With a minor recovery at play, an upcycle in Cardano teases a bull trend. Is Cardano making a comeback, or is a drop to $0.35 imminent?

With a positive sentiment in the Cardano community, 72% expect a bullish trend in the coming times. Further, the 8.14% surge in the last seven days reveals a growth in bullish momentum and teases an extended uptrend.

Will the uptrend in Cardano surpass the $0.40 mark? Or is a drop to $0.35 imminent?

Cardano Eyes A Bullish Exit

In the 4-hour chart, Cardano shows a recovery run from the $0.29 support level after the crash in early August. The bullish recovery forms a support trendline and accounts for a price surge of 25% in the last three weeks.

Further, the bull run results in a positive crossover of the crucial EMAs (20, 50, 100, 200), except for the 100- and 200-day EMA crossover. In the recent pullback, the MACD and signal lines dropped to the zero line.

A morning star pattern at the 200-day EMA at $0.367 results in a 1.4% surge and increases the positive crossover chances in the MACD. In the 1-hour chart, the pullback in Cardano forms a falling channel and hits the $0.366 base.

With a surprising comeback, an upcycle in Cardano teases a breakout rally to reinstate the uptrend. Further, the MACD indicator shows a positive crossover, increasing the bullish chances.

Cardano Network Grows Weak Amid Volatile Market

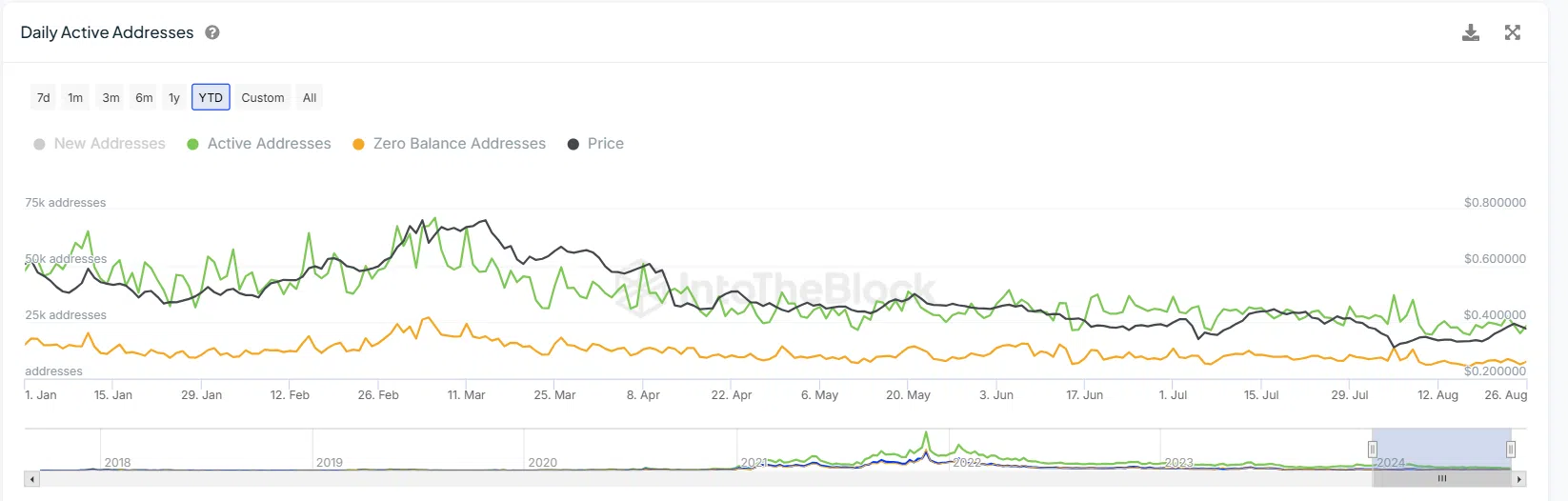

According to IntoTheBlock data, the Daily Active Addresses in the Cardano network failed to show a bullish recovery in 2024.

In a year-to-date measurement, the daily active addresses have dropped from 47,930 to 20,120. Meanwhile, the zero balance addresses have dropped from 15,210 to just 6,370.

