin drops below $59K

Due to Bitcoin’s significant influence and market dominance, a sharp decline in the altcoin market is often linked to Bitcoin’s performance. Substantial price drops tend to create a ripple effect across the cryptocurrency market, leading to widespread declines in altcoin values as investor confidence wanes and market sentiment turns bearish.

Bitcoin (BTC) fell 6% over the past day to $58,609 on Aug. 28 morning. Its 24-hour lows and highs were recorded as $58,059 and $62,963, respectively. Furthermore, the Fear and Greed index currently stands at 30, suggesting that the crypto market is in a state of fear per data from Alternative.

A recent report from Glassnode suggests that Bitcoin’s recent price drop is linked to the market reaching a balanced state that might not last. The report focuses on the MVRV ratio, which measures whether Bitcoin holders are in profit or loss by comparing the current market price to the price at which coins were last moved.

Recently, the MVRV ratio has hovered around its long-term average of 1.72, a level that typically signals a shift between a bull and bear market. This suggests that after the initial excitement of the Bitcoin spot ETFs, investor profitability has levelled out, leading to a cooling in the market and contributing to the recent price decline.

Some analysts linked Bitcoin’s recent price drop to the escalating Russia-Ukraine conflict, where risk-on assets like Bitcoin are often the first to be sold off.

However, crypto analyst Ash Crypto speculated that smart money is accumulating Bitcoin between $50,000 and $65,000, anticipating a breakout once the accumulation phase ends, likely by the end of September.

The Relative Strength Index for Bitcoin currently stands at 44.56, suggesting that Bitcoin is neither oversold nor undervalued at its current price level.

Bitcoin’s funding rate also dropped to negative 0.004%. This abrupt change is often indicative of a rise in the number of trades betting against Bitcoin’s price, which followed $96.5 million in liquidations over the past 24 hours.

Historically, such a sudden change in an asset’s funding rate often leads to a price movement in the opposite direction. In Bitcoin’s case, this could mean a short-term price rebound.

Overall, the crypto market experienced more than $320 million in liquidations in the past day, with $285 million from long positions and $35 million from shorts being wiped out.