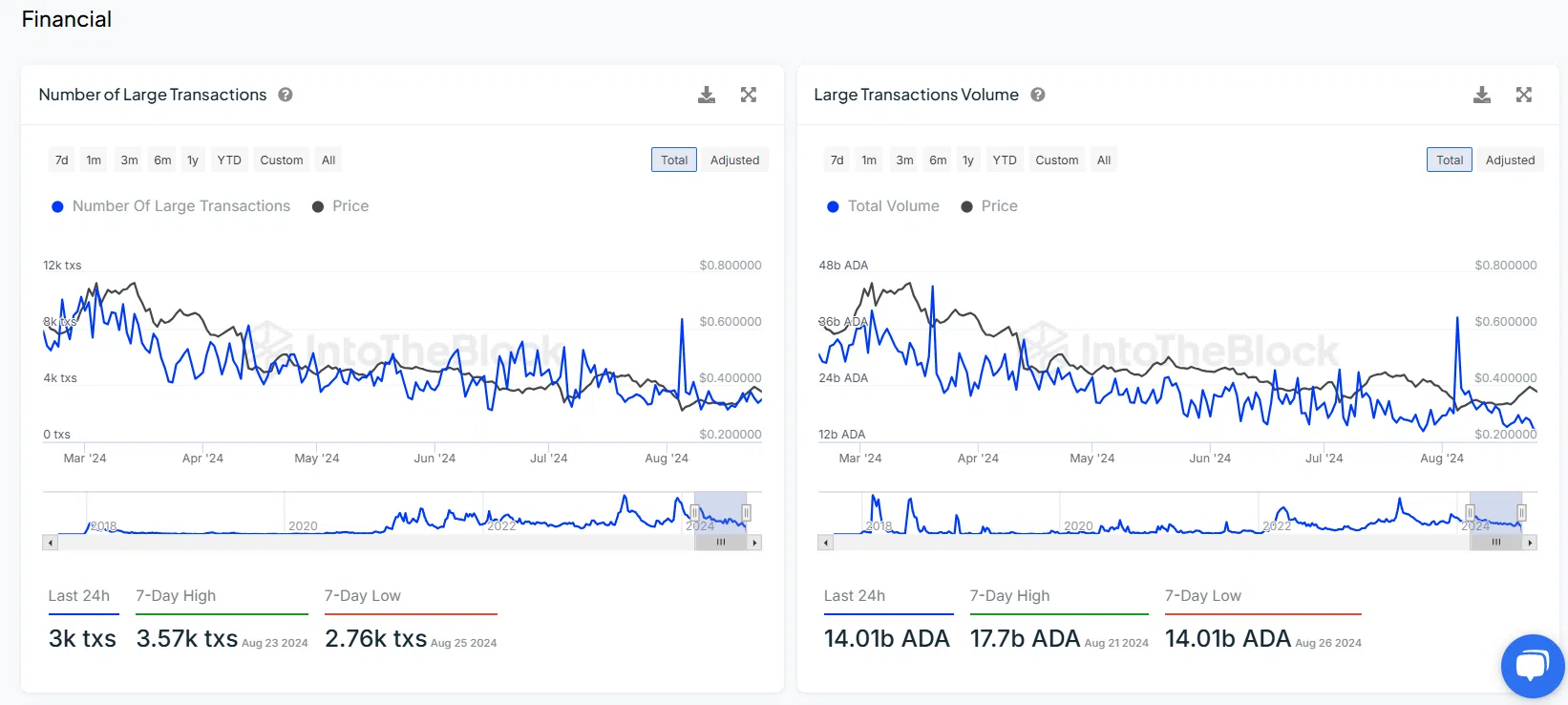

As the number of addresses decreases, the network’s transactions are affected. The number of last transactions and the last transaction volumes over the Cardano network have been declining in the past six months.

The number of last transactions has dropped from 7.26k to just 3,000 in the last 24 hours. Meanwhile, the volume of the last transactions has dropped from 29.04 billion ADA tokens to just 14.01 billion ADA tokens in the past 24 hours.

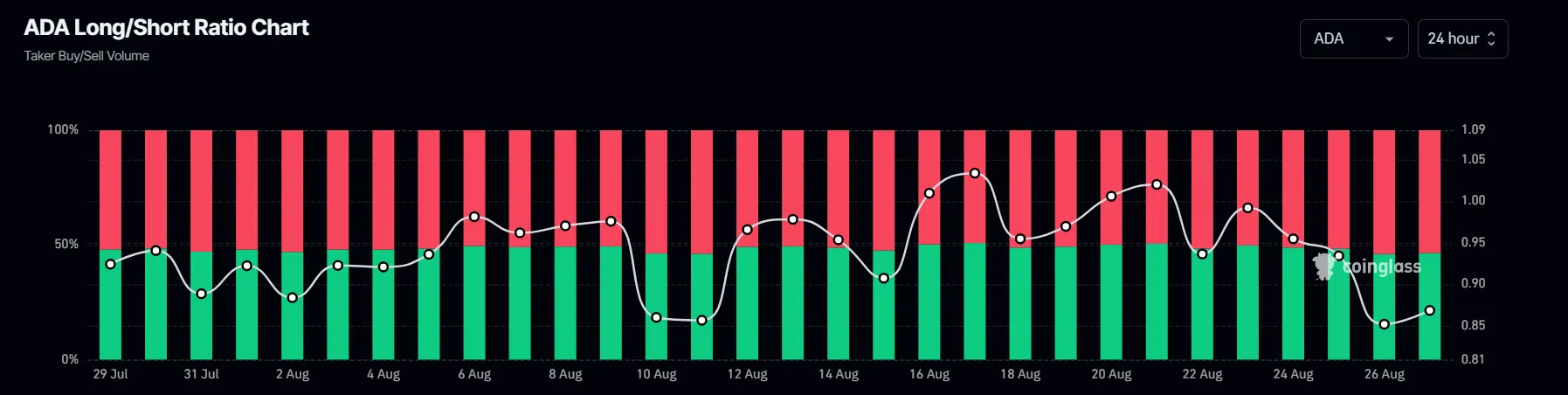

However, the derivatives market signals a potential recovery in the Cardano prices despite the weak network growth.

Based on the ADA Long/Short Ratio from Coinglass, the ratio remains bearish but has increased from 0.8519 to 0.8685 in the last 24 hours.

Will Cardano Give A Bullish Break?

With a weak underlying network, the chances of Cardano sustaining the uptrend are questionable. While minor recovery runs are possible, improvement in the underlying network will be crucial for a sustainable bull run.

The bullish breakout of the channel can find resistance at the 23.60% and 50% Fibonacci levels at in the 1-hour chart $0.383 and $0.40, respectively.

On the flip side, the support levels in the 4-hour chart are present at $0.36, $0.353, and $0.32.

thecryptobasic.com

thecryptobasic.